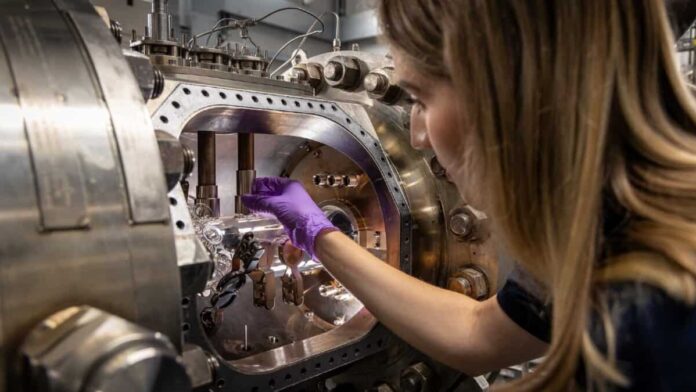

Picture supply: Rolls-Royce plc

The Rolls-Royce (LSE:RR) share worth has gone from £1.30 to £10.64 within the final 10 years. However that doesn’t mechanically imply the inventory’s overvalued.

Simply as shares which have gone down may be dangerous investments, a inventory that’s gone up can nonetheless be one. So does Rolls-Royce nonetheless provide good worth, or have traders missed the chance?

Discounted money flows

Top-of-the-line methods of attempting to determine what a inventory’s value is through the use of a reduced money stream (DCF) calculation. This places a price on the money the agency will generate sooner or later.

It is a good methodology, but it surely’s solely as correct as its inputs. So it relies on an investor having the ability to having the ability to anticipate how a lot money an organization goes to make sooner or later.

Within the inventory market, that’s by no means assured, particularly with Rolls-Royce. Disruptions to journey demand from pandemics, ash clouds, or recessions, can considerably affect profitability.

There may be nevertheless, one other manner of attempting to determine whether or not or not a inventory’s overvalued. It basically reverse-engineers the DCF calculation and it’s known as… a reverse DCF.

Reverse DCF

A reverse DCF doesn’t contain speculating about future money flows. As an alternative, it calculates what expectations are mirrored within the present share worth. That may be extraordinarily helpful – traders can see whether or not the implied development charge is beneath what they assume’s possible. However there’s nonetheless a component of guesswork.

One of many inputs asks what a number of the inventory’s prone to be buying and selling at sooner or later? And to some extent, that’s prone to be influenced by how effectively the corporate’s doing.

With Rolls-Royce, this may be very arduous to foretell. However after I ran a 10-year calculation primarily based on a ten% annual return and a future a number of of 15, I acquired an implied development charge of 11.7%.

Progress

Is that this achievable? My sense with Rolls-Royce is that it’s not out of the query, however I do assume some fairly bullish assumptions should be behind the thought it may develop at that charge.

The agency has clear development potential. A shift to nuclear energy within the UK, a transfer to sustainable aviation fuels in plane, and a rise in defence spending are all potential alternatives.

Nonetheless, it takes rather a lot to take care of an 11.7% annual development charge for a decade. And whereas Rolls-Royce has managed it lately, it’s benefited from unusually robust journey demand.

I feel it’s going to take rather a lot for the agency to maintain going at that charge for one more 10 years. So whereas it’s not essentially the most overvalued inventory available on the market, I don’t see it as an apparent cut price to contemplate.

Valuations

The assumptions that go right into a reverse DCF mannequin can all the time be challenged. Some traders would possibly assume that the inventory’s prone to commerce at the next a number of, or demand the next return.

Growing the a number of makes the implied development charge come down and elevating the required return makes it go up. However the vital factor is that it’s clear what the assumptions are.

This offers traders one thing they’ll use to worth different shares. And so they can see in the event that they share my view that there are extra engaging alternatives elsewhere.