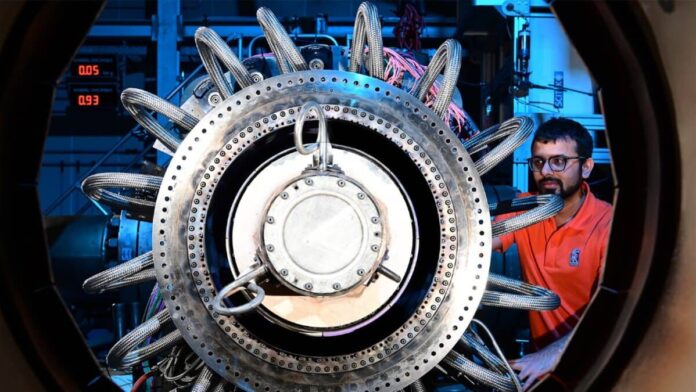

Picture supply: Rolls-Royce Holdings plc

Most traders wouldn’t say FTSE 100 shares are costly proper now. Nevertheless, after I’m assessing shares to purchase, just a few of them tick my bins.

Utilizing near-term metrics just like the price-to-earnings (P/E) ratio, most shares on the FTSE 100 look cheap or discounted versus their worldwide counterparts.

Whereas it’s not an ideal comparability, the typical P/E ratio for the FTSE 100 is round 13.9 occasions, whereas on the S&P 500 it’s 24.6.

In fact, this additionally displays the focus of growth-oriented shares on US exchanges, nevertheless it’s additionally illustrative of the poor progress forecasts we’re seeing within the UK.

Investing for progress

I don’t thoughts investing in corporations which have much less thrilling progress prospects if the dividend makes up for it. Nevertheless, I’d quite spend money on corporations which have a powerful progress trajectory, and ideally one which’s under-appreciated by the market.

One valuation metric that takes progress into consideration is the value/earnings-to-growth (PEG) ratio. That is calculated by dividing the P/E ratio by the anticipated progress price.

Usually, a PEG ratio of 1 suggests an organization is buying and selling at truthful worth. In the meantime, a valuation above one infers the inventory is overvalued. Beneath one suggests a inventory is undervalued.

It’s not an ideal valuation metrics, however none are. It depends of analysts forecasts for the approaching 5 years, and these aren’t at all times correction.

The issue is, it’s not simple to seek out FTSE 100 shares with PEG ratios under one. So listed below are two that do have PEG ratios under one.

Lloyds

Lloyds (LSE:LLOY) could also be a shocking addition to this listing. However in response to information printed on varied websites, Lloyds is buying and selling with a PEG worth of 0.5. That’s barely decrease than my very own calculations. However the above PEG ratio is calculated utilizing a consensus of analysts’ estimates.

Lloyds is buying and selling in direction of the decrease finish of its 52-week common, pushed down by considerations about buyer credit score defaults in a excessive rate of interest atmosphere and recession forecasts.

Nevertheless, with UK rates of interest set to fall in direction of the good ‘Goldilocks’ zone — 2%-3% — and constructive hedging preparations, the medium time period may see robust progress.

A part of this could be pushed by greater than £5bn a yr in gross hedging earnings. That is the place banks offset adjustments within the BoE rate of interest by shopping for fixed-income belongings, like bonds, with increased returns.

Rolls-Royce

Rolls-Royce (LSE:RR) is buying and selling with a PEG worth of 0.55. That’s regardless of the share worth surging over 200% within the final 12 months.

Amid an bettering backdrop for air journey, and secure efficiency elsewhere within the portfolio, the engineering big is anticipated to see a significant enchancment in earnings per share (EPS).

In a latest announcement, the group mentioned it was concentrating on an working revenue inside the vary of £2.5bn-£2.8bn by 2027, with vital progress on margins.

One other shock to the civil aviation — just like the pandemic — would undoubtedly hamper the restoration. Nevertheless, the forecasts stay engaging.

Rolls might also profit from long-term demand for air journey, which is anticipated to see greater than 40,000 new plane enter service over the approaching twenty years.