Picture supply: Getty Pictures

Warren Buffett’s method to investing entails specializing in high quality corporations which can be out of favour. With shares near file highs, I’m seeking to do one thing related.

Simply over a decade in the past, his funding automobile, Berkshire Hathaway, purchased a giant stake in farm tools agency John Deere in an agricultural downturn. And my newest concept is alongside these traces.

Buffett’s funding

Between 2012 and 2016, Berkshire purchased simply over 7% of Deere’s excellent shares. This was at a time when weak crop costs had been weighing on the business.

In some ways, this was a basic Buffett funding – shares in a high quality enterprise buying and selling at a reduction due to momentary points. However issues didn’t go solely to plan. Crop costs took a very long time to get well, staying in a protracted downcycle till round 2020. And this was lengthy sufficient for Berkshire to surrender on its funding.

This reveals that investments are by no means assured to work, even for the very best within the enterprise. However I’m an analogous concept for my portfolio in the meanwhile.

Secular progress

The inventory I’m is CNH Industrial (NYSE:CNH). Like Deere in 2012, it’s a farm tools producer that’s buying and selling at a reduction as crop costs have fallen.

This concept didn’t work effectively a decade in the past. However I believe the rise of automation in agriculture means an funding now isn’t nearly ready for a cyclical rebound.

With no site visitors round, it’s a lot simpler to make a self-driving tractor than a self-driving automobile. And CNH is on the lookout for this a part of the enterprise to account for 10% of gross sales by 2030.

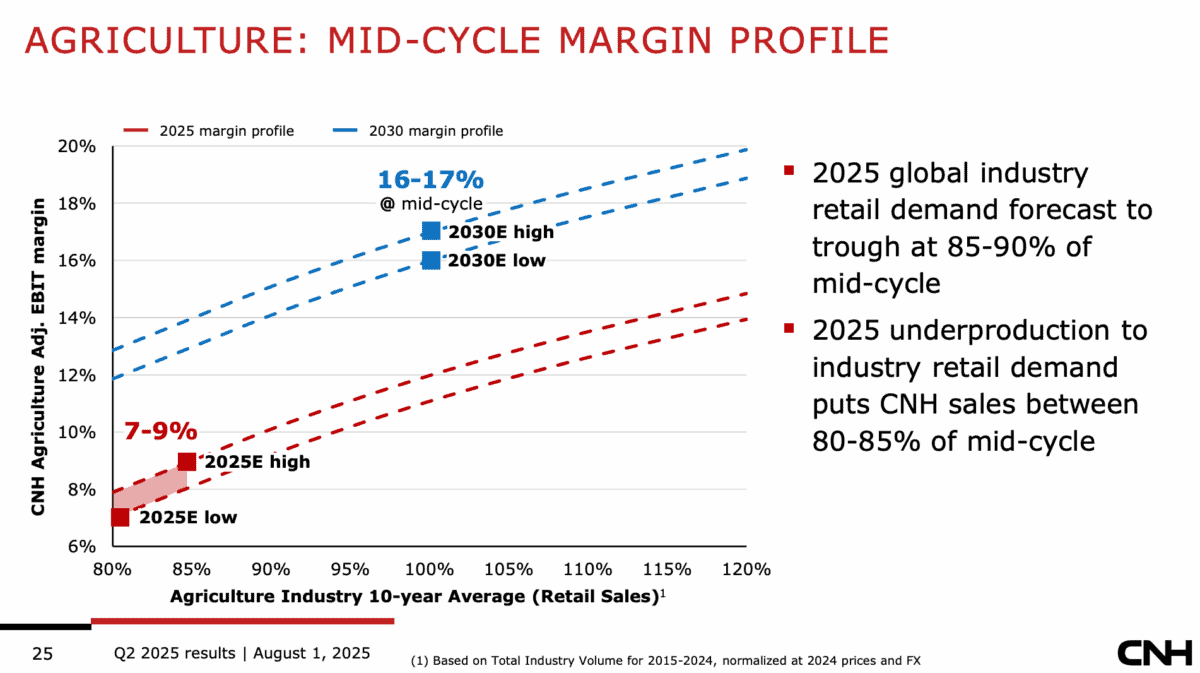

Supply: CNH Q2 Outcomes Presentation

That’s double the present stage and the corporate expects this to imply margins in its agriculture enterprise enhance from round 8% to 16%. Different issues being equal, meaning income ought to double.

Out-of-favour valuation

The inventory’s buying and selling at a ahead price-to-earnings (P/E) ratio of round 14. That’s effectively beneath the S&P 500 common and based mostly on earnings which can be down resulting from decrease crop costs.

The corporate has a whole lot of debt on its stability sheet and this creates danger, particularly if rates of interest don’t fall as anticipated. However this isn’t essentially as simple because it appears.

Round 80% of the agency’s debt is matched by financing receivables. In different phrases, it’s money that the agency borrows and lends to clients to assist them finance their purchases.

If CNH’s clients sustain with their debt obligations, I don’t count on its money owed to be a problem. And in the event that they don’t, it could repossess the tools used as collateral to offset the losses.

Discovering shares to purchase

In a 2022 interview, Todd Combs – a Berkshire investor – set out three issues Buffett seems to be for in a inventory to purchase. And I believe CNH may meet all of them.

The primary is a ahead P/E ratio beneath 15. The second is a 90% likelihood of upper earnings in 5 years, and the third is a 50% likelihood of rising income at 7% a yr.

The rise of automation within the farming business ought to generate sturdy progress. And with agricultural commodities at unusually low ranges, I’m seeking to take benefit.