Picture supply: Getty Photographs

If historical past is something to go by, 2024 may very well be an enormous 12 months for the FTSE 250. Within the UK, rates of interest have almost definitely peaked (most economists anticipate a number of cuts this 12 months). And previously, when charges have peaked, the UK’s mid-cap index has outperformed the broader UK market by an honest margin over one, three, and five-year durations.

Right here, I’m going to elucidate why the FTSE 250 tends to outperform after a peak in rates of interest. I’ll additionally spotlight three shares within the index that I just like the look of as we begin 2024.

Excessive returns

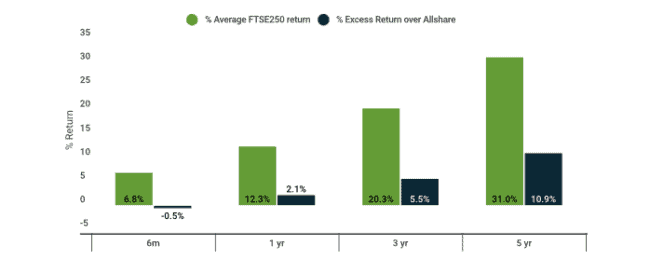

The chart from funding supervisor Martin Currie beneath exhibits the surplus returns that the FTSE 250 has generated previously when UK rates of interest have peaked.

Supply: Martin Currie

Over the next one-year interval, for instance, the index has delivered a return of 12.3% on common – 2.1% increased than the broader UK market.

As for why the index has outperformed previously, it’s all the way down to the truth that mid-cap corporations are usually extra delicate to rates of interest than large-cap companies (as a result of mid-caps usually have extra want for debt funding).

So, when rates of interest fall, their income can get an actual increase.

Three shares to contemplate

Shifting on to FTSE 250 shares I like proper now, first up is pub operator J D Wetherspoon.

It has fairly a little bit of debt on its stability sheet, so decrease rates of interest ought to profit the group.

On the similar time, the corporate – which provides low-priced meals and drinks – is nicely positioned within the present financial surroundings the place shoppers want to get extra for his or her cash.

After all, the debt right here does add danger. I believe the corporate ought to be capable to service it, nevertheless, given its money flows.

The second inventory I wish to spotlight is IT specialist Computacenter.

One motive I’m bullish right here is that the corporate is nicely positioned to profit from digital transformation throughout the company world. It is a huge theme globally immediately.

One other is that it’s a really worthwhile operation. During the last 5 years, return on capital has averaged 24%.

Moreover, its valuation may be very affordable. At the moment, Computacenter has a price-to-earnings (P/E) ratio of simply 15.5. That’s fairly low for a tech inventory.

It’s value declaring {that a} downturn in IT spending is a danger within the quick time period. I’m assured within the long-term story, nevertheless.

Lastly, I wish to spotlight Dowlais Group. It’s an engineering enterprise with a give attention to the automotive sector.

This inventory appears to be like actually low-cost proper now. At the moment, it has a P/E ratio of simply 6.2.

I see numerous worth at that a number of.

Just lately, the corporate mentioned that it stays assured of delivering sector-leading efficiency going ahead. It added that its largest enterprise, GKN Automotive, has a variety of main new programme launches deliberate throughout its portfolio, and these are anticipated to drive worthwhile progress forward of the market.

A slowdown within the automobile trade is a danger right here. On the present valuation, nevertheless, I like the danger/reward set-up.