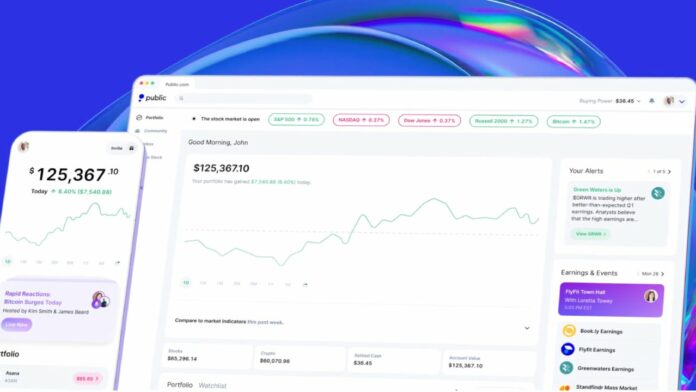

Public is an investing platform that provides a stable buying and selling expertise and can seemingly attraction to buyers who’re new to monetary markets. You’ll get entry to a lot of academic content material that may assist starting buyers stand up to hurry on numerous subjects and with fractional shares, you can begin buying and selling with as little as $1.

You additionally received’t have to fret about commissions on shares, ETFs or choices. Public does provide cryptocurrency buying and selling, although there’s a markup payment, in addition to the chance to spend money on non-traditional property equivalent to luxurious items and modern artwork. A social feed is out there to attach with different buyers about commerce concepts and firm executives are generally obtainable for investor questions by its “city corridor” conferences.

Whereas Public affords a lot of what is going to curiosity a typical investor, you received’t discover mutual funds on the app and particular person taxable accounts are the one account kind provided. Buyers on the lookout for a broader brokerage providing ought to contemplate conventional brokers equivalent to Constancy Investments or Charles Schwab.

Greatest for

- Starting buyers

- Purchase-and-hold buyers

- Fractional shares

Public at a look

| Class | Public |

|---|---|

| Minimal stability | $0 |

| Securities tradable | Shares, ETFs, choices, cryptocurrency, bonds |

| Value per commerce | $0 |

| Customer support | E mail, chat Monday-Friday 9 a.m.-5 p.m. ET |

| Account charges | $75 for transfers out; $5 inactivity payment each 6 months for accounts with lower than $20 |

| Cell app | The Public cell app is out there on the Apple App Retailer and Google Play Retailer. |

Execs: The place Public stands out

Low commerce minimal and no commissions

Public makes it astoundingly simple to purchase into the market. You’ll want simply $1 to get into the sport. And also you’ll have entry to actually 1000’s of shares and funds, so that you’re prone to discover that sizzling inventory you need to purchase. Public actually can’t decrease the bar any additional to inventory possession.

As a part of its worth proposition, Public doesn’t cost any fee. Zero-commission buying and selling isn’t fairly the hook that it was just a few years in the past when Robinhood began pulling this little trick. Nonetheless, it’s good to see that Public meets the usual business fee construction.

Fractional shares

Public permits fractional shares on its platform, and that’s an incredible characteristic for freshmen. With fractional shares, you should buy a slice of even the highest-priced shares or ETFs. And with the low commerce minimal of simply $1, you’ll be able to personal a bit – albeit a tiny one – of something. This characteristic will get each final greenback of your cash working for you, whatever the inventory worth.

Not solely does Public assist shopping for partial shares, nevertheless it lets you reinvest in them, too. So whenever you obtain a dividend, you’ll be able to set the app to reinvest it into the inventory that paid it.

Each options are good for freshmen, and never many brokers provide each. In actual fact, Constancy, Charles Schwab and Robinhood are among the solely main on-line brokers that provide each options.

Intensive training and information

Public does a great job of offering a plethora of academic content material for starting buyers, together with tons of “101” kind info on the investing fundamentals. So that you’ll have the ability to learn clear articles that designate the fundamentals (“What’s a brief squeeze?” or “What causes market volatility?”).

You’ll additionally get an in depth information feed from any inventory that you just need to comply with in addition to very important monetary info, upcoming earnings reviews and message boards for every inventory.

Social feeds

One of many extra uncommon – and fascinating – options of Public is the social feed that lets you comply with different buyers, scan by featured profiles and interact in some inventory chat with them on the platform. So it’s not solely shares you’ll be able to comply with, however individuals, too. You’ll be able to see why one other investor likes a sure inventory and after they may need to purchase or promote it.

You too can search by thematically linked shares (“Residence & Backyard” or “Ladies in Cost,” for instance) to drag concepts after which see what different buyers suppose. And naturally, you’ll be able to search for the day’s huge movers and different comparable types of pre-screened shares.

One other cool characteristic is what Public calls “city halls,” which is a type of question-and-answer session with CEOs of publicly traded firms, maybe even one among your holdings. You submit written questions and leaders reply to them in a reside discussion board.

Public Premium subscription

Should you’re on the lookout for extra information, steering and evaluation than what’s obtainable on a inventory’s web page, Public additionally affords Public Premium, a subscription service that prices $10 per thirty days. That dough will get you extra monetary metrics to research the corporate in addition to evaluation from Morningstar, a well-regarded analysis store that may present stable insights and perspective on the companies it covers. You’ll additionally get an upgraded stage of buyer assist from the Public workforce.

Clients do have a solution to skip the $10 payment, although. Merely have an account with $20,000 and Public offers you entry to Premium free of charge.

Entry to cryptocurrency

Along with shares and ETFs, cryptocurrency can also be obtainable on Public. The app affords seven of the most well-liked cash, together with Bitcoin, Ethereum and Shiba Inu. Plus, you’ll be able to make investments with as little as $1 and with no fee expense. And also you’ll additionally have the ability to use the app’s social feeds to speak with others about all of it.

Cons: The place Public might enhance

Lack of mutual funds

If you wish to spend money on shares and ETFs, like many buyers, you’ll discover what you’re on the lookout for right here. This choice will suffice for a lot of and possibly most. These securities have sufficient danger and potential return — you’ll be able to earn passable income with out different sorts of investments.

However buyers on the lookout for comparatively widespread selections equivalent to mutual funds should arrange an account elsewhere. That’s the character of an app that pitches itself to coach freshmen on learn how to make investments.

That mentioned, Public does provide cryptocurrency buying and selling and entry to non-traditional property equivalent to superb artwork, NFTs, uncommon buying and selling playing cards, comics and even uncommon sneakers. It additionally started providing Treasurys and company bonds in 2023, which give it a foot within the fixed-income world, in addition to investments in music royalties. A sturdy providing in these classes makes Public mainly not like any conventional on-line low cost dealer.

Restricted account sorts

You’ll have already got created your account earlier than you understand that you just weren’t even requested for the account kind. That’s as a result of Public affords solely probably the most easy choice right here: a person taxable account. That’s in all probability not a dealbreaker for the type of individuals Public is seeking to appeal to, however many others received’t discover it to their liking and should finally go elsewhere. Buyers seeking to save for retirement by tax-advantaged accounts equivalent to conventional and Roth IRAs should open an account with one other dealer.

Backside line

With its give attention to training in an easy-to-use app, Public affords a stable bundle to freshmen within the investing recreation:

- The tutorial and social parts will assist newer buyers interact with investing and provide them a cause to return again to the app even when they aren’t buying and selling.

- Starting buyers ought to recognize no account minimal, fractional shares and extra.

- These seeking to commerce choices could discover the fee construction right here engaging.

Buyers on the lookout for brokers with sturdy academic choices ought to take a look at Constancy, Charles Schwab and Merrill Edge. These needing extra sorts of accounts might select virtually every other dealer, although among the bigger gamers equivalent to E-Commerce will present a wider choice.

How we earn money

Bankrate is an impartial, advertising-supported writer and comparability service. Bankrate is compensated in alternate for featured placement of sponsored services and products, or your clicking on hyperlinks posted on this web site. This compensation could influence how, the place and in what order merchandise seem. Bankrate doesn’t embrace all firms or all obtainable merchandise.