Picture supply: Getty Pictures

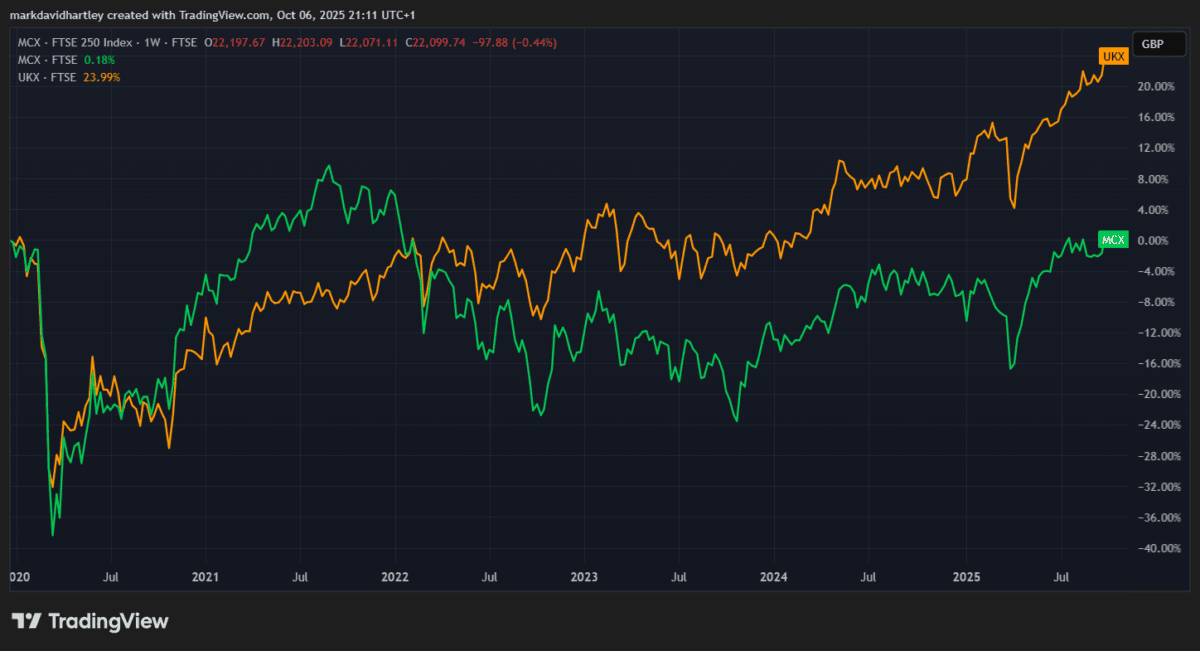

The UK funding world’s buzzing because the FTSE 100 has smashed by way of new highs once more this month. In the meantime, the mid-cap FTSE 250 appears caught at its pre-Covid degree of about 22,115 factors — a mark it briefly breached in July however has since failed to interrupt by way of.

In the meantime, the FTSE 100 sits virtually 24% above its pre-pandemic ranges.

It’s tempting to put in writing off mid-caps completely. However I stay a staunch believer that smaller dividend shares deserve a spot in a portfolio, particularly when many huge Footsie names look overpriced.

With that in thoughts, listed here are two FTSE 250 dividend shares I gained’t be promoting any time quickly.

Banking on a property growth

I’ve held Main Well being Properties (LSE: PHP) for a number of years, and it stays a core element of my revenue portfolio. Because the title suggests, this actual property funding belief (REIT) is concentrated on major care and health-oriented amenities, many leased to the NHS or personal healthcare suppliers.

Please be aware that tax therapy depends upon the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation.

Its ahead dividend yield stands round 6.78%, nicely above what many FTSE names provide now. Extra importantly, dividends are sufficiently lined by earnings and it’s been paying dividends persistently for practically three many years.

In the case of long-term investing, that’s the type of reliability I want over the risky nature of big-name development shares.

After all, no inventory’s with out dangers. Being property-based, it’s delicate to rates of interest and property valuations. If the broader actual property market weakens or borrowing prices climb, rental revenue and valuation positive aspects may come underneath strain.

However given its observe document, stability sheet and dividend consistency, I feel it’s a share traders ought to take into account holding in a dividend-seeking portfolio.

Placing my cash the place my mouth is

One other favorite of mine is MONY Group (LSE: MONY). The enterprise delivers providers in private finance, comparability instruments and monetary recommendation — precisely the type of operations that keep related in tighter financial instances. Its present dividend yield is about 6.25%, with a payout nicely supported by earnings.

The corporate additionally has an 18-year streak of uninterrupted dividend funds, and the typical development fee during the last decade is roughly 4.28% each year. That blend of sturdiness and revenue focus appeals strongly to me.

After all, it additionally faces dangers. The sector’s more and more aggressive, and any misstep in adapting to digital transformations or regulatory shifts may compress margins. Despite the fact that its dividend is well-covered for now, a shock earnings shock or elevated prices may pressure sustainability.

It’s at all times necessary for traders to take these considerations to coronary heart. However in comparison with many different revenue shares on the FTSE 250, I consider MONY Group’s in a stronger place than most and is value additional analysis.

Sustaining a long-term mindset

Sure, the FTSE 250 has struggled to interrupt new floor this 12 months. However that doesn’t imply all’s misplaced. Excessive-quality dividend shares like Main Well being and MONY Group provide money returns plus room for capital appreciation.

In my opinion, revenue traders could be smart to think about shopping for and holding such names, even when the mid-cap index feels caught. In any case, typically it’s much less about hitting new highs and extra about amassing dependable revenue alongside the best way.