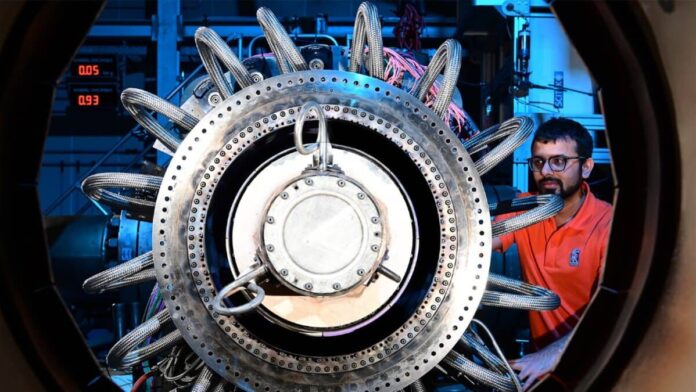

Picture supply: Rolls-Royce Holdings plc

The Rolls-Royce (LSE:RR) share value has roughly tripled because the begin of the 12 months. Whereas a repeat efficiency in 2024 appears unlikely, might the inventory once more be one of many FTSE 100’s high performers?

As I see it, the corporate has clearly benefitted from some one-off tailwinds in 2023 that aren’t prone to be repeated. However there’s loads to love in regards to the inventory in the meanwhile – and the market is aware of it.

A 2023 turnaround

Rather a lot has gone proper in 2023 for Rolls-Royce. The enterprise has managed some spectacular achievements in working in direction of undoing the harm completed by the pandemic.

The obvious a part of that is the uplift in its servicing income because the variety of flying hours for wide-body plane has returned to close pre-pandemic ranges. This has boosted each margins and income.

In consequence, Rolls-Royce had its credit standing upgraded by Fitch earlier this month. A stronger credit standing ought to put the corporate in a greater place on the subject of servicing its excessive debt load.

The agency has additionally been making different strikes to enhance its steadiness sheet. This has included chopping prices by lowering employees numbers and promoting non-core working divisions, similar to its off-highway engines enterprise.

All of this has led to a big uplift in sentiment across the inventory. Barclays, JP Morgan and Morgan Stanley have all upgraded their scores on the inventory not too long ago, inflicting the Rolls-Royce share value to rise.

What’s subsequent?

That is all constructive stuff, however the query for buyers now’s what the following few years will appear to be for the enterprise. The restoration in air journey demand seems prefer it is likely to be full, so what’s subsequent?

It’s price noting that the surge within the Rolls-Royce share value this 12 months has pushed it near the worth targets analysts have set for 2024. That suggests there may not be a lot room to run within the brief time period.

The best value goal I can see for 2024 is £4.31, implying an upside of round 49% from the present value. The common, although, is far nearer to immediately’s degree at £3.07.

In different phrases, analysts are typically constructive on Rolls-Royce shares for subsequent 12 months, however the view is clearly that the tempo of enhancements is ready to sluggish from right here. That’s not a giant shock.

The post-pandemic restoration has now all however worn off, however the agency’s give attention to bettering returns in its core operations appear to be the correct ones to me. So I believe buyers ought to really feel constructive for 2024.

Is it nonetheless a discount?

At the beginning of the 12 months, Rolls-Royce had a market cap of round £8.7bn. For a corporation with credible formidable of reaching £3.1bn in annual free money move by 2027, that’s a transparent discount.

With the share value having roughly tripled, issues are much less clear. Even at immediately’s ranges although, there’s nonetheless a 12% free money yield if the corporate can hit its targets within the medium time period.

The upper value makes the inventory much less of a discount and extra of a threat. However I wouldn’t wager towards it having one other constructive 12 months in 2024 – particularly if the Financial institution of England cuts rates of interest.