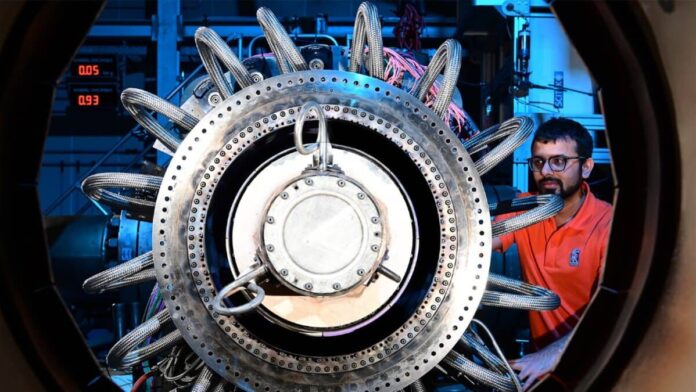

Picture supply: Rolls-Royce Holdings plc

Rolls-Royce (LSE:RR.) shares have but once more loved an unimaginable begin to the yr, rising by 27%. From the beginning of 2024, they’re up by 150%. What’s extra spectacular is that from January 2023, they’ve risen by a staggering 703%.

If an investor had put £10,000 into the corporate’s shares at first of 2023, they’d now have £80,340. However after such a spectacular run-up, is it potential the shares might crash?

Why have Rolls-Royce shares been flying?

If we take a look at Rolls-Royce’s monetary efficiency, it’s not tough to see why its shares have elevated.

Since CEO Tufan Erginbilgiç took the reins at first of 2023, the corporate has impressed on many metrics.

In 2022, the plane engine producer generated income of £13.5bn with a loss earlier than tax of £1.5bn. In 2024, it generated a revenue earlier than tax of £2.2bn on the again of £18.9bn of gross sales. What a turnaround!

Moreover, the agency has managed its debt very effectively. It had web debt of £3.3bn on the finish of 2022. It’s now obtained web money of £475m.

What I personally wish to see in a enterprise is bettering margins. It’s because it demonstrates that administration is working the enterprise with growing effectivity. Rolls-Royce has carried out excellently on this entrance too. Working margins have widened from 6.2% in 2022 to fifteen.4% in 2024.

Analysts are additionally anticipating the corporate to proceed rising, with income progress estimates of 8.3% and seven.9% in 2025 and 2026, respectively.

All of this optimistic information has essentially pushed up its share worth.

Crash catalysts

So what might trigger its shares to crash? Earlier than answering this query, it’s necessary to evaluate whether or not Rolls-Royce’s share worth has been pushed up justifiably by placing its valuation into context.

With a price-to-earnings (P/E) ratio of 32 on 2025’s anticipated earnings, its shares are definitely on the costly facet. Nonetheless, I don’t imagine they’re overly costly. There’s a case to be made that it deserves a premium for its spectacular outlook.

Furthermore, primarily based on its present share worth, its P/E is anticipated to fall to 27 primarily based on 2026’s anticipated earnings, after which to 24 in 2027.

Due to this fact, I don’t see valuation by itself with the ability to trigger the agency’s shares to crash.

What’s extra more likely to trigger this are occasions that would hurt the corporate’s enterprise, as buyers could then begin to query its valuation.

For instance, President Trump’s tariffs are an enormous menace. Its US enterprise accounts for 31% of its gross sales, so importing parts into the nation could adversely affect its bettering margins.

Additionally, as costs rise from these tariffs, it might additional constrain the price of residing for individuals, which means they’re much less doubtless to purchase a flight. This decreased demand for flights might translate into much less demand for plane engines and servicing contracts, which might harm Rolls-Royce.

With US GDP declining by 0.3% within the first quarter of this yr, it could be a sign that we’re heading for this situation

If sentiment adjustments on the agency’s outlook on account of the financial system deteriorating, it’s potential the shares might crash however total, I feel Rolls-Royce gained’t see a serious plunge. Though I don’t imagine its shares will ship the identical spectacular returns as earlier than, I imagine they’re nonetheless value contemplating for the long run.