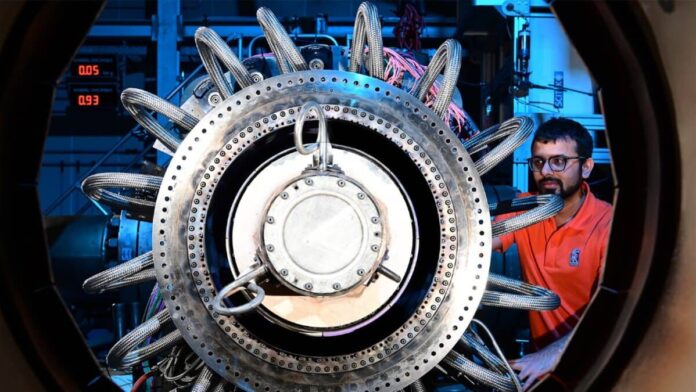

Picture supply: Rolls-Royce Holdings plc

It’s no secret that Rolls-Royce (LSE: RR) shares have been on hearth this 12 months as a restoration in air journey has improved the corporate’s fortunes.

Additionally effectively documented is the function chief govt Tufan Erginbilgiç has performed within the agency’s turnaround since he took the helm on 1 January 2023.

Trying again, I ought to have invested instantly upon his arrival. The FTSE 100 inventory was nonetheless within the doldrums again then, buying and selling for underneath a quid, however seemingly ripe for a comeback.

But I didn’t make investments, and solely belatedly jumped on the Rolls bandwagon in springtime.

After all, hindsight is a superb factor. I wouldn’t be pondering this fashion if the inventory was nonetheless struggling!

Anyway, right here’s how a lot I’d have now if I had invested £5k when the brand new CEO took over.

I’d be flying

In the beginning of 2023, the share worth was 93p. As I write, it’s 295p, which interprets into an unbelievable 217% rise.

Which means my £5,000 would have changed into round £15,850 in only one 12 months. That’s the type of return I’d count on from a US tech inventory moderately than a Footsie blue-chip.

Metropolis analysts are additionally anticipating dividends to return in 2024. The forecast yield is modest at 0.86%, but when paid, it might add one other £134 or so to my return.

One final likelihood

Ben Horowitz, co-founder of enterprise capital agency Andreessen Horowitz, popularised the idea of ‘wartime’ and ‘peacetime’ CEOs.

In brief, a selected management type could also be extra appropriate relying on whether or not a enterprise is dealing with a interval of stability (peacetime), or coping with vital challenges, disruptions and even existential threats (wartime).

On taking cost, Erginbilgiç described Rolls-Royce as a “burning platform” that needed to change to outlive. “Given the whole lot I do know speaking to traders, that is our final likelihood,” he warned.

This was textbook wartime CEO language utilized to an organization in a basic wartime state of affairs (it was massively in debt and had misplaced two-thirds of its market worth in 5 years).

Fast turnaround

The following overhaul of the enterprise — involving disposals, effectivity financial savings and restructuring — has had a dramatic early affect.

In 2023, the corporate anticipates full-year underlying working revenue and free money stream of £1.2bn-£1.4bn and £0.9m-£1bn, respectively.

By 2027, it expects to ship annual working revenue of £2.5bn-£2.8bn and free money stream of £2.8-£3.1bn. That will be an enormous uplift.

Whereas these figures are definitely spectacular, and achievable in accordance with analysts, the agency isn’t out of the monetary woods simply but. It nonetheless had web debt of £2.8bn as of June, and a few debt is due in 2025.

The steadiness sheet may once more develop into the agency’s Achilles heel if there’s a setback in its key Civil Aerospace division.

Trying forward

Based mostly on forecasts for 2024, the inventory is buying and selling at 23.6 occasions ahead earnings. I don’t suppose that’s too costly as issues stand, however it doesn’t go away a lot of a margin of security.

That mentioned, I see loads of issues to be bullish about, together with the potential return of dividends and a full restoration in engine flying hours to pre-Covid ranges.

If I wasn’t already a shareholder, I’d be trying to purchase the inventory the following time there’s a dip.