Picture supply: Getty Pictures

The Barclays (LSE:BARC) share worth has largely underperformed its friends lately. This may be traced to numerous points. They embody internet curiosity margin (NIM) downgrades, and SEC fines associated to securities offered in error.

Nevertheless, downward stress on the inventory has arguably created some enticing shopping for situations. Barclays trades at 6.96 occasions ahead earnings, representing a 35.79% low cost to the sector common.

Furthermore, for a inventory that pays a major dividend, it possess an interesting worth/earnings-to-growth (PEG) ratio of 1.39. Usually a PEG ratio above one suggests a inventory is overvalued when adjusted for progress. However factoring within the 4.8% dividend yield, it seems to be good worth.

So, is there higher worth within the banking sector than Barclays in 2024?

UK lender

Lloyds (LSE:LLOY) is the UK’s largest mortgage lender. And because it doesn’t have an funding arm, it’s extra interest-rate-sensitive than its friends.

So, with rates of interest rising over the past two years, and rates of interest set to fall over the following three, Lloyds has doubtless been impacted greater than its friends.

The affect of fixing rates of interest on banks is multi-faceted. Increased charges means increased internet curiosity revenue. However additionally they result in increased impairment expenses as clients battle with their repayments.

Lloyds has some deal of insulation from these impairment expenses as its common mortgage buyer boasts an revenue of £75,000 — far forward of common.

Nevertheless, it might actually profit from falling charges, particularly if the financial institution’s hedging technique is as efficient as analysts anticipate it to be. And that is why the financial institution trades with a PEG ratio of 0.56. That’s a 60.59% low cost versus the sector common.

Lloyds can also be cheaper than Barclays on a ahead earnings ratio at 6.8 — that’s a 37.01% low cost to the sector.

Higher worth abroad?

One motive UK banks look so low cost versus the sector common is that the sector common is dragged upwards by US-based banking establishments. They commerce at a lot increased multiples.

And it is because banks are cyclical shares that are inclined to replicate the well being and potential of the economic system. The US remains to be seen as a a lot protected economic system. And it’s one with a lot stronger progress potential versus the UK and Europe.

To that finish, European banks actually aren’t costly both.

Intesa Sanpaolo is considered one of Europe’s prime banking teams, with a major presence in Italy and past. It’s Italy’s largest financial institution and has produced some its most profitable quarters ever over the previous 12 months.

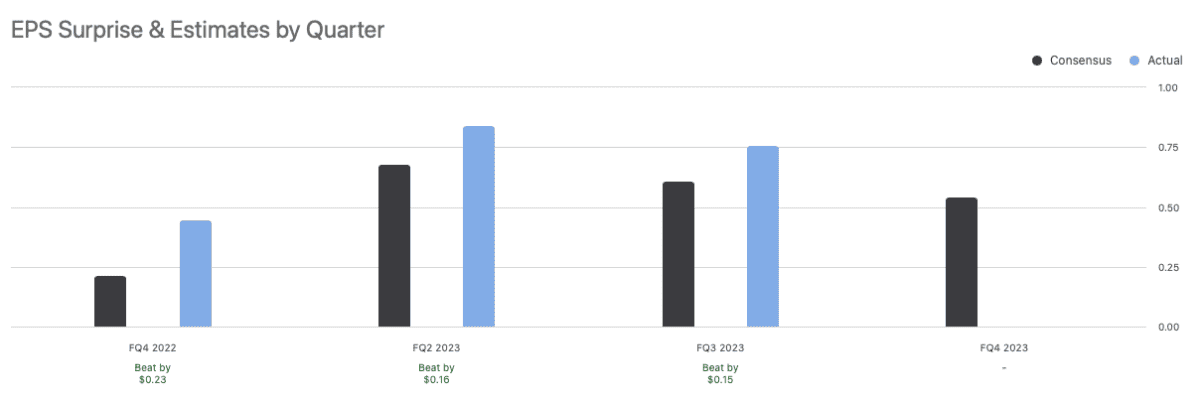

Because the chart exhibits, Intesa has delivered three consecutive earnings beats, partially as a result of affect of upper rates of interest on revenue. Regardless of this, the inventory has been unstable, rocked by a windfall tax in Italy.

Nevertheless, this uncertainty has contributed to enticing shopping for situations. Intesa Sanpaolo trades at 5.8 occasions ahead earnings — a 46.26% low cost to the sector, and has a ahead PEG ratio of simply 0.22.

So, personally, my prime banking shares for 2024 are Lloyds and Intesa Sanpaolo. However Barclays actually seems to be good worth too.