Picture supply: Getty Photos

The Lloyds (LSE:LLOY) share value has been climbing virtually continuous since mid-February, closing with a better value for six weeks in a row not too long ago. It’s now just a few pence away from breaking a brand new four-year excessive above 56p.

The final time it traded above that degree was in February 2020 when the pandemic hit, knocking the value down from a excessive of 58p to 32p in lower than a month. Lloyds got here near breaching this degree in February final 12 months however finally failed, so I’m questioning if this time is totally different.

Let’s see what the charts say.

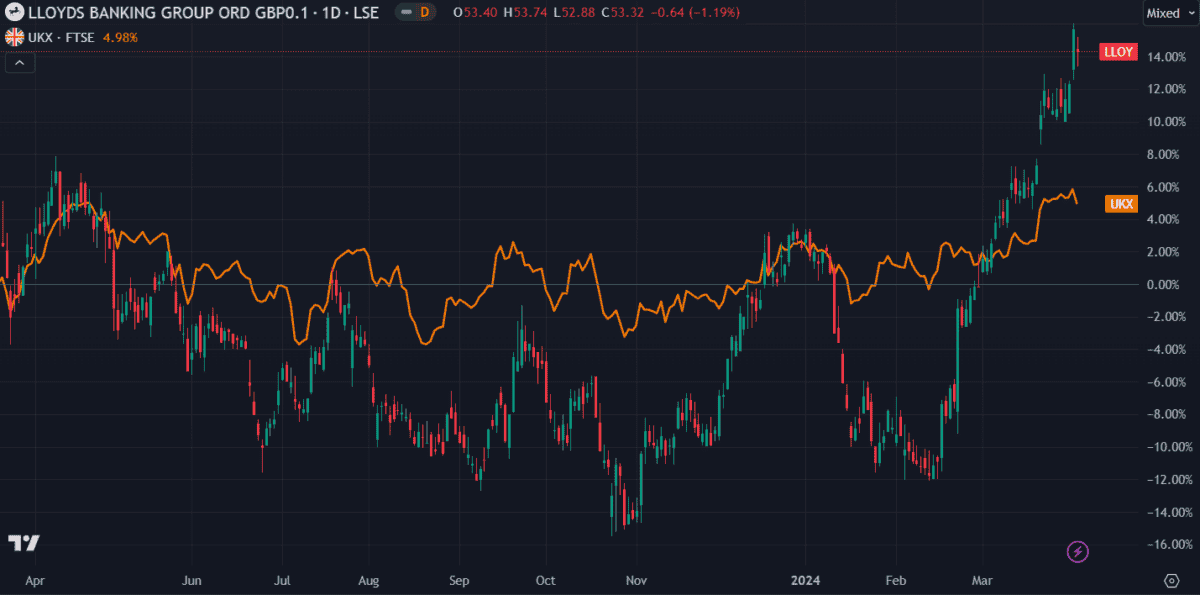

UK market comparability

Lloyds not too long ago overtook the FTSE 100 in share value good points, one thing it achieved briefly in January however has in any other case not performed so since April final 12 months. This means that it’s performing higher than the typical of the UK’s prime 100 shares. Whether or not or not this could proceed is the query I hope to reply right now.

Value-to-book ratio

The value-to-book (P/B) ratio is calculated by dividing the present market value by the corporate’s e book worth per share. A excessive P/B ratio is typical in a financial institution with excessive anticipated earnings progress and excessive returns on fairness.

Lloyds’ P/B ratio has been rising together with the share value since mid-February. Though it’s nonetheless in vary, it’s nearing a price of 1, at which level the value may very well be thought of overvalued. For now although, the P/B ratio of 0.84 suggests Lloyds shares might nonetheless climb additional.

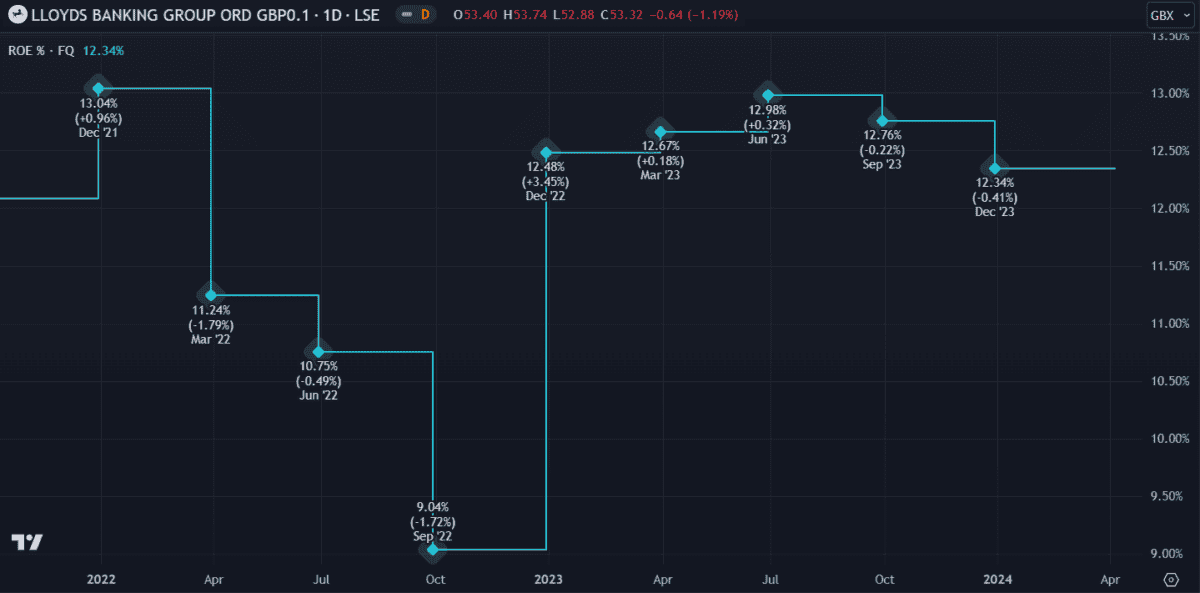

Return on fairness

Return on fairness (ROE) is an efficient indication of how properly an organization is performing primarily based on its fairness. In different phrases, how a lot revenue it generates in comparison with the extent of funding that shareholders have put into the enterprise. Whereas ROE doesn’t straight correlate with value, it’s a reassuring indication of an organization’s working energy.

ROE is calculated by dividing the corporate’s internet revenue by its shareholder’s fairness. Lloyds reported an honest ROE of 12.34% in its 2023 annual earnings report. Something below 10% can be regarding.

Relative energy index

The relative energy index (RSI) is an oscillator used to measure the volatility of an asset’s value actions. It may be used to forecast value targets by gauging how a inventory’s value is trending.

The oscillator ranges between zero and 100, with 30 and 70 being key ranges dictating whether or not an asset is overbought or oversold. A chronic transfer above 70 is often an indication that the asset is overbought and will decline quickly.

Taking a look at a every day chart, I see that Lloyds’ share value declined in early 2024 following a interval when the RSI ticked above 70 just a few occasions. Waiting for right now, I see the RSI has been above 70 for over a month now. From my perspective, it will be troublesome to argue {that a} correction isn’t imminent.

My verdict

Lloyds appears to be performing properly for the time being, with the latest value good points doubtless boosted by the information of delayed fee cuts. Whereas rates of interest stay excessive, banks often proceed to revenue.

Nevertheless, a number of metrics point out the value is overbought. Whereas the shares might nonetheless make some good points within the quick time period, I wouldn’t purchase them at this degree.