Picture supply: Getty Pictures

At the moment I’m taking a look at one FTSE 100 share that all of the sudden dropped to a four-month low previously two weeks.

Investor lore proclaims that ‘time available in the market’ beats ‘timing the market’. The unique quote implies that making an attempt to catch worth highs and lows is much less efficient than merely remaining invested for the lengthy haul.

Whereas which may be true, it’s all the time tempting to attempt to reel in just a few low cost shares whereas the fishing is sweet.

So what’s the deal?

M&G (LSE:MNG) shares crashed 16% over the previous few weeks regardless of the corporate posting optimistic outcomes on 21 March this yr. The spectacular 2023 full-year report included web consumer inflows as much as £1.1bn from £0.2bn final yr, to not point out a 28% rise in adjusted working revenue earlier than tax.

So why the sudden droop?

Positive, the £4.8bn funding supervisor barely bothered to lift its dividend yield however at 9.77%, can shareholders actually complain? The corporate continues to be on observe to pay a dividend of 13.2p per share on 9 Might, 2024. That’s solely a 0.2p lower from April 2023 – hardly a trigger for concern.

The dip might be a lagging fallout from the suspension of its property portfolio in October final yr, funds from which have been deliberate for distribution this February. However on the time the information broke, the share worth solely suffered a minor setback and recovered inside weeks. The sudden decline now might be defined if there have been an sudden delay in fund distribution — or on account of the distribution itself.

Can the charts reveal something?

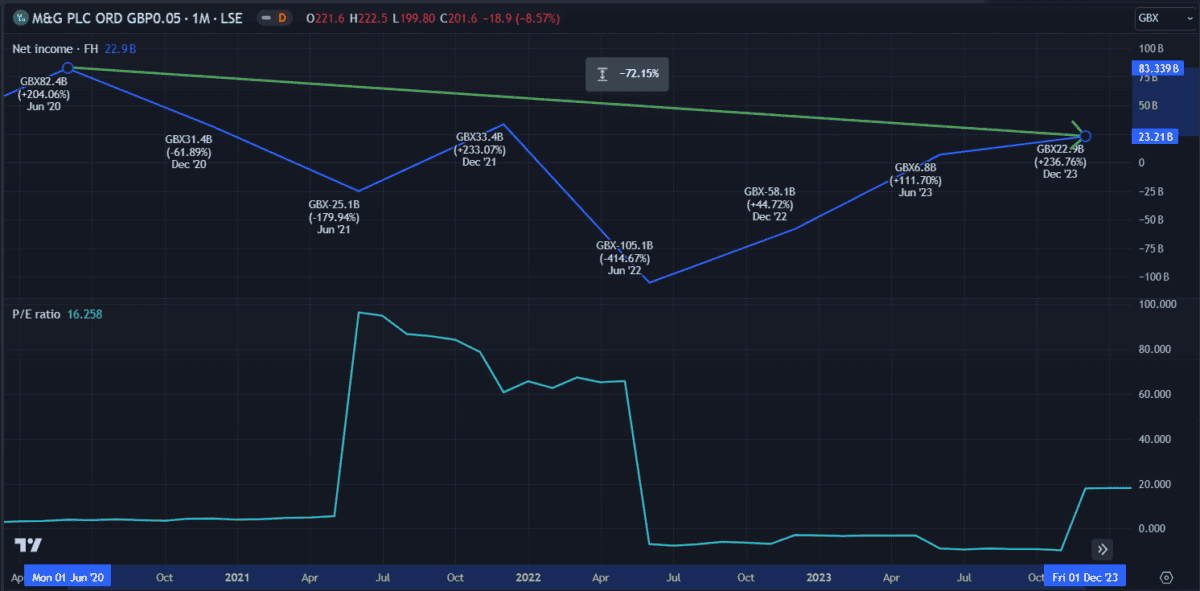

Utilizing a reduced money stream mannequin, analysts estimate the £1.97 shares to be buying and selling at 48% under truthful worth. However when in comparison with web revenue, the value appears precisely valued. M&G’s web revenue has declined 72% over the previous three-and-a-half years, leaving it with a trailing price-to-earnings (P/E) ratio of 16.25 (barely above the trade common however not notably excessive for the monetary providers sector).

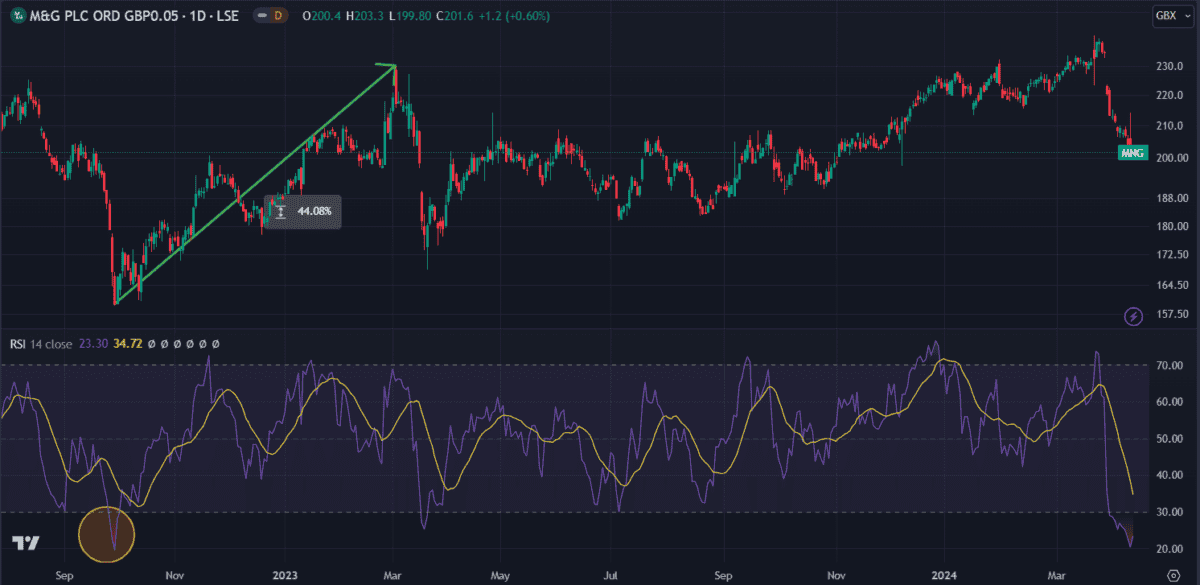

Taking a look at worth forecasts from a number of analysts, consensus estimates are for a 17% enhance within the coming 12 months. Contemplating how comparatively low the value is now, I might say that appears about proper. It might be mimicking an identical worth motion sample that occurred again in early 2023. Final yr, a giant dip in March noticed the value regain 23.35% within the following six weeks.

Having fallen to twenty, M&G’s relative energy index (RSI) is now the bottom it’s been in over 18 months — normally a precursor to a worth reversal. In September 2022, after the RSI dipped under 19, the value rose 44% within the following six months. RSI seldom stays under 30 for lengthy, normally rising together with the value.

General, I can’t uncover any basic motive for the value decline. If it’s a one-off dip on account of the property fund distribution, then it’s unlikely to fall additional. And in response to the charts, the value may begin rising once more within the coming days.

M&G stays a strong firm with an incredible dividend. In the long term, I don’t suppose this dip is simply too critical. However at this level, I might hold my eye on the shares to make certain the sell-off has ended earlier than shopping for.