Picture supply: Getty Photographs

Each within the UK and the US, the inventory market hasn’t made an excellent begin to the month. The FTSE 100 and the S&P 500 are each down since Monday (1 September).

This, nevertheless, isn’t that uncommon. Traditionally, September has been a foul month for share costs and there are some necessary the reason why that is the case.

The ‘September Impact’

The decline within the inventory market a this time of yr is well-known sufficient to have a reputation. It’s referred to as the September Impact and there are a number of potential explanations related to it.

One is greater buying and selling volumes. The concept is that, as skilled traders get again to work after their summer season holidays, elevated exercise results in larger actions – in both path.

The explanation this ends in share costs falling – quite than rising – is commonly attributed to tax-loss harvesting. This includes promoting shares which are all the way down to offset tax liabilities on ones which are up.

Whether or not or not both of those is the best clarification of the well-documented September Impact is open to query. However I don’t assume it’s the primary motive share costs have been falling this week.

Market actions

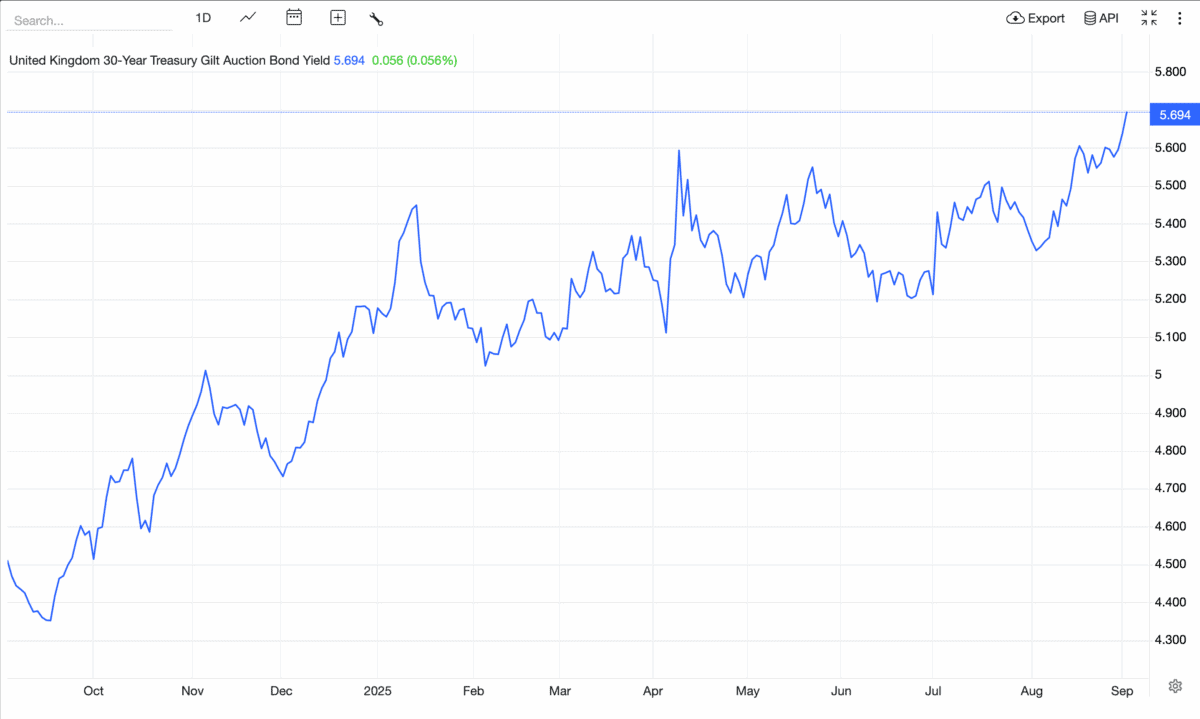

Issues over the UK financial system have despatched 30-year authorities bond yields to 27-year highs. Proper now, there’s a return of virtually 6% on provide from an asset the place the chance is extraordinarily low.

Supply: Buying and selling Economics

That naturally creates downward strain on share costs as traders search for higher returns from shares consequently. And this is a vital a part of why the FTSE 100 is down this week.

On the identical time, the US Courtroom of Appeals has dominated quite a lot of President Trump’s newest tariffs unlawful. The case is prone to proceed to the Supreme Courtroom, however the verdict creates additional uncertainty.

Investor positioning may effectively be amplifying the results of those developments. However I feel it’s these particular options – quite than seasonal tendencies – which are weighing on share costs proper now.

Shopping for alternatives

I’m trying to make use of the heightened volatility as a shopping for alternative. And a inventory on my radar is 3i (LSE:III) – the FTSE 100’s top-performing inventory of the final 10 years.

Not like different personal fairness corporations, the agency focuses on deploying its personal capital. Which means it’s capable of be selective about when to purchase, quite than being constrained by exterior traders.

Regardless of falling 6% within the final week, 3i shares commerce above the worth of its portfolio. Which means the wants to search out future development alternatives to justify its present value, which is a danger.

As I see it, although, a 55% premium to the agency’s e-book worth is greater than justifed by a 22% return on fairness. That’s why it’s on my purchase listing at in the present day’s costs.

Wake me up when September begins?

Given the September Impact, traders may ponder whether ready till the top of the summer season to purchase shares is an effective plan. However that isn’t at all times the case.

With 3i, the inventory remains to be 7% greater than it was initially of the yr. So ready 9 months for a possible sell-off would have been a mistake – and I’m glad I didn’t.