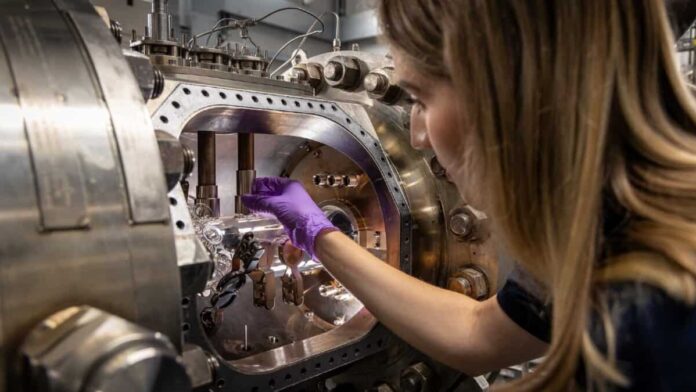

Picture supply: Rolls-Royce plc

The rising Rolls-Royce (LSE: RR) share worth was the speak of the city final 12 months. Throughout that point, it gained a whopping 200%. That made the British producer simply the FTSE 100’s greatest performer.

However will 2024 be a lot of the identical? It’s been a shaky few years for the agency. The pandemic noticed it close to chapter. And whereas the inventory took a success, it has posted a robust revival since.

I’ve been watching Rolls-Royce intently. It’s been on my watchlist for a substantial period of time. Might now be the time to purchase?

A robust begin

I’m most intrigued to know what’s been fuelling this efficiency. In any case, if this continues, there’s a big risk the inventory will keep on rising.

Properly, there are a couple of catalysts. However arguably the most important is the work accomplished by CEO Tufan Erginbilgiç. When he took over the agency again in January 2023, he described it as a “burning platform”. But since then, he’s taken appreciable strides to return the enterprise to its former glory.

As a part of this, he’s set formidable goals for Rolls. By 2027, he’s focused the agency to quadruple income to between £2.5bn and £2.8bn. He additionally plans to generate over £1bn in money by promoting off a few of its non-core companies. This could assist it scale back its debt pile.

Rolls’ full-year outcomes aren’t due till the tail finish of February. Nevertheless, it’s predicted that 2023 outcomes will are available forward of final 12 months’s. With that, it appears he’s making good progress.

A bubble?

So, Erginbilgiç has an formidable imaginative and prescient. And this has clearly excited buyers. Nevertheless, I’m frightened buyers could also be too excited.

Granted, the enterprise has made sturdy progress in pulling itself out of its pandemic troubles. However I’m anxious buyers have gotten carried away. Within the quick time period, share costs might be carried by investor sentiment and hype. However I’m a long-term investor, so I’m extra frightened about the place the inventory’s worth can be within the years and a long time to return.

A leap of almost 200% is spectacular. However is it justified? There’s the danger the inventory is in a bubble ready to burst.

Lengthy-term development

That stated, there are causes to stay bullish on the long-term outlook for Rolls. For instance, the aviation sector, which the agency generates almost half of its revenues from, is predicted to expertise giant development within the years to return as the worldwide center class continues to develop. Most just lately, Airbus’s World Market Forecast predicted a necessity for over 40,000 plane by 2042. That’s a big demand for the agency to doubtlessly capitalise on.

Will it preserve rising?

So, will the inventory preserve rising? And may I be speeding to purchase some shares?

Properly, I just like the strikes Erginbilgiç has made throughout his first 12 months on the agency. However I’m holding off from including Rolls to my portfolio proper now.

At just below 300p, I’m involved we may see its share worth sharply pulled again at any time. If that occurs, I’ll rethink. Till then, I’ll be ready on the sideline.