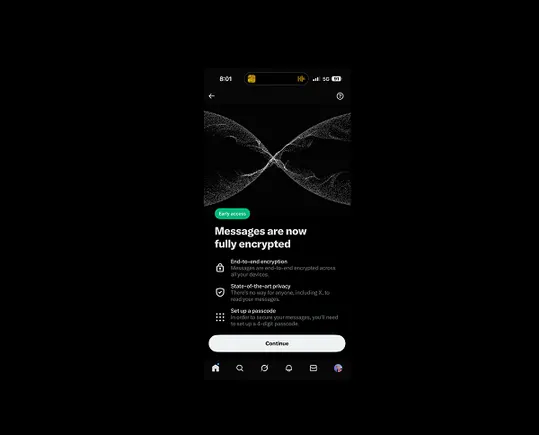

X is transferring forward with its reformation of messaging within the app, with some customers now in a position to entry the preliminary beta of X’s up to date “Chat” component.

As you’ll be able to see in these examples, shared by app researcher Jonah Manzano, X is rebuilding its DM back-end with enhanced privateness in thoughts, with encryption being a foundational component of the brand new expertise.

With the intention to arrange your new chat profile, you’ll must create a four-digit code, including one other security barrier.

The added safety factors to DMs develop into the main target of X’s coming in-stream funds push, offering extra assurance for customers who could also be seeking to share cash within the app.

Presumably, that may make DMs the practical utility for cash sharing, whereas X can also be seeking to increase past funds, by enabling individuals to load cash into their account within the app, so you can too host financial savings in the identical place.

How, precisely, that may work just isn’t fully clear, however X proprietor Elon Musk lately reiterated his plans to maneuver on this path, noting that:

“When individuals’s saving are concerned, excessive care have to be taken.”

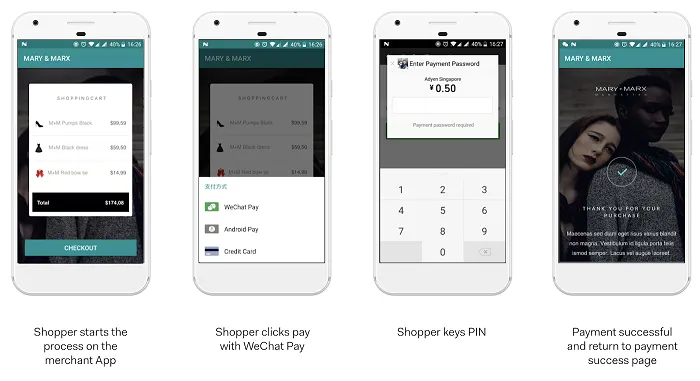

The give attention to utilizing messaging for this function additionally suits with Elon’s broader imaginative and prescient to create a Western model of WeChat, the messaging platform that’s now central to many transactional parts of day by day life in China.

Elon’s “all the pieces app” imaginative and prescient is impressed by WeChat, whereas additionally incorporating parts of Musk’s preliminary growth plans for PayPal, earlier than he was ousted from the corporate in 2000.

Musk’s been sitting on his built-in funds/banking/purchasing platform idea ever since, and reforming DMs appears to be the primary stage in that shift.

So will it work?

It’s tough to say, as a result of whereas conceptually, a extra built-in social/funds app appears to suit, and has been a transformational innovation for Chinese language customers, numerous platforms have tried related approaches in Western markets, and none have caught on, even marginally.

Meta is essentially the most notable instance. Meta additionally cited WeChat because the inspiration for its reformation of Messenger again in 2016, which was additionally set to include funds by way of its Fb Pay, and finally its Libra in-stream funds performance. Fb Pay is the one component nonetheless remaining from this effort, with regulatory challenges, and low client adoption, finally derailing Zuck and Co’s plan for a Western WeChat of their very own.

And even Fb Pay has struggled to achieve any actual traction, although that additionally pertains to broader issues round Meta’s previous knowledge privateness controversies, and business stonewalling to cease Meta turning into a fair larger participant in one other key market.

TikTok has been pushing in-stream gross sales for years, and is progressively gaining traction, Twitter tried in-app purchasing (and it didn’t work), Pinterest is engaged on extra direct funds, Instagram and YouTube would love the identical, and so forth.

Each single one in every of these platforms would swap on streamlined, one-tap, in-stream funds if they may, and if there was important client demand for such, they could nicely be capable to make it occur. However once more, Western customers have typically appeared extra content material to maintain their social media and purchasing experiences separate, with the safety and reliability of identified suppliers, like Amazon, profitable out general.

So whereas, theoretically, this must be a logical mixture, an ideal matching of social and funds, right into a singular built-in platform, in follow, that hasn’t labored out.

And it’s exhausting to think about that X would be the one to lastly crack the code and facilitate broad-scale client adoption of such.

As a result of whereas X could possibly introduce funds, it hasn’t discovered even the preliminary phases of this course of simple. X has struggled to achieve cost processor licenses within the U.S., with key states refusing its preliminary purposes attributable to issues round its possession.

Late final yr, New York rejected X’s preliminary cost processing request, primarily based on the truth that X has deep ties with the Kingdom of Saudi Arabia, attributable to Saudi Crown Prince Mohammed bin Salman being an investor in Musk’s X challenge. The Kingdom of Saudi Arabia, in response to NY assessors, has a protracted historical past of brutality and repression, which it claims “has been fueled and enabled” by the platform itself.

That’s simply one in every of a number of hurdles that X has confronted in gaining preliminary approval for funds within the app. And that is simply funds, not transactions (which is one other license in every area), and that is solely within the U.S., X seemingly hasn’t even appeared to increase to different nations as but.

Initially, Musk believed that X would have funds energetic within the app by the tip of final yr, noting that “it would blow my thoughts” if that wasn’t the case.

However we’re now halfway by way of 2025, and funds are nonetheless not energetic.

And whereas they might be coming, as a part of the brand new messaging re-furbish, X nonetheless has a protracted approach to go in profitable over essential regulatory teams, after which shoppers, in making the app a central utility.

And the customers might be essentially the most tough half, as a result of X is dropping them over time.

So even when X can get all the mandatory approvals (which no different app has been in a position to), and even when it may combine simplified funds in-stream (which no different app has succeeded with), it’s viewers share could quickly be so small that it received’t matter both approach.

That’s to not say it may’t occur. Elon is thought for turning not possible challenges on their head, and it could possibly be that he has some luck-enabled plan to make X funds a extra important component.

However I don’t see it but.

Although we’re seemingly going to quickly discover out, with the primary stage being the gradual launch of its new X Chat performance.

X Funds, presumably, will then comply with shortly after.