Picture supply: Getty Pictures

Some shares may pay their very own method in dividends alone, if these payouts are maintained at their present stage. With a dividend yield of 9.8%, for instance, if I purchased British American Tobacco shares in the present day I might have earned my buy worth again in little over a decade ought to the dividend keep flat – and I nonetheless personal the shares. Many buyers just like the dividends supplied by Nationwide Grid (LSE: NG) shares.

Because the proprietor of a vital piece of nationwide infrastructure that has no direct rival, Nationwide Grid could have what looks like a license to print cash – and pay dividends.

In actuality the image is extra nuanced.

Regulatory caps restrict costs. Sustaining a big energy distribution community may be pricey.

However what if I had purchased Nationwide Grid shares a decade in the past? How would that funding have labored out for me?

Optimistic share worth change

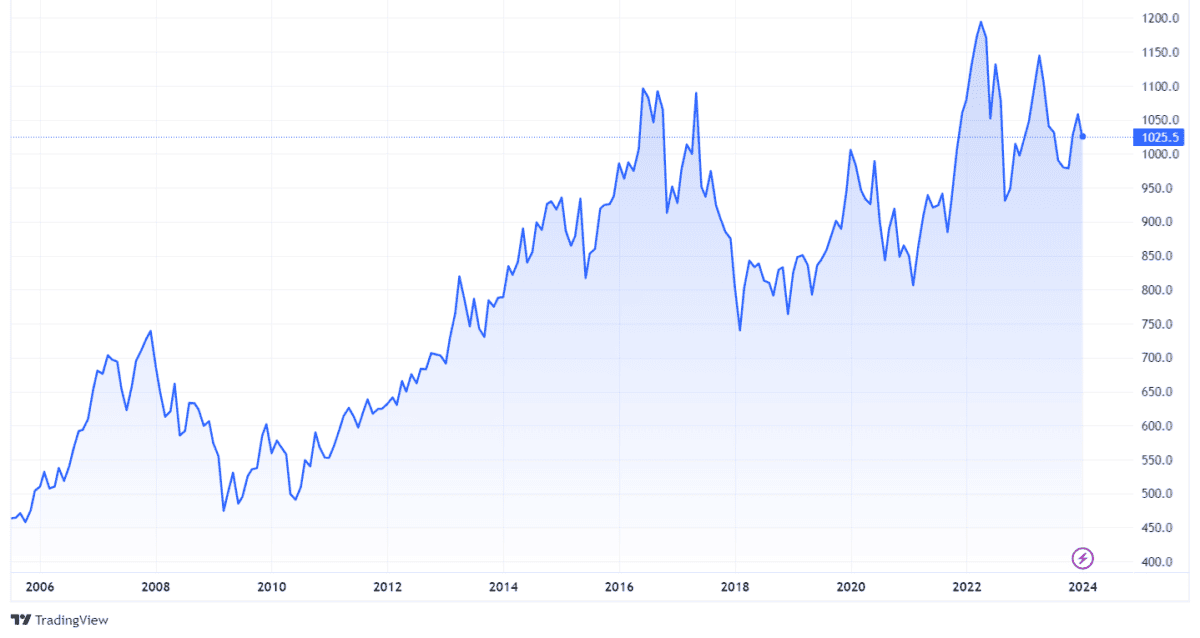

A decade in the past, Nationwide Grid shares had been altering fingers for just below £8 apiece. They’re now buying and selling for about £10.25 every.

In different phrases, my shares would now be price 28% greater than I paid for them 10 years in the past.

Monitor file of bizarre dividend development

Because it occurs, a decade in the past in the present day (22 January), Nationwide Grid paid an interim dividend of 14.5p per share. That compares to the newest interim dividend, paid earlier this month, of 19.4p per share.

But when I had purchased again then, I might have missed the ex-dividend date already so my first dividend would have are available summer time 2014.

Throughout the interval since then, the corporate has yearly raised its bizarre dividends. On high of that, in June 2017, it paid a particular dividend of 84.4p per share. That got here after the corporate bought a majority stake in a UK fuel distribution enterprise. A share consolidation changed every 12 present shares with 11 new ones.

Excluding the particular dividend, the shareholder distributions I might have obtained since shopping for the shares a decade in the past would have added as much as £4.75 per share. That doesn’t cowl my buy worth, however is equal to round three fifths of it.

Between share worth development and bizarre dividends, then, my holding would have given me a complete return in 10 years approaching 90%.

Ought to I purchase now?

Evidently, shopping for Nationwide Grid shares 10 years in the past would have turned out to be a rewarding monetary transfer for me.

What about now, although? In any case, previous efficiency is just not essentially an indicator of what would possibly occur subsequent.

The enticing options of the enterprise are nonetheless in place, I reckon. It advantages from a community with no direct rival, with a big finish person base and prone to profit from resilient demand.

But over the previous decade, web debt has ballooned. Nationwide Grid ended its 2013-14 monetary 12 months with £21.2bn of web debt on its stability sheet. By the tip of March that determine was £41bn. The corporate expects it to extend by £3.5bn throughout its present monetary 12 months, when capex is anticipated to high £8bn.

Sustaining a nationwide energy distribution community and rising the dividend usually is an costly enterprise.

In the long run, I don’t assume web debt can merely carry on rising indefinitely with out the dividend being in danger. So I’ve no plans to purchase Nationwide Grid shares in the present day.