Picture supply: Getty Photographs

Investing £200 a month generally is a highly effective strategy to construct wealth and goal a considerable second earnings. That is very true after we harness the facility of compounding.

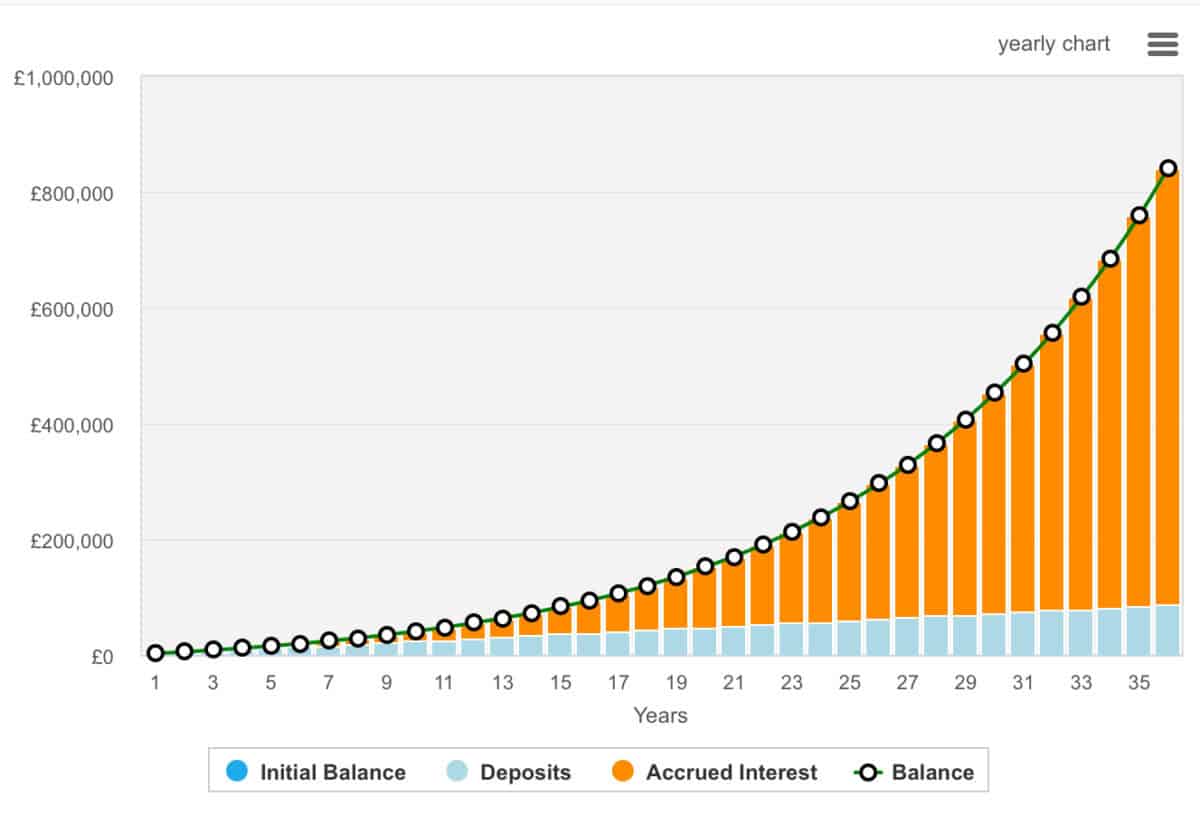

Compounding means buyers earn returns not simply on their unique investments, but additionally on the returns these investments have already generated. Over time, this “curiosity on curiosity” impact can speed up development dramatically.

Gradual and regular

If anybody persistently invests £200 each month and achieves a median annual return of 10% over the long term, the portfolio may develop to over £841,000 in 36 years. Sure, it takes time, however the longer we depart it, the quicker it’ll develop.

The maths behind that is rooted within the compound curiosity formulation, the place annually’s good points are added to your principal, so the bottom for future development retains getting bigger.

After 36 years, an investor may look to allocate their portfolio in direction of corporations with paying dividends or just purchase debt. With a 5% annualised yield, an investor would obtain £42,050 yearly. And that’s tax-free.

Please observe that tax therapy relies on the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Don’t lose cash

The above is nice. Nevertheless, none of this issues if buyers make poor selections and lose cash. Defending capital is simply as vital as looking for excessive returns. As Warren Buffett famously says, “Rule primary is rarely lose cash. Rule quantity two is always remember rule primary”.

That is essential as a result of a big loss may be devastating. If a portfolio falls by 50%, it wants a 100% achieve simply to get again to the place it began. That’s why it’s smart to concentrate on high quality corporations, ideally with sturdy stability sheets and sustainable dividends, and to diversify investments throughout sectors to cut back threat.

Investing correctly

One UK inventory that I imagine has quite a lot of potential is Melrose Industries (LSE:MRO). The aerospace producer’s valuation massively lags its friends regardless of the very fact that it’s the sole supply provider for 70% of its gross sales. Meaning it has an extremely sturdy financial moat. Its elements additionally function on all main plane engines.

Wanting forward, Melrose has set out a plan for top single-digit annual income development, focusing on round £5bn in income and over £1.2bn in adjusted working revenue by 2029. Free money circulation is predicted to greater than quadruple over the subsequent 5 years, reaching £600m by 2029.

Administration is guiding for greater than 20% annual development in adjusted diluted EPS over this era. All of this from an organization valued at 14.1 occasions ahead earnings. This additionally suggests a price-to-earnings-to-growth (PEG) ratio effectively beneath one. In the meantime a number of friends are nearer to 2 occasions or above.

Dangers? Nicely, internet debt is slightly excessive at £1.3bn. There’s additionally the matter of execution threat because it completes its transition. Regardless of this, it’s a inventory I like rather a lot. It positively deserves broader consideration.