Picture supply: Getty Photos

How useful would a £500 weekly second revenue be for you? It’d make my life much more comfy, which is why I make investments any spare money I’ve within the inventory market.

Why wouldn’t I? The UK is known for its sturdy dividend tradition, backed by its big number of mature, market-leading, and financially strong firms. AJ Bell expects FTSE 100 firms alone to pay a shocking £80.7bn price of dividends for 2025.

However how a lot would one have to put money into UK shares for a £500 passive revenue every week? Let’s have a look.

Concentrating on a second revenue

It’s essential to do not forget that dividends are by no means, ever assured. Taking this on board, traders can take motion to spice up their possibilities of a powerful and sustained second revenue over time.

Some of the highly effective instruments for maximising dividends is to construct a diversified portfolio of shares. We’re speaking firms unfold throughout sectors and areas, which protects traders’ returns from particular person shocks and supplies a clean (and hopefully rising) dividend stream.

However how massive would somebody’s portfolio have to to generate tons of of kilos of revenue per week? That relies on the dimensions of the dividend yield, which reveals how a lot revenue in dividends somebody makes from their funding.

Let’s say an investor is focusing on a £500 revenue with 6%-yielding dividend shares. At this degree, they’d want a portfolio price simply over £433,000.

Is that this achievable?

Most individuals don’t have that type of sum sitting in the back of a drawer. However given time, it’s a sum which — as historical past reveals — is a really achievable goal.

The wealth-building energy of the inventory market is appreciable. The long-term return from international share investing sits at between 8% and 10%. Add within the energy of compounding — the place funding earnings snowball over time — we’ve a robust mixture that may multiply one’s returns over the long run.

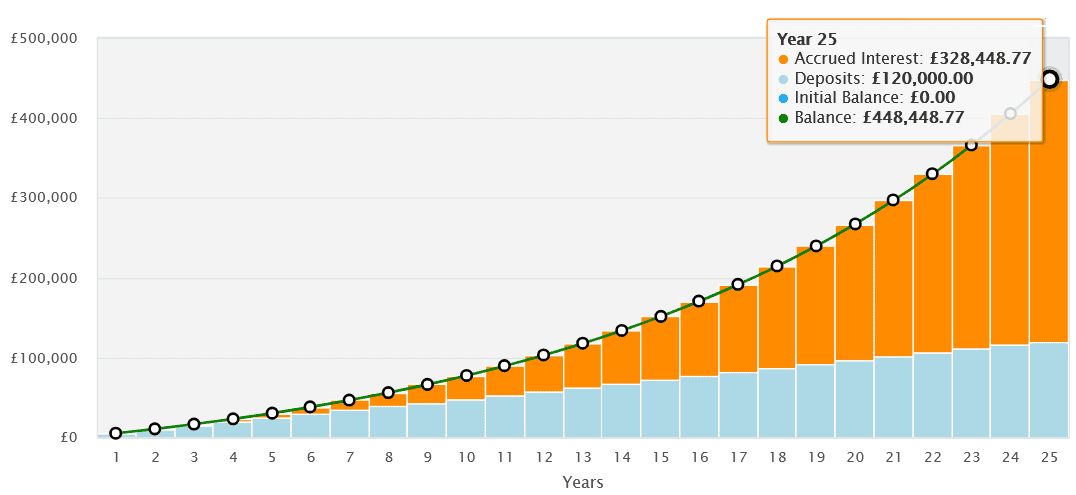

For that £433,000 portfolio, somebody may make investments £400 a month for lower than 25 years and have a practical likelihood of reaching that. That is assuming they obtain a mean yearly return of 9%.

A FTSE 100 dividend star

Authorized & Common (LSE:LGEN) is only one nice dividend share for traders to think about right now. It’s a money machine, merely put. And it’s proven a powerful urge for food for returning the surplus capital it generates to shareholders.

Excluding pandemic-hit 2020, dividends right here have risen yearly since 2011. Metropolis analysts anticipate this proud report to proceed, leading to monumental 8.4% and eight.6% dividend yields for 2026 and 2027 respectively.

However can Authorized & Common preserve paying these monumental dividends on its shares? Previous efficiency isn’t all the time a dependable information to future returns. And payouts from this level may very well be impacted if powerful financial circumstances and aggressive threats hit income.

It’s attainable, however on stability I’m assured it’ll stay a prime revenue inventory. A Solvency II capital ratio of 217% supplies a superb buffer in opposition to any earnings volatility. That is greater than double what regulators require.

And looking out over the long term, I anticipate income to steadily rise because the monetary companies market balloons. Given Authorized & Common’s sturdy dedication to dividends, this may doubtless ship extra tasty revenue for traders