Picture supply: Getty Pictures

Berkeley Group Holdings (LSE:BKG) is a major UK homebuilder, and I feel it may make for a superb worth funding based mostly on my discounted money circulation evaluation. The corporate is within the FTSE 100, and its important markets are in London and the South East.

Listed below are the primary causes I feel it’s not unlikely the shares may develop 20% over the following 12 months.

Core markets and competitors

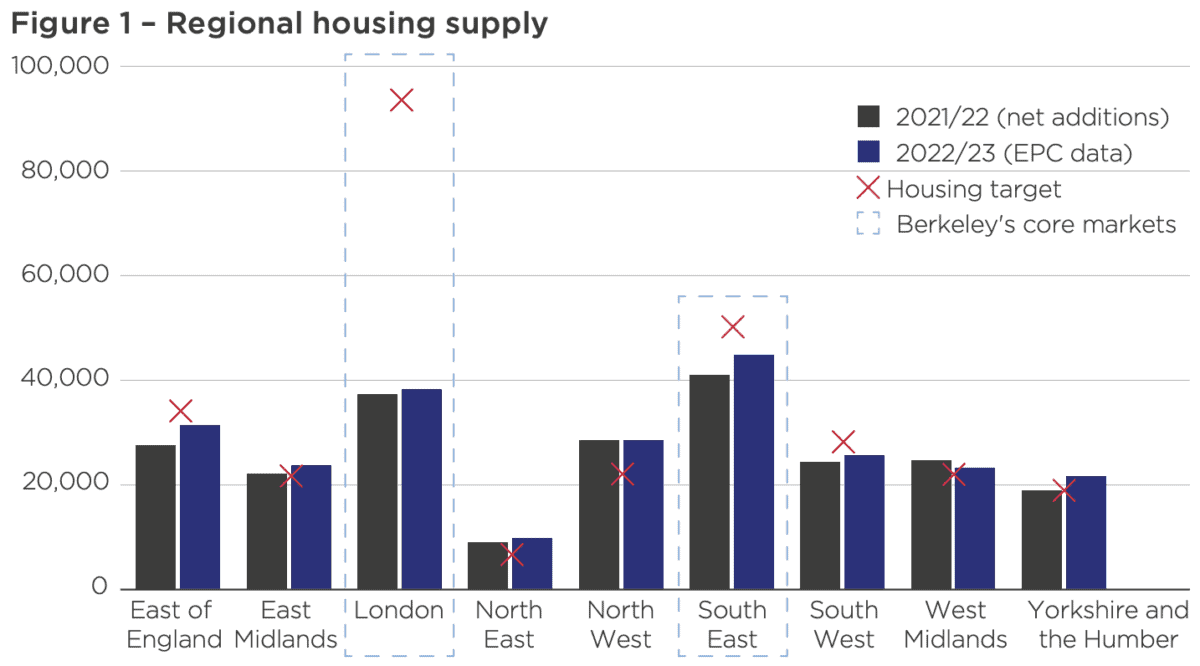

After I was studying the agency’s 2023 annual report, I got here throughout this chart, which exhibits the funding potential as a consequence of housing market progress in Berkeley’s core working areas within the close to future:

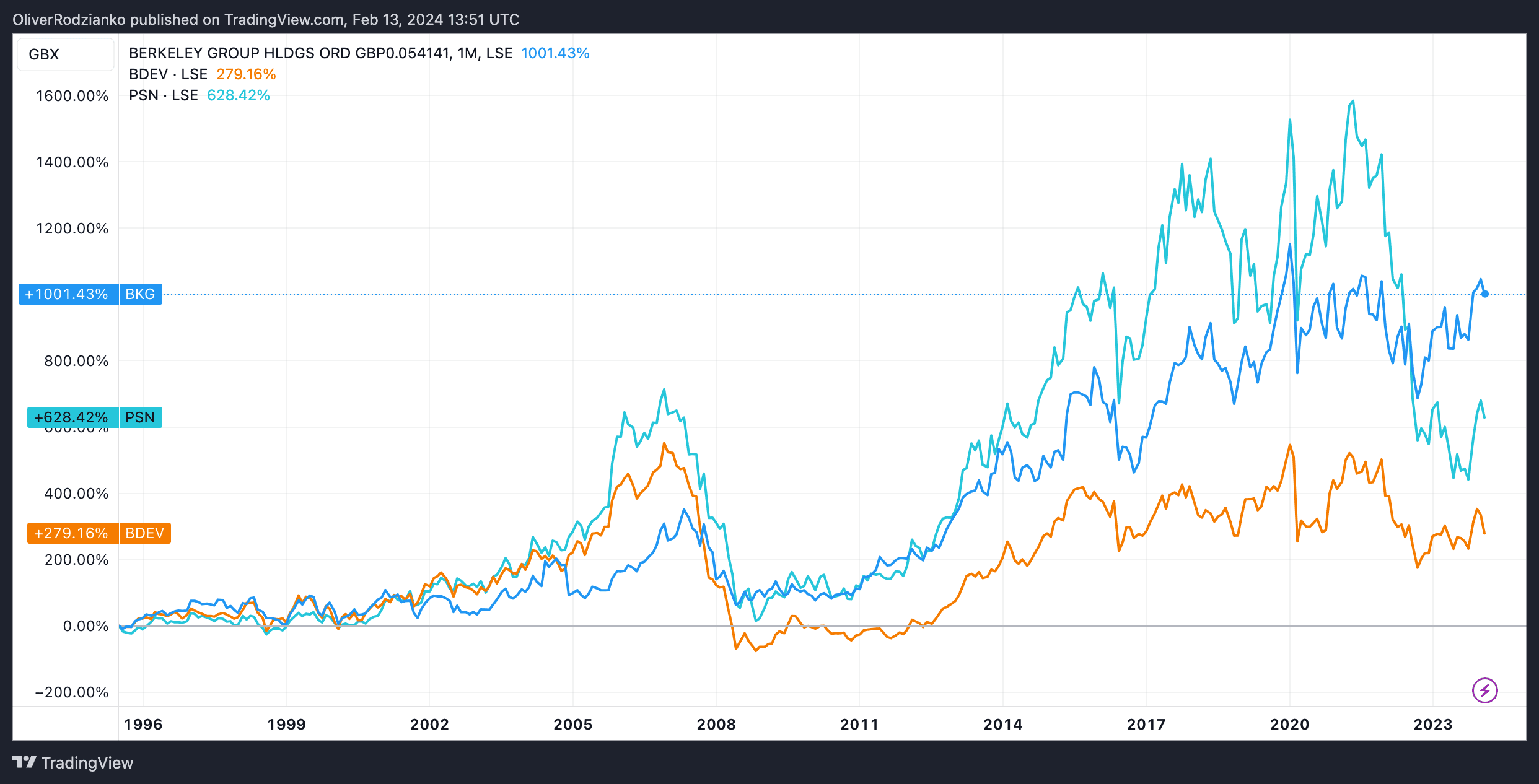

Nonetheless, that wasn’t sufficient to pique my curiosity. I additionally needed to know the way the enterprise has carried out traditionally towards its competitors. Due to this fact, I in contrast it to 2 different main UK housebuilding gamers, Barratt Developments and Persimmon.

To start with, I charted the three investments on historic share worth progress, whereby Berkeley has just lately taken the lead:

Created at TradingView

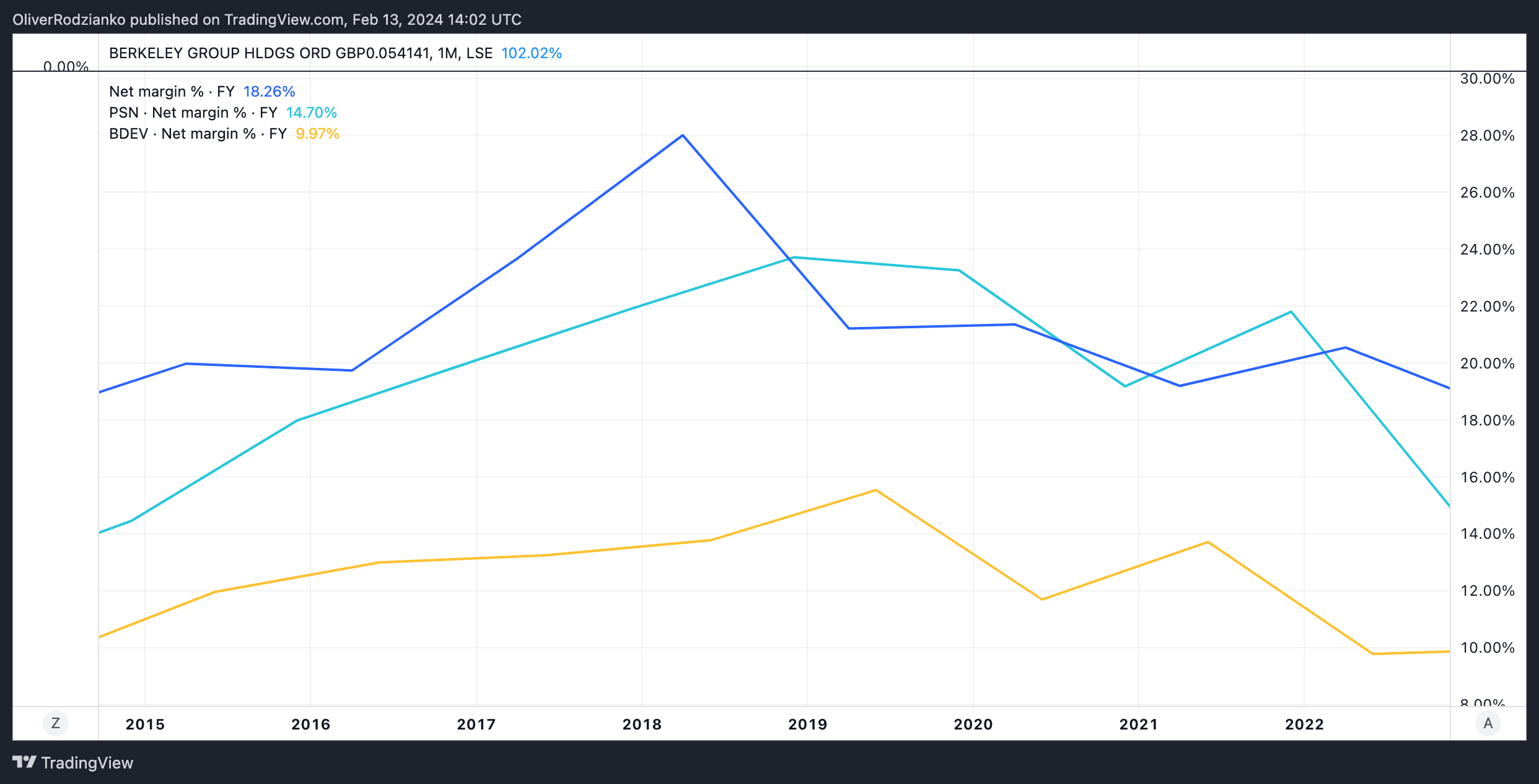

Then, I in contrast the three firms on web revenue margin. Berkeley has been persistently on the high of the group and at the moment retains its primary place:

Created at TradingView

Different financials I like

In addition to the abovementioned market alternatives and aggressive strengths, there are another components I like concerning the funding.

For instance, its stability sheet is steady. Whereas it may very well be improved, 49% of its belongings are balanced by fairness, which means it doesn’t have an excessive amount of debt at the moment.

Additionally, its three-year income progress may be very excessive, reported at 16.4% per yr on common.

The 31% low cost I seen

Now, precisely predicting a reduction on an funding is actually not possible, which is why I make estimations based mostly on monetary forecasts.

Berkeley has loads going for it after I have a look at its future earnings progress relative to its current worth. During the last 10 years, it has grown its earnings at a median of 9% per yr.

Due to this fact, if it may possibly preserve this over the following decade, the shares look like promoting at a 31% low cost in the intervening time. I used a way known as discounted money circulation evaluation to calculate this.

If my estimate is right, the shares may rise in worth faster than regular if the financials stay regular. The explanation for that is that traders like myself ought to decide up on the worth alternative, inflicting an inflow of shares to be purchased and the value to rise because of this.

I’ve a goal of 20% in worth appreciation in a yr. Whereas this isn’t assured, I anticipate appreciable progress in any case.

Crucial dangers

As seen in my chart above, Berkeley’s web margin is decrease than beforehand in the intervening time. If this pattern continues, it may imply the agency turns into much less worthwhile over the long run, and that would have an effect on my valuation estimate.

Moreover, the corporate’s dividends have been lowering by 8.8% on common yearly over the past three years. That may very well be off-putting if I needed passive revenue from my funding within the enterprise.

On my watchlist

Whereas Berkeley has loads going for it, proper now, I’m taking my time and never speeding into a call.

It’s on my watchlist for after I subsequent make investments.