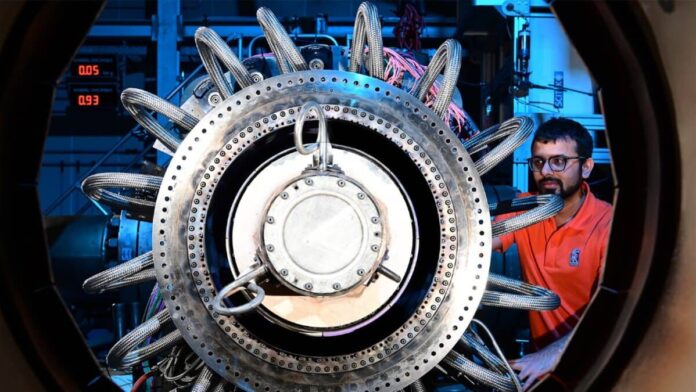

Picture supply: Rolls-Royce Holdings plc

There was a rising sense of concern in monetary markets just lately, with silver costs crashing and AI expenditure casting a shadow over many huge tech shares. With the FTSE 100 having hit new all-time highs, the inventory market is driving excessive – for now.

However some persons are anxious about whether or not we’d see a inventory market crash.

Spoiler alert – I can verify that, sure, we undoubtedly will. However, like everybody else, I can not say with certainty when it should occur.

It may very well be tomorrow. Or a long time down the highway.

Listed below are three sensible steps an investor might take now, to organize for the subsequent inventory market crash — and even use it as a chance to attempt to construct long-term wealth.

1. Evaluation your portfolio

As a long-term investor, I goal to purchase and maintain shares with a timeframe of years. Alongside the best way, I count on there to be ups and downs – possibly vital ones.

However on the whole I don’t goal to time the market.

If a enterprise actually is pretty much as good as I hope it’s, then hopefully its share value will develop over time even when there are some steep falls alongside the best way.

Simply because I believe that, although, doesn’t cease me from typically taking earnings.

When a share I personal appears to be like wildly overvalued to me (both as a result of the share value has soared, the enterprise has acquired a lot worse, or each) then I’ll resolve to promote it.

Periodically reviewing a portfolio can assist focus an investor’s thoughts on whether or not any pruning – or certainly, dramatic weeding – is likely to be helpful.

2. Be sure you’re diversified

Not having all of your eggs in a single basket is clear widespread sense. Within the inventory market it’s referred to as diversification.

However it may be tougher than it appears to be like even for somebody who tries to remain diversified.

Why? Think about you personal 10 shares, initially placing the identical quantity into every.

A pair principally go nowhere. Three or 4 do fairly nicely, however three or 4 do fairly badly – and one does brilliantly. It is likely to be like Nvidia, for instance, up 1,242% in 5 years, or Rolls-Royce (LSE: RR), up 1,199% over that interval.

Having not touched it in any respect, your portfolio has turn out to be far much less diversified. However whereas Nvidia or Rolls now has a really outsized function, does it make sense to promote your greatest winner?

Placing the correct steadiness between good funding and staying correctly diversified might be tough. Nevertheless it issues.

If the inventory market plummets, an absence of diversification might be very painful.

I’ve missed out on a lot of that hovering Rolls-Royce share value. I bought my stake years in the past.

Rolls faces the chance {that a} sudden surprising droop in civil aviation demand might harm revenues and earnings. I didn’t assume that was correctly mirrored in its share value – and nonetheless don’t.

On the proper value, although, I might be completely satisfied to take a position. Rolls has a big put in base of engines, highly effective model, and proprietary enterprise mannequin.

When the inventory market plummets, some shares can all of a sudden be bargains. However which may not final for lengthy.

So it may pay to organize prematurely a listing of shares you wish to personal, on the proper value. Rolls is on mine!