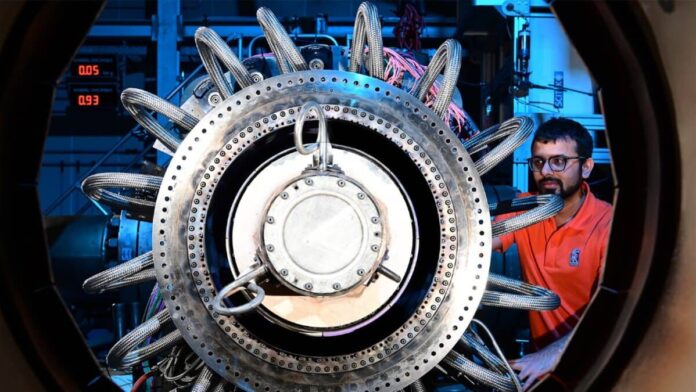

Picture supply: Rolls-Royce Holdings plc

Rolls-Royce (LSE:RR) shares have undergone a mighty turnaround lately. A bit over 18 months in the past, the shares have been altering fingers for 65p. At the moment, Rolls shares are value greater than £4 every they usually’re up 165.6% over 12 months.

Nonetheless, if I have been to have invested 5 years in the past, my funding would have solely not too long ago turned optimistic. Rolls-Royce shares at the moment are up 25.5% over 5 years, so if I’d invested £1,000 earlier than the pandemic, I’d have £1,255.

I’d even have obtained an interim dividend in early January 2020 value 4.6p per share. That may have equated to round £12 for my £1,000 of holdings. So, all in all, I’d have £1,267. It’s not a foul return, particularly contemplating every thing that’s occurred within the interim.

Would I purchase at present?

Rolls-Royce shares nonetheless look enticing to me at present. So sure, I’d purchase extra Rolls inventory if I might. The inventory has nice momentum, robust metrics, and the brand new(ish) CEO actually seems to have put the corporate heading in the right direction.

The agency’s now a lot leaner than it was and is spending much less cash on improvement initiatives which may by no means come to market. It’s additionally benefiting from a sequence of tailwinds throughout the defence and civil aerospace.

Civil aerospace

Rolls-Royce’s civil aerospace phase soared in 2023, and it contributed almost half (48%) of the corporate’s underlying income.

Unsurprisingly, it was the corporate’s fastest-growing phase with a 29% improve in income. This development was fuelled by a major restoration in massive engine flying hours, which reached 88% of 2019 ranges. In flip, order quantity for brand spanking new engines surged.

The corporate expects continued momentum in 2024, with a full restoration in flying hours, reaching 100%-110% of 2019 ranges. Moreover, Rolls-Royce hopes to ship 500-550 engines, representing a major 14.6% improve from the 458 delivered in 2023.

Defence

Rolls-Royce says its revenues weren’t straight impacted by Russia’s struggle in Ukraine. But it surely’s simple that the battle’s having a profound affect on the corporate’s defence phase — which represented 28% of revenues in 2023.

In response to a current report, world defence spending jumped by 9% in 2023, reaching a report $2.2trn. Loads of this defence spending has come inside the NATO alliance the place Rolls-Royce does loads of enterprise. It additionally advantages from long-term strategic programmes like AUKUS and Tempest.

The underside line

I don’t suppose many issues are holding Rolls-Royce again proper now. After all, we should always all be cautious concerning the affect of illness outbreaks on journey sooner or later. One other not-necessarily-global illness outbreak might nonetheless end in cautious inhabitants teams avoiding journey.

And the information helps my place. Rolls-Royce shares are presently buying and selling at 22.46 instances ahead earnings. That’s not costly versus its peer group, which tends to commerce at barely increased multiples due to development expectations and the large obstacles to entry of working of their sector.

Moreover, the price-to-earnings ratio drops to 18.6 in 2025, and finally 16.2 in 2027, based mostly on the present forecasts.