Picture supply: Getty Pictures

With a share worth that’s fallen 74.7% since a excessive of 427p in late Could 2015, FTSE 250 constituent abrdn (LSE:ABDN) may not appear to be an important funding at first.

In August 2022 it unceremoniously misplaced its place throughout the FTSE 100 index and was relegated to the benches of the FTSE 250. A fast restoration meant it quickly rejoined the revered ranks however sadly, the highs didn’t final. In August final yr, it was as soon as once more demoted from the main index after the share worth fell 30% in solely two weeks. Subsequently, a swathe of FTSE 100 trackers bought their abrdn shares, leading to additional losses.

Nevertheless, the collapse appears to have lit a hearth inside administration. Final month, abrdn introduced a serious restructuring initiative geared toward revitalising the embattled agency.

A strong passive earner

A key good thing about investing in abrdn is the ten% dividend yield. This implies shareholders may earn an additional 10% yearly on every share they personal.

Emphasis on the phrase ‘may’.

If restructuring efforts don’t enhance earnings, abrdn might have to chop the dividend to scale back prices. Even when they do pay, the share worth wants to keep up not less than extra worth than the dividend yield to make it worthwhile.

The restructuring efforts embrace tons of of job cuts to save lots of £150m in prices. Whereas this helps the restoration, it additionally strains employees relations. There’s no level saving all that cash if everybody jumps ship, so administration might want to tread fastidiously.

What do the numbers say?

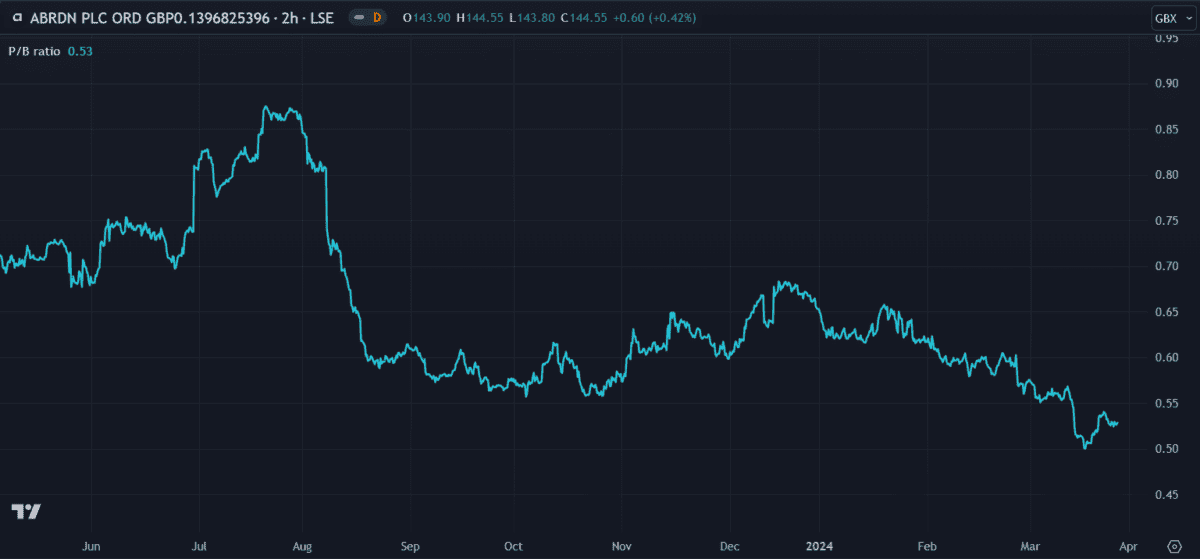

A key metric that signifies worth is the price-to-book (P/B) ratio. If it’s under one, then the corporate’s shares are well-priced in comparison with the worth of its property. For abrdn, this metric has been lowering steadily since late 2023, falling from 0.68 to 0.53. Whereas this isn’t any assure of enchancment, it does imply the shares may have ample development potential if the corporate’s earnings enhance.

The most recent earnings figures launched final December don’t precisely instil confidence. Regardless of £1.4bn in gross revenue, the corporate was solely left with £1m in earnings after bills. This implies earnings per share (EPS) are virtually zero and web revenue margins are 0.068%.

Luckily, it has £8bn in property and solely £2.9bn in liabilities (of which £5bn is fairness and solely £822m is debt). However its market cap is just £2.6bn — nearly half its fairness. So its benefit as an funding relies upon whether or not or not one believes it has intrinsic worth.

A beneficial forecast?

Financials apart, some forecasters stay constructive about abrdn’s future. I discovered the typical 12-month worth goal of 9 unbiased analysts is 157p — nearly 9% up from present ranges. It’s not a lot but it surely reveals there’s a point of confidence within the firm recovering.

Personally, I can’t say I really feel the identical manner.

There’s an opportunity abrdn will get well because it’s completed prior to now. It has a strong stability sheet and the ten% dividend yield is a large plus. However I’d have to see some definitive proof of sustained earnings development earlier than I make investments.

For now, it merely doesn’t impress sufficient.