Picture supply: Getty Photographs.

Nvidia (NASDAQ:NVDA) inventory isn’t far off report highs. However there was some pullback on Tuesday 4 November after the market received just a little apprehensive about valuations within the expertise sector.

A part of that fear can in all probability be attributed to Palantir’s outcomes. They had been distinctive, nevertheless it seemingly wasn’t sufficient to fulfill the market, which was valuing the information software program firm at 300 occasions ahead earnings. These outcomes and the ensuing worth motion have in all probability despatched some shockwaves by means of the market.

Another excuse for the pullback in Nvidia was the information that Michael Burry has shorted the inventory through places. In easy phrases, Burry — greatest recognized for predicting the subprime mortgage disaster in 2028 — is betting that Nvidia and friends, notably Palantir, will see their share costs fall.

Burry’s put choices on Nvidia cowl 1m shares. That’s an enormous quantity and value $186m. Admittedly, his wager towards Palantir is six occasions greater.

A transfer price taking?

I believe quite a lot of traders would perceive or agree with taking a brief place on Palantir, however Nvidia is a really completely different story. Whereas Palantir trades at 117 occasions ahead price-to-sales, Nvidia trades at trades at 45 occasions earnings.

To broaden this comparability, Nvidia’s price-to-earnings-to-growth (PEG) ratio is 1.27 whereas Palantir’s is 8.1. This tells us that Nvidia is less expensive utilizing conventional metrics.

And this the place I’m skeptical about Burry’s transfer. Personally, I imagine there are many causes to imagine that Nvidia inventory stays undervalued.

For one, the inventory’s PEG ratio — which is a growth-adjusted earnings metric — is 29.5% decrease than the data expertise sector common. Sure, {hardware} firms historically do commerce at a reduction. However Nvidia is rather more than only a {hardware} firm. It’s central to the AI revolution and it’s received an enormous software program ecosystem.

It has additionally persistently overwhelmed earnings expectations lately. Whereas current beats haven’t been big, they nonetheless inform us that the forecasts might be underneath appreciating the corporate’s development potential.

That’s actually essential, as a result of, as famous above, it’s already buying and selling at a 29.5% low cost to the sector common.

There’s extra to it

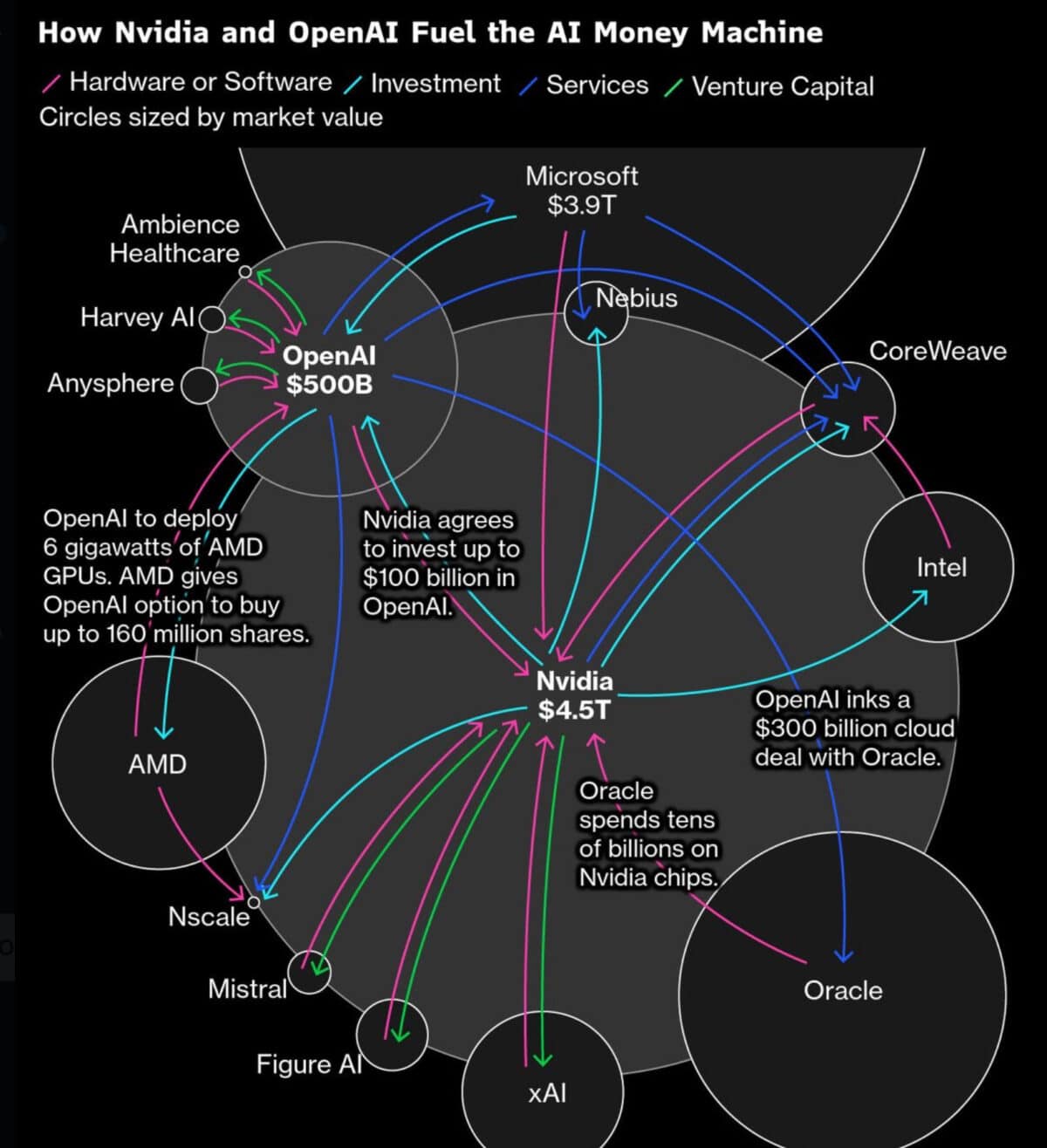

I recognize, nonetheless, that Burry might be not involved with the valuation, however with a bubble within the AI sector. He has beforehand referenced the well-known graphic which exhibits how cash is flowing in a round sample throughout the sector.

What does this graphic present us? It exhibits us that Nvidia is a central participant within the motion of capital across the sector. For instance, we are able to see Nvidia investing in OpenAI, which then commits to a $300bn take care of Oracle, which itself buys Nvidia chips.

I can see how this could be regarding, however that is largely being funded by free money circulation and never debt. That’s an essential distinction.

Personally, I believe that some valuations are a giant concern available in the market, however Nvidia’s isn’t considered one of them. I nonetheless imagine it’s a inventory traders ought to think about.