Picture supply: Getty Photos

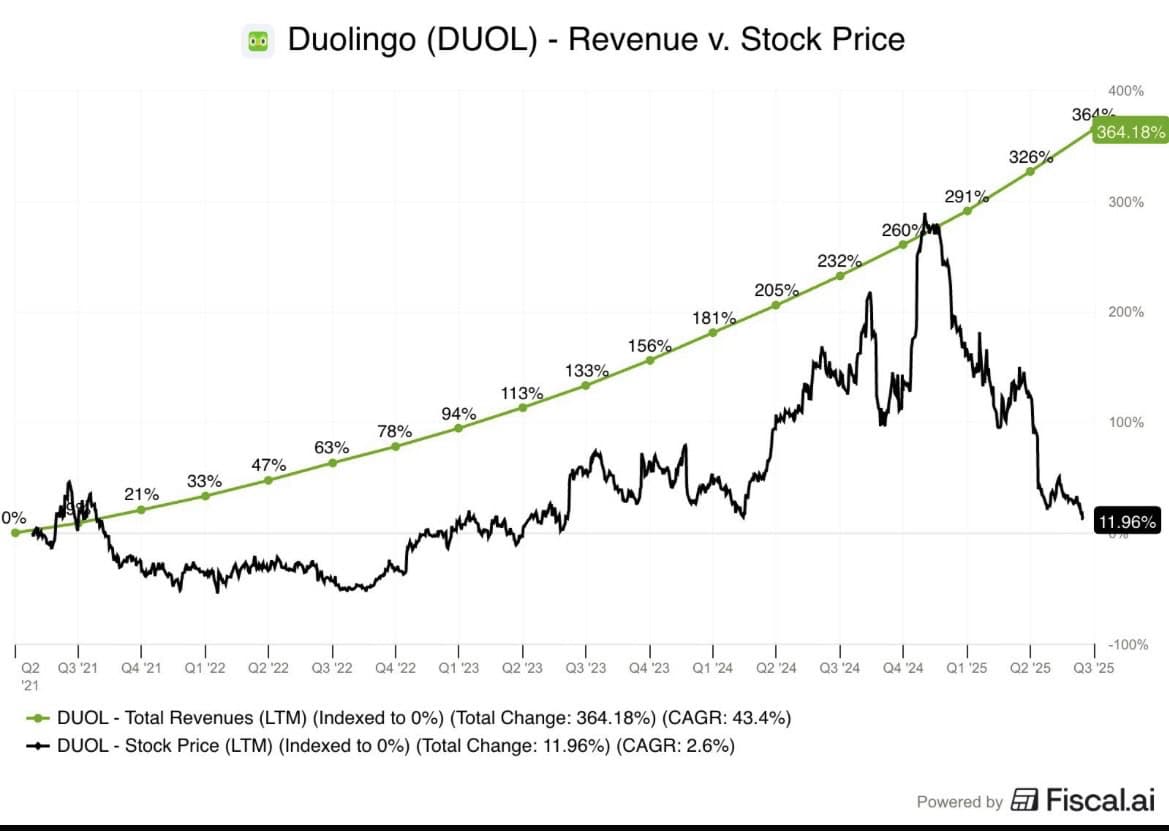

Duolingo (NASDAQ:DUOL) is a development inventory that has been on a stomach-churning spherical journey since its IPO in 2021.

After opening at $141, it misplaced 50% of its worth by way of the start of 2023, earlier than surging 630% to a peak of $544 by Might 2025. Since then, it has crashed 73% and is now again the place it began at $142.

I purchased shares of the language studying agency 3 times in 2025. And my holding is now deep underwater with a lack of 50%.

¡Qué desastre!

Is Duolingo now doomed in my Shares and Shares ISA?

Guidelines

Once I first explored Duolingo, I wasn’t satisfied. I feared this was only a buzzy, gamified language studying app that would simply be replicated.

Simply because an app is standard, it doesn’t imply that interprets (pun supposed) into a very good funding (see Snap or Pinterest). I fearful that Duolingo had no sturdy moat.

Nevertheless, one after the other, it began ticking off packing containers on my development inventory guidelines. Beneath, I’ve listed a few of them.

| Massive market? | There are almost 2bn language learners. Duolingo has 52m every day lively customers (~3% of the full). |

| Fixing an issue? | Languages want every day apply. Duolingo gamifies the training expertise to maintain customers motivated. |

| Proprietary moat? | Its AI mannequin is educated on billions of every day studying occasions. No rival has 10+ years of granular information. |

| Wholesome unit economics? | The agency boasts robust profitability and free money stream. |

| Is it progressive? | Duolingo makes use of AI-powered avatars to apply talking expertise in actual time. |

| Visionary management? | CEO Luis von Ahn invented reCAPTCHA. He intends the AI-driven app to show billions of individuals. |

| Optionality? | Sure. Duolingo now affords maths, music, and chess programs, in addition to 40+ languages. |

On prime of this, I search for one thing unusual or distinctive in my development corporations (a sure je ne sais quoi, because it have been). The corporate ticks this field with its weird Duo owl mascot and quirky social media campaigns.

Von Ahn describes the agency’s tradition as “healthful however unhinged”.

What’s gone mistaken?

The corporate’s newest outcomes for Q3 2025 have been stable. Income jumped 41% to $271.7m, whereas the adjusted EBITDA margin expanded to 29.5% from 24.7% the 12 months earlier than. Paid subscribers elevated 34% to 11.5m, with Asia now the agency’s fastest-growing area.

Nevertheless, two issues have spooked the market. One is that the agency goes to concentrate on “making the free model the perfect it’s ever been…An excellent free product drives phrase of mouth and, in the end, subscriptions“.

Wall Road hates it when corporations sacrifice near-term income to drive long-term development. The inventory cratered 25% after the Q3 outcomes.

In 2005, Amazon inventory additionally crashed when CEO Jeff Bezos introduced an “all-you-can-eat categorical transport” service (aka Amazon Prime). Wall Road loathed this “charity venture“, nevertheless it in the end strengthened Amazon’s aggressive place.

I feel Duolingo’s transfer to enhance the app’s instructing high quality will finally end in extra subscriptions, which can drive earnings development. However a slowdown in bookings clearly provides near-term uncertainty.

A second concern is a normal one about AI disrupting complete software program/expertise classes. In Duolingo’s case, some traders concern learners will swap to ChatGPT and different free AI apps.

Whereas it is a theoretical threat, it hasn’t occurred but, nor has a rival language app been knocked up in every week with AI-generated code. In addition to, it must encourage behavior formation to cease learners quitting, which is what Duolingo has mastered.

Personally, I feel the AI risk is massively overblown. However solely time will inform.

Doomed Duolingo?

Duolingo is again at its IPO value regardless of rising income almost 4 instances and the variety of paid subscribers virtually 5 instances since 2021. Even CNBC’s Jim Cramer, who doesn’t price Duolingo’s prospects, now thinks the inventory is “oversold“.

So there’s now a stark mismatch between the share value and underlying fundamentals. As such, I gained’t be promoting my shares, and I nonetheless suppose the inventory’s price contemplating as a part of a diversified ISA.