Through the years, there have been varied tales about Elon Musk’s higher-than-normal danger tolerance, and his willingness to take main probabilities on issues, regardless of the potential impacts that will come, to himself and to his corporations.

We’ve seen that with X s nicely, with Musk randomly ripping out servers and reducing workers, regardless of not realizing, for positive, what the precise end result of such is perhaps. Such actions, regardless of carrying important danger, have turned out advantageous (in relative phrases), and it’s this gung-ho, action-first strategy that many attribute to Elon’s ongoing enterprise success.

Which is what got here to thoughts after I noticed right now’s announcement that X is partnering with Kalshi to supply Grok insights inside Kalshi’s market prediction overviews.

As you’ll be able to see on this instance, market analytics platform Kalshi will now be capable of show contextual insights from Grok inside its inventory overviews, offering extra knowledge for buyers to include into their shopping for and promoting strategy.

Which is sensible, in serving to buyers make extra sense of what’s occurring. However then once more, there’s a line that must be drawn between including perception, and influencing funding selections, based mostly on what an AI bot says.

As a result of that appears fairly dangerous. If an investor loses out as a result of Grok instructed them to not purchase in, that will be thought of direct monetary recommendation, and the FTC has some fairly strict guidelines round that ingredient. As a result of it’s so dangerous, as a result of it will possibly have a serious affect, but X is moving into this with seemingly little regard for potential fallout on this respect.

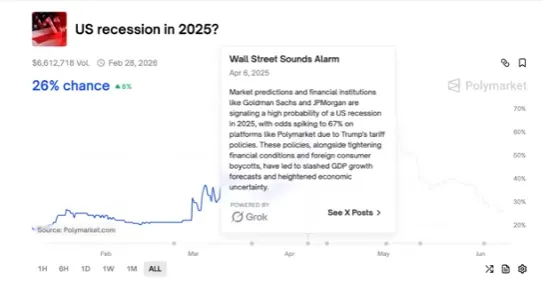

X additionally introduced an analogous take care of Polymarket final month, with Polymarket now capable of incorporate predictions based mostly on X posts, together with insights from xAI’s Grok system, to supply contextual pointers for its forecasts.

And each of those activations current the identical degree of danger in offering monetary recommendation, or financial-type recommendation, through AI means.

It looks like a possible lawsuit ready to occur, significantly while you additionally take into account Elon Musk’s personal enterprise ties, and the way these recommendation notes might hyperlink again to them.

Certainly, the FTC advises that:

“In the event you endorse a product by way of social media, your endorsement message ought to make it apparent when you’ve a relationship (‘materials connection’) with the model. A ‘materials connection’ to the model features a private, household, or employment relationship or a monetary relationship – such because the model paying you or supplying you with free or discounted services or products.”

That’s extra particularly associated to influencer endorsement, however the identical guidelines would apply to AI instruments as nicely. And with Elon having a hand in varied inventory impacting parts, and with xAI seeking to angle Grok to raised align together with his private views, it looks like solely a matter of time earlier than each of those partnerships result in not less than some points on this entrance.

However once more, Elon is ok with increased ranges of danger than most. And with X’s “every part app” imaginative and prescient being largely centered on finance, and enabling individuals to handle their total monetary life throughout the app, funding integrations make sense in that broader scope.

I’m simply unsure there are clear sufficient parameters as but round the usage of AI for inventory recommendation, and for X particularly to be facilitating such.