Picture supply: Getty Photographs

I consider packing my Shares and Shares ISA with FTSE 100 shares is an effective way to make a second earnings. The regular stream of juicy dividends I’ve obtained since I started my funding journey a few years in the past is a testomony to how profitable this investing technique might be.

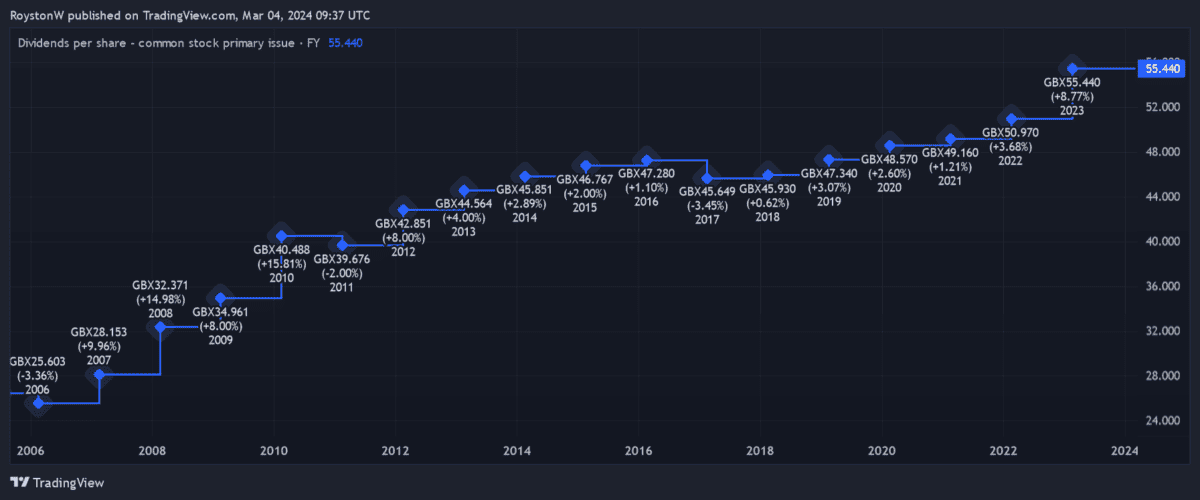

Nationwide Grid (LSE:NG.) is one prime inventory with a robust historical past of rising shareholder rewards. I have to do not forget that giant capex payments may probably derail this monitor file afterward. However spectacular money flows and a formidable ‘financial moat’ nonetheless imply it may stay one of many Footsie’s biggest earnings shares.

A £100 passive earnings

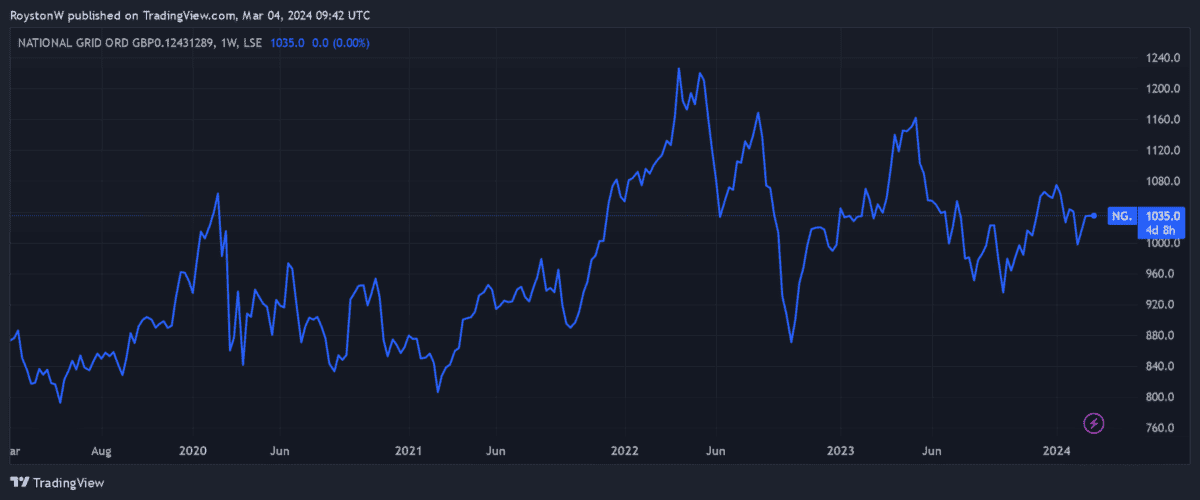

What number of Nationwide Grid shares would I want for a three-figure month-to-month earnings nonetheless? If I focused a £100 payout every month, I’d want to purchase 2,010 shares within the firm. That is primarily based on a dividend yield of 5.8% for the monetary 12 months to March 2025.

At a present share value of £10.35, I would wish to spend £20,803.50 to do that. It’d be a sum value paying, for my part.

As I say, Nationwide Grid’s yield sits slightly below 6%. To place this into context, the typical yield for FTSE 100 shares sits means again at 3.8%. The excellent news is that Metropolis analysts anticipate dividends to maintain rising in fiscal 2026, too. So the yield rises as much as 5.9%.

A dependable earnings supplier

Nationwide Grid’s glorious dividend historical past might be attributed to its ultra-defensive operations. Income and money flows stay secure in any respect factors of the financial cycle. It has the means and the arrogance due to this fact to pay massive dividends (virtually) 12 months after 12 months.

It’s additionally all the way down to these financial moats, or aggressive benefits, that I discussed earlier. Regulator Ofgem has given it a monopoly on sustaining the UK’s energy grid, which means it doesn’t undergo from rivals chipping away at it revenues.

Debt risk

After all dividends are by no means assured. And as with all UK inventory, there are potential issues I want to think about earlier than shopping for the shares for earnings.

As I touched upon earlier, the enterprise of protecting Britain’s lights on is enormously costly. What’s extra, Nationwide Grid must spend plenty of cash going forwards to decarbonise the nation’s electrical energy community.

This can add additional stress to a steadiness sheet that already has plenty of debt. Web debt is tipped to hit £44.5bn in March, up £3.5bn 12 months on 12 months.

Share value spike?

But on steadiness, the agency appears to be like in higher form than many different high-yielding dividend shares. And the agency is positioning itself for additional sustained dividend development via its strategic investments. Its plan is to develop its asset base by 8% to 10% annually.

I’ll be trying so as to add the shares to my very own portfolio when I’ve spare money to speculate. As soon as the Financial institution of England begins chopping rates of interest its share value may take off. Within the meantime, I can consolation myself by receiving some fairly massive dividends.