Picture supply: Getty Photos

In keeping with the newest information from Financial institution of America, fund managers seeking to stand out from the group in 2026 are UK shares. However ought to abnormal buyers do the identical?

Incomes above-average returns within the inventory market entails doing one thing completely different. And that is perhaps in search of undervalued alternatives within the FTSE 100 and the FTSE 250.

Outperforming the inventory market

Outperforming the inventory market’s onerous even for the very best buyers. However those that simply purchase funds that observe an index give themselves zero likelihood of doing this.

There’s nothing fallacious with incomes a mean return. Traditionally, shares and shares have generated higher long-term returns than money and bonds and that is no accident.

For skilled fund managers although, that is no good. They should discover methods to do higher than common to justify charging their purchasers charges for managing their cash.

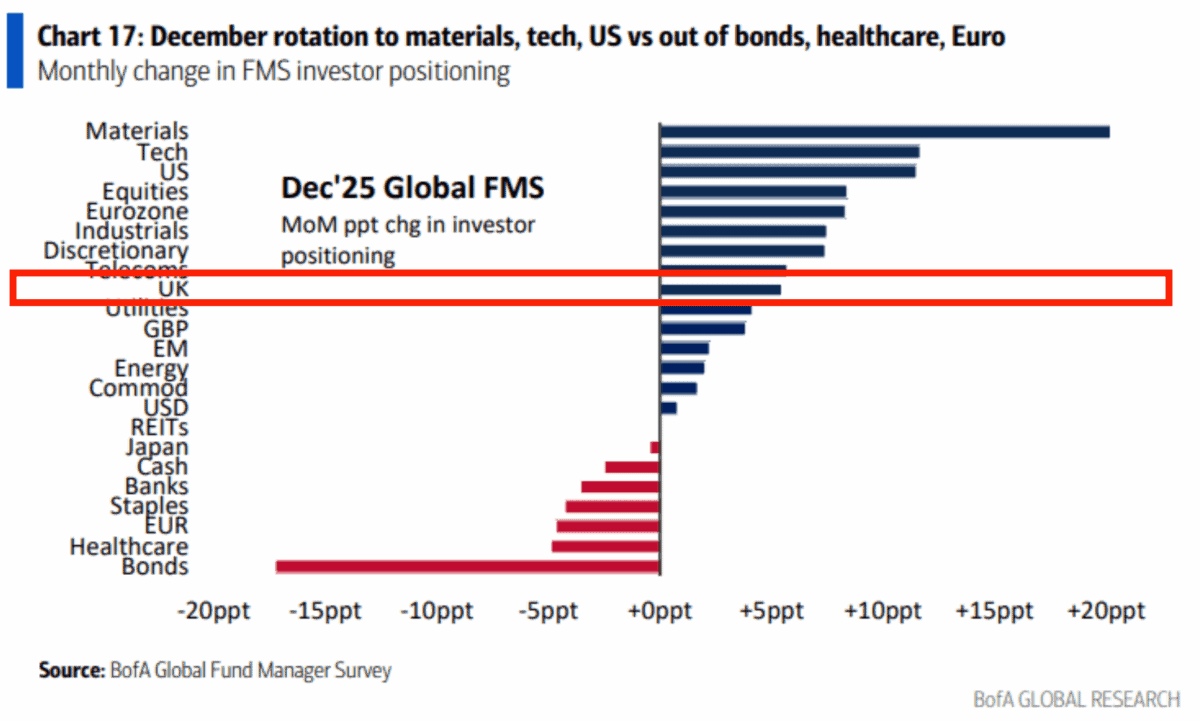

The Financial institution of America Fund Supervisor Survey comes out month-to-month. And it offers buyers an attention-grabbing perception into what the sensible cash’s considering and doing.

Comply with the cash…

In keeping with the newest information, the most well-liked shares for fund managers as 2026 approaches are know-how, supplies, and US equities. However a choose few are taking an curiosity in UK shares.

In different phrases, UK shares are removed from a consensus alternative, however a handful of buyers are taking an opportunity on a possible alternative. And I believe that’s value being attentive to.

Fund managers sometimes have to inform their purchasers how they’ve achieved every year. And that makes it pure to suppose in 12-month durations (or probably even shorter).

I’m wanting additional forward with my investing. However even in that context, there is perhaps shopping for alternatives in UK shares now that may not be there on the finish of subsequent yr.

UK worth

As regards to contrarian views, JD Wetherspoon’s (LSE:JDW) a UK inventory I plan to personal for a very long time. It’s been a troublesome yr for the hospitality business, however the inventory’s up 23%.

In contrast to many buyers, I believe the robust setting may nicely be a part of the rationale why the corporate’s achieved nicely. As opponents have been closing venues, the agency has seen like-for-like gross sales growing.

It’s an unorthodox view, however I believe the most important danger is the federal government making an attempt to assist the hospitality sector. My sense is it might assist JD Wetherspoon’s opponents than its enterprise.

The corporate’s value benefit comes from its scale and its freehold property that cut back lease liabilities. And I’m prepared to guess it’s going to be one which endures for a very long time to come back.

Doing issues in a different way

Whether or not it’s the subsequent 12 months or 12 years, buyers can solely get above-average outcomes by doing one thing completely different. However it doesn’t need to be something drastic.

It may be so simple as considering that UK shares are higher worth than most buyers suppose. And that appears to be the view of some fund managers proper now.

JD Wetherspoon shares have outperformed in 2025 and I believe they’ll do the identical over the long run — and even faster.