Picture supply: Getty Photos

The Shares and Shares ISA gives us with the chance to speculate and pay no tax on the cash we generate throughout the wrapper. No matter whether or not it’s dividends or capital beneficial properties, we are able to hold all the cash for ourselves. And that is very useful when constructing wealth. It means our investments can develop to their full potential with none of our beneficial properties being rerouted to the taxman.

Please observe that tax therapy relies on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.

Doubling my cash

So, simply how shortly may I double my cash in a Shares and Shares ISA? Nicely, it relies on the speed of progress — how shortly our investments are rising.

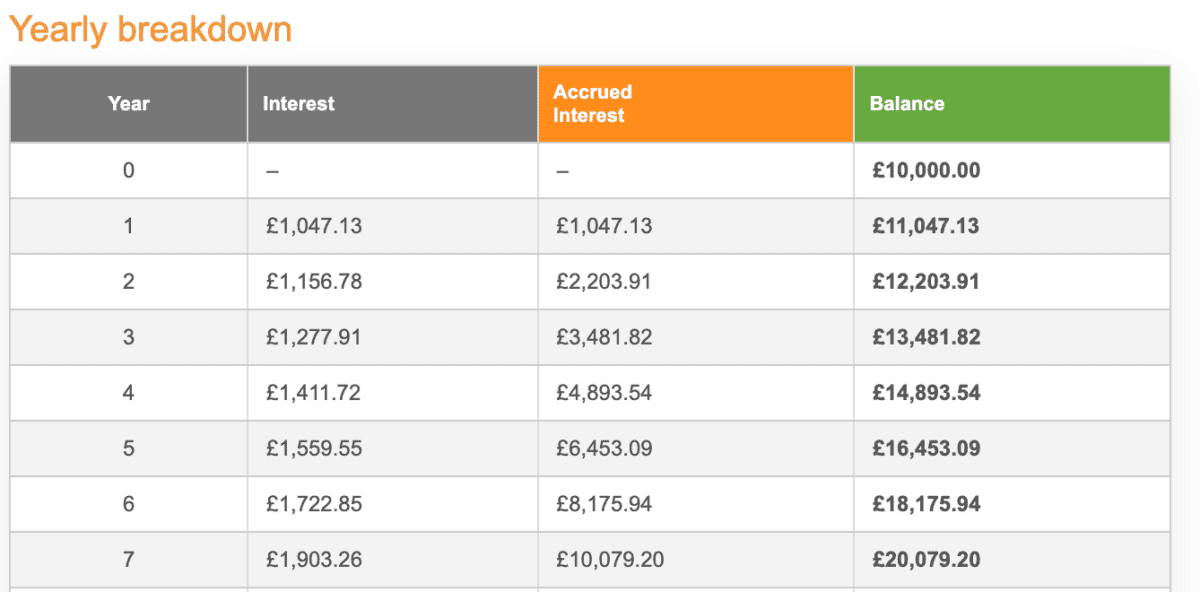

For instance, if I have been capable of actualise 10% progress yearly — that is in the direction of the upper finish of what most novice traders could obtain — I’d be capable of double my cash in simply seven years.

Right here’s the way it seems to be when beginning with £10,000. As we are able to see, the velocity of progress will increase over time. That is the influence of compound returns.

After all, I may make this develop quicker if I have been to make common contributions. This might contain me depositing as little as £50 or £100 a month with a view to additional gasoline my investments. In reality, when contributing £100 a month, my £10,000 would turn into £20,000 in simply 4 years!

Investing correctly

The issue is, many novice traders make errors — choose the mistaken shares, promote too quickly, or maintain onto their losses for too lengthy. And if I do that, I may lose cash. It’s vital I don’t fall foul of these pitfalls.

Fortunately, these days there’s a wealth of sources, notably on-line, to assist me make the proper choices. Investing correctly additionally means doing my analysis and taking a look at information, and never being influenced by private bias.

That is why I make investments is corporations with robust metrics like AppLovin (NASDAQ:APP). The corporate helps app and platform operators maximise their promoting revenues via its proprietary know-how and concentrate on the cellular app ecosystem. Its major purchasers are cellular app builders and publishers, and AppLovin gives the instruments to enhance person acquisition, engagement, and promoting.

It’s a rising market, one with big potential, but in addition one that’s arguably much less secure than normal web site promoting monetisation. That is mirrored in AppLovin’s income progress — it’s been fairly erratic. Furthermore, AppLovin’s $2.8bn of debt could put some traders off. Nonetheless, this seems to be greater than priced into the corporate’s valuation.

And valuation is what pursuits me most. AppLovin trades with a price-to-earnings progress (PEG) ratio of 0.73. The PEG ratio is basically worth divided by earnings per share, divided by the anticipated annual progress price over three-five years. Something beneath one is value contemplating very strongly.

The underside line is that the metrics listed here are very robust. So, regardless of traditionally unstable progress and a sizeable debt burden, the funding proposition may be very interesting to me. And this is the reason I’ve invested in AppLovin, together with different grow-focused corporations with PEG ratios beneath one — like Nvidia, Tremendous Micro, and Celestica.