Picture supply: Getty Pictures

The easyJet (LSE:EZJ) share value is at present buying and selling over 75% under its all-time excessive. Whether or not this is a chance for me is determined by many components, together with how I examine this funding to different shares.

I feel the corporate deserves to be given credit score as a really progressive and helpful enterprise. I’ve flown on the airline many instances myself, and I like that it offers low cost flights, in contrast to most different airways.

Nonetheless, the corporate’s financials are usually not the most effective, in my view. There may be important cause to consider that the low share value might, the truth is, be a ‘worth entice’.

A worth entice

A worth entice is when shares could seem undervalued at a low, engaging value, however the truth is, the worth deserves to be this manner for legitimate causes.

For instance, within the case of easyJet shares, whereas the price-to-earnings ratio is round a wholesome 9.5, there are deeper monetary issues. These embrace unfavourable long-term income progress charges and a excessive degree of debt proper now.

One of many core causes which may make easyJet look like a price entice is the pandemic’s impact on the enterprise. If it weren’t for such a harmful flip of occasions, it’s cheap for me to assume that the share value would have remained a lot larger than it’s now.

What the pandemic triggered

The easyJet shares had been buying and selling at 1,260p pre-pandemic. Now, they’re at virtually 500p.

Clearly, Covid-19 triggered a standstill for many air journey for various intervals, relying on location and jurisdiction. easyJet’s income tanked, down from £6.4bn in September 2019 to as little as £1.5bn in 2021, a 77% lower.

The corporate’s complete liabilities on the steadiness sheet additionally elevated from 63% of belongings in 2019 to 72% immediately.

But, amazingly, the corporate has managed to keep up an equal amount of money in comparison with debt as of immediately. That is important to think about after I consider easyJet’s long-term prospects relating to its capacity to take care of its debt burden.

easyJet’s plan from right here

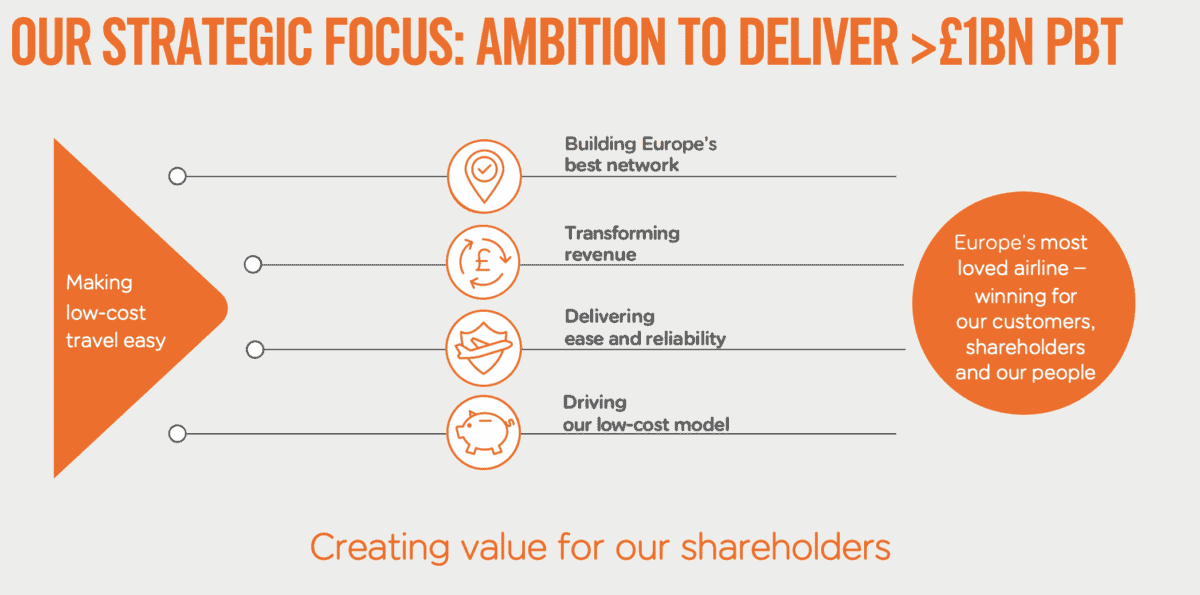

From studying the annual stories and investor displays, the organisation clearly plans to stick to its low-cost enterprise mannequin.

Right here’s the present technique as outlined by the CEO Johan Lundgren:

The corporate additionally plans to comply with a ‘roadmap to internet zero’. That is important for an investor like me who cares deeply about environmental, social, and governance issues.

But, there’s little or no point out within the current stories and displays on the corporate’s restoration post-pandemic.

The excellent news is that easyJet’s income per share has elevated steadily from £2.70 in September 2021 (the bottom level of the pandemic woes) to £10.90 immediately. That’s over a 300% improve.

Watching rigorously

Whereas the corporate seems to be undervalued to me, the low value could possibly be a entice if the organisation doesn’t improve its income progress charges to make up for the numerous pandemic drop.

I feel there could possibly be a possibility right here, however I additionally assume it’s too quickly to inform.

I don’t wish to threat getting trapped at a low value, so I’m simply including this one to my watchlist for additional analysis as a substitute of shopping for the shares.