Picture supply: Getty Photos

At the beginning of final yr, it was removed from sure that the Tesco (LSE:TSCO) share worth would stage a powerful rally. In opposition to a backdrop of excessive inflation and an intense battle for market share, some traders might need prevented Britain’s largest retailer.

Nonetheless, to the delight of shareholders, the grocery store managed to navigate these challenges efficiently. Tesco shares soared 27% final yr, outperforming the FTSE 100 by a substantial margin.

Right here’s why.

Strong gross sales

Interim outcomes for the primary half confirmed loads of promise. Group gross sales rose 8.9% and adjusted working revenue elevated 14% to £1.48bn, beating analysts’ expectations.

Fears that elevated wage and vitality prices may weigh on the corporate’s efficiency proved to be unfounded.

The proof up to now means that Tesco has traversed the inflationary local weather admirably. Maybe the clearest signal of that is the board’s upgraded FY23 retail adjusted working revenue forecast. Tesco now anticipates it’s going to ship between £2.6bn and £2.7bn, up from a earlier £2.5bn estimate.

The Q3 and Christmas buying and selling assertion is due on 11 January. This could present additional perception into how the grocery store fared over the essential festive interval.

Each little helps

Whereas retail operations stay the core of the enterprise, it’s encouraging to see Tesco firing on all cylinders.

It additionally owns Booker, a wholesale distributor. Catering quantity progress has helped this arm, which delivered like-for-like gross sales progress of seven.5%.

Furthermore, Tesco Financial institution has benefitted from larger rates of interest. This division appears to be like to be in stable form, offering helpful diversification and one other string to the group’s bow.

Competitors

Aggressive threats from rival retailers are a key threat dealing with the Tesco share worth. Britain’s grocery market is notoriously cutthroat and margins are tight. The presence of German discounters Aldi and Lidl has made life harder for homegrown retailers.

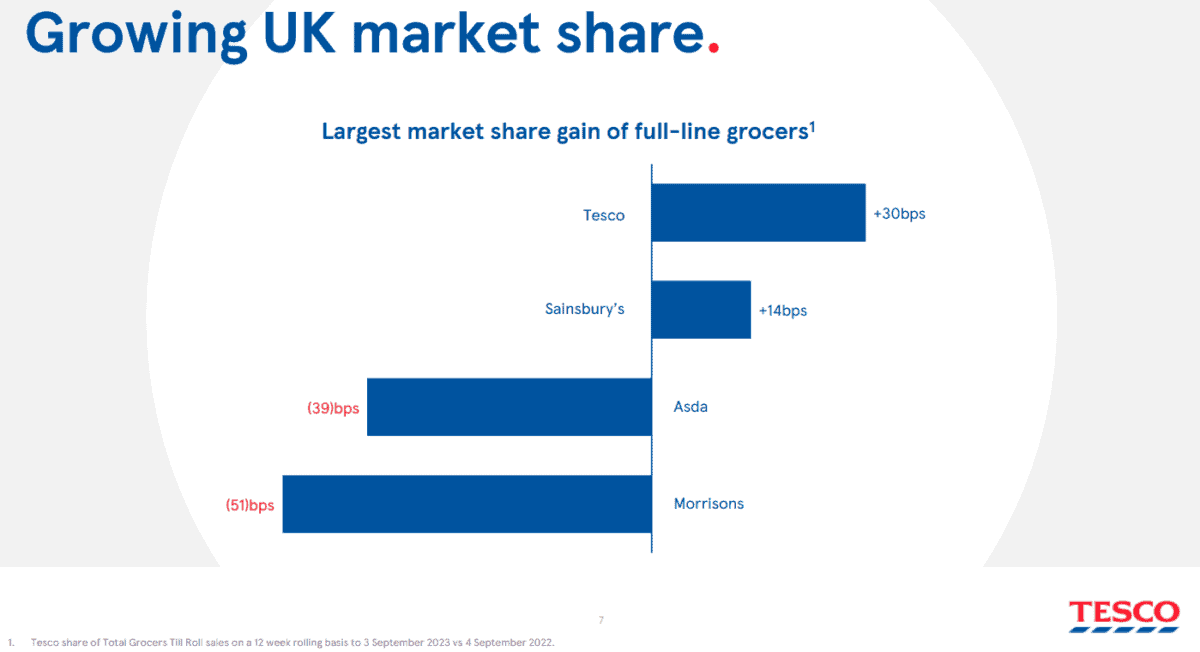

That mentioned, Tesco has accomplished nicely to maintain its market share above 27%. An Aldi price-matching technique throughout a whole bunch of merchandise seems to be bearing fruit. Tesco’s stability sheet power is a bonus right here towards its extra extremely leveraged competitors.

Nonetheless, I’ve issues surrounding the aggressive panorama. A full-blown worth struggle would put vital strain on the agency’s profitability, regardless of its deep pockets. As well as, any potential merger between Tesco’s rivals may disrupt the market and doubtlessly restrict additional share worth progress.

Granted, a couple of years in the past, the Competitors and Markets Authority torpedoed a proposed tie-up between Sainsbury’s and Asda. However, the regulator could not take the identical view on future proposals.

Deflation

Lastly, there are issues that as inflation turns into deflation, revenue margins may very well be below stress throughout the sector.

Tesco has managed excessive inflation charges nicely, so I’ve confidence within the board’s skill to rise to this new problem.

Nonetheless, potential traders ought to observe that long-term dangers may very well be posed by deflationary traits.

A inventory to purchase in 2024?

As buying and selling circumstances evolve, I’ll be monitoring Tesco’s outcomes to verify it stays on monitor. In any case, it faces a number of dangers.

Nonetheless, the retailer appears to be like like a well-run enterprise at current. I feel there’s a very good probability it may repeat final yr’s spectacular efficiency in 2024. Plus, there’s a tasty dividend too.

If I didn’t already personal Tesco shares, I’d purchase some immediately.