Picture supply: Getty Photos

The potential of renewable power firm ITM Energy (LSE: ITM) has lengthy been apparent due to its promising hydrogen expertise — however the share value has moved round dramatically. It has nearly tripled over 5 years, however it’s down greater than 90% from its peak simply over three years in the past.

In early buying and selling this morning, the shares jumped 17%. That was following the discharge of the enterprise’s interim outcomes. May the corporate lastly have turned the nook – and will now be the suitable second so as to add the shares to my portfolio?

Gross sales increase

Income greater than quadrupled in comparison with the identical interval final yr. That’s the kind of gross sales progress many firms can solely dream of.

Nonetheless, it was from a low base so the revenues within the first half had been £8.9m. That’s not rooster feed, however it’s also pretty modest for my part.

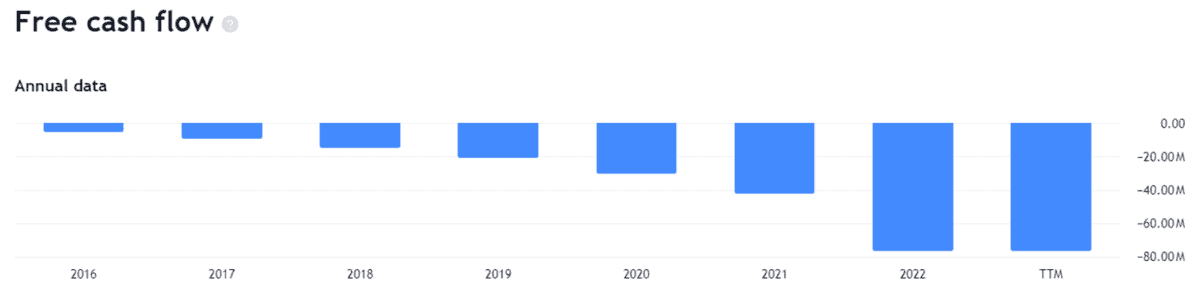

In the meantime, the corporate has burnt by way of over £60m of money prior to now yr. Money burn stays a key danger for my part, because it may result in additional shareholder dilution in future if the enterprise wants to lift extra money.

Its present money pile is £254m, solely round £100m lower than the market capitalisation. That implies that traders are assigning the corporate a valuation of roughly £100m.

The post-tax loss was £18.2m. At greater than twice revenues, that alarms me. Nonetheless, administration deserves credit score for reducing it by round two thirds in comparison with the identical interval final yr.

Bettering prospects?

For an organization with modest revenues and huge losses, a 17% soar within the ITM Energy share value could seem sizeable. So, why have the shares leapt on this morning’s buying and selling?

After years of seemingly missing a viable industrial technique, the interims recommend {that a} turnaround plan at ITM could also be beginning to bear fruit.

Clearly numerous work stays to be carried out, however sharp gross sales progress mixed with a lot decrease (although nonetheless huge) losses could level to how the corporate may carry out in future. Certainly, the corporate described its first half efficiency as “bringing us one step nearer to turning into a worthwhile firm sooner or later”.

ITM maintained its full-year income outlook. It decreased the highest finish forecast for loss earlier than curiosity, tax, depreciation and amortisation from £55m to £50m.

To purchase or to not purchase

I’m positively intrigued by the newest set of figures from the hydrogen firm.

Its expertise is enticing and rising gross sales recommend that some goal clients really feel the identical. The stage now appears set for gross sales progress in coming years mixed with ongoing deal with value administration. I don’t but see revenue in sight however the potential for reaching that stage seems to be greater than it did a yr in the past, I reckon.

Set towards that, shopping for at as we speak’s share value may but grow to be a profitable transfer. I really feel extra upbeat concerning the agency than I’ve ever carried out earlier than.

Nonetheless, quite a bit stays to be carried out and the corporate continues to be closely lossmaking. So, somewhat than purchase now, I’ll wait and look ahead to extra concrete indicators of a sustainably worthwhile enterprise mannequin.