Picture supply: Getty Pictures

I’ve a plan to construct a wholesome passive revenue for retirement. It includes constructing a profitable portfolio of development and dividend shares with my Shares and Shares ISA.

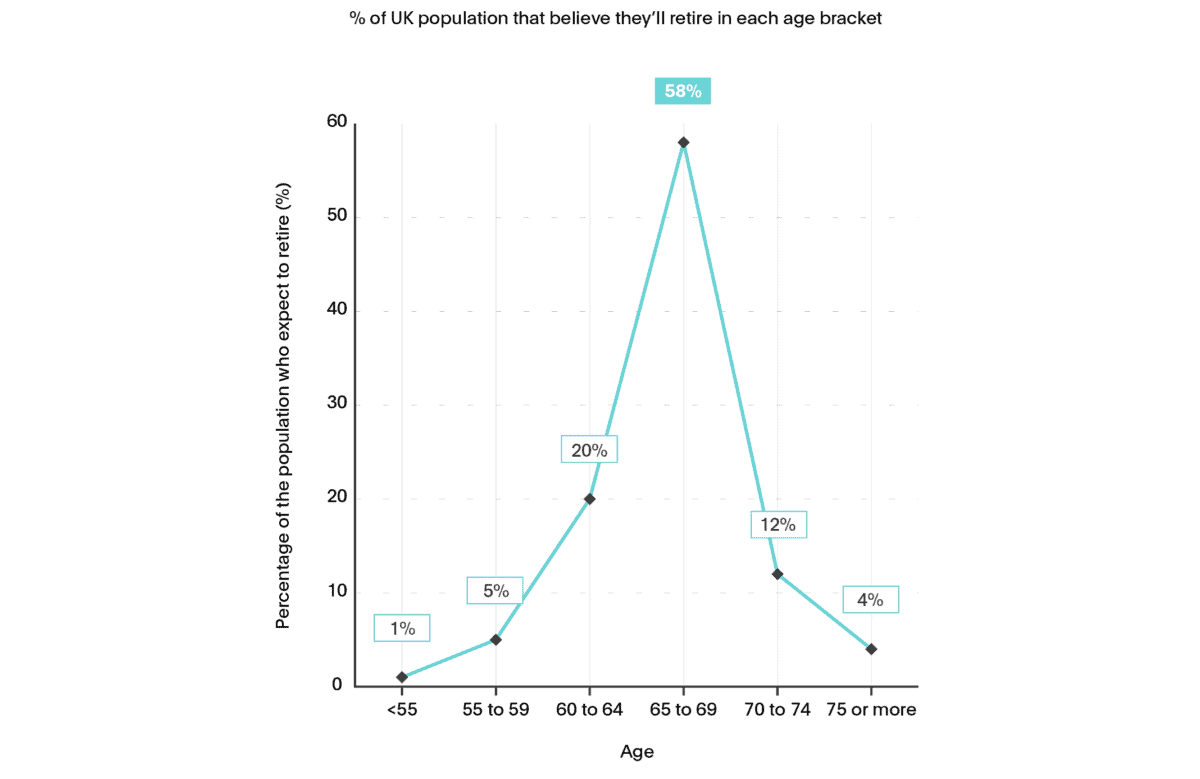

Like many individuals, I plan to retire whereas I’m nonetheless in a position to do the issues I like. Some 60% of Britons have retired between the ages of 65 and 69. Analysis from monetary providers supplier Flagstone reveals that almost all of UK adults aspire to retire inside this age vary, because the chart under reveals.

Sadly tens of millions of individuals are sleepwalking right into a way forward for perpetual work, even of their later years. It’s one thing I’m taking lively steps to keep away from, as I’ll clarify shortly.

How a lot will somebody want?

In line with Flagstone, a whopping 68% of individuals don’t know what number of years of retirement they should fund. They’re leaving themselves broad open to having to return to — or maybe even keep in — the office.

The passive revenue every of us will want in retirement can differ wildly. Flagstone notes that “the cash you’ll want will range relying in your life-style and retirement plans, together with the size of your retirement.”

Having stated that, the Pensions and Lifetime Financial savings Affiliation has helpfully provide you with a ballpark determine to assist folks plan.

They estimate that the common UK retiree will want a minimal yearly revenue of £12,800. Somebody who needs to retire comfortably will want virtually 3 times that quantity (£37,300).

A plan to retire

It received’t be a stroll within the park. However by making a dedication to often make investments, every of us has an opportunity to construct long-term wealth and thus monetary safety in previous age. The abundance of knowledge obtainable from funding consultants like The Motley Idiot fortunately makes the duty simpler too.

The sooner we take steps to plan for retirement, the higher. That is due to the miracle of compounding, the place — by reinvesting curiosity or, within the case of share investing, dividends — I can generate huge returns.

As I stated at the beginning, I’ve determined to spend money on UK shares to focus on a strong second revenue in retirement. Previous efficiency isn’t any assure of the longer term, however the confirmed successes of share buyers reveals what’s attainable with common funding.

A £37,557 second revenue

Over the previous half-century, British shares have produced a mean annual return of between 6% and eight%. If this development continues I might — with an funding of £630 a month in UK shares over the following 30 years — construct a formidable nestegg of £745,180.

If I then utilized the 4% drawdown rule, I might generate a yearly passive revenue of £37,557. Making use of this share would permit me to take pleasure in this annual sum earlier than the effectively runs dry.

That might give me an excellent probability of retiring comfortably, not less than in line with what the Pensions and Lifetime Financial savings Affiliation has stated.

Inventory investing is usually a bumpy experience at occasions. However over a very long time horizon it’s a dependable wealth-builder. And I feel it’s a greater approach for me to hit my retirement objectives than by placing my money in a low-yielding financial savings account.