Picture supply: Getty Photographs

The Tesco (LSE:TSCO) share worth has had a tough time over the previous few years. It’s down over 50% from its all-time excessive.

Nevertheless, lately, the shares have made considerably of a comeback. Since October 2022, they’ve been up over 40%. However I feel it’s been fairly a bumpy trip since 2015.

The share worth has typically fallen over 20%, like from February to September 2022 or August 2018 to January 2019.

However might this time be totally different? Or are the shares headed down once more?

Nicely, I feel they might be up over the long run, even when they go down within the brief time period. Nevertheless, I reckon the worth will climb slowly and steadily and will really stay fairly flat.

What I can see

I feel one of many core causes for the fluctuations in share worth since 2015 is the income modifications the corporate has reported.

For instance, in 2015, it reported £57bn in income, then went all the way down to £54bn in 2016. The corporate’s income then elevated to £64bn in 2019 and sunk as little as £58bn in 2021.

I’ve adopted the worth chart with the timings of those reviews, and the share worth appears to shift together with the income decreases and will increase.

Since 2021, the income has elevated from £58bn to £67bn at the moment. So, I feel it is a important contributor to the latest share worth rally.

That is no shock to me, as I firmly imagine that monetary reviews are probably the most important affect on an organization’s share worth over time.

Additionally, because the organisation is already so outstanding in its dominant market (the UK), I wouldn’t precisely name Tesco a progress firm anymore.

In my view, this stunted income progress might result in lacklustre share worth will increase.

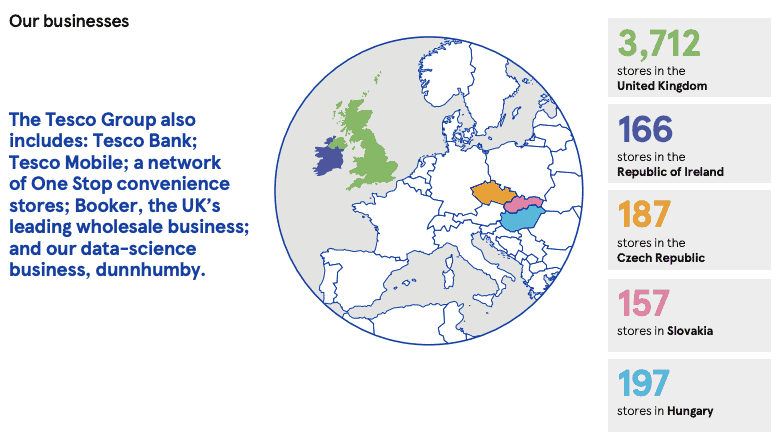

The image under properly outlines the size of the Tesco enterprise:

The place I feel it might go from right here

I feel the corporate’s growth will largely should be pushed by worldwide markets any more.

However Tesco has had a number of failed international launches, together with a failed chain of shops within the US known as Recent & Simple. It will definitely withdrew from the American market in 2013, leading to round £1bn in losses.

There was additionally an analogous story in Japan and Turkey, starting in 2003. The corporate finally exited from Japan in 2011 and Turkey in 2016.

Nevertheless, it has had some success in China. Though there have been preliminary challenges from 2004 onwards, it shaped a three way partnership with China Assets Enterprise in 2014. But, it offered out its complete stake in 2020.

In fact, the annual report picture I supplied above reveals 4 international locations apart from the UK during which the corporate has been profitable.

However my nice takeaway from Tesco’s worldwide plans is that it has struggled.

So, I ponder whether it may possibly successfully develop sooner or later prefer it did previously if it can’t simply conquer abroad markets.

The underside line

I don’t suppose the latest 40% rally will final as a result of I don’t imagine the corporate is ready to maintain up its income progress. I feel historical past would possibly repeat itself.

Subsequently, the doubtless stagnant nature of the share worth with slower progress prospects means I’m not shopping for the shares.