Picture supply: Rolls-Royce plc

The Rolls-Royce (LSE:RR) share value has clocked up one other spectacular 12 months. Because of this, anybody who invested £1,000 within the inventory 5 years’ in the past now has an funding price £9,868.

Analyst value targets for 2026 recommend one other sturdy 12 months for the FTSE 100’s model of Nvidia might be on the playing cards. So regardless of the inventory being up 889%, is there nonetheless a shopping for alternative?

Analyst forecasts

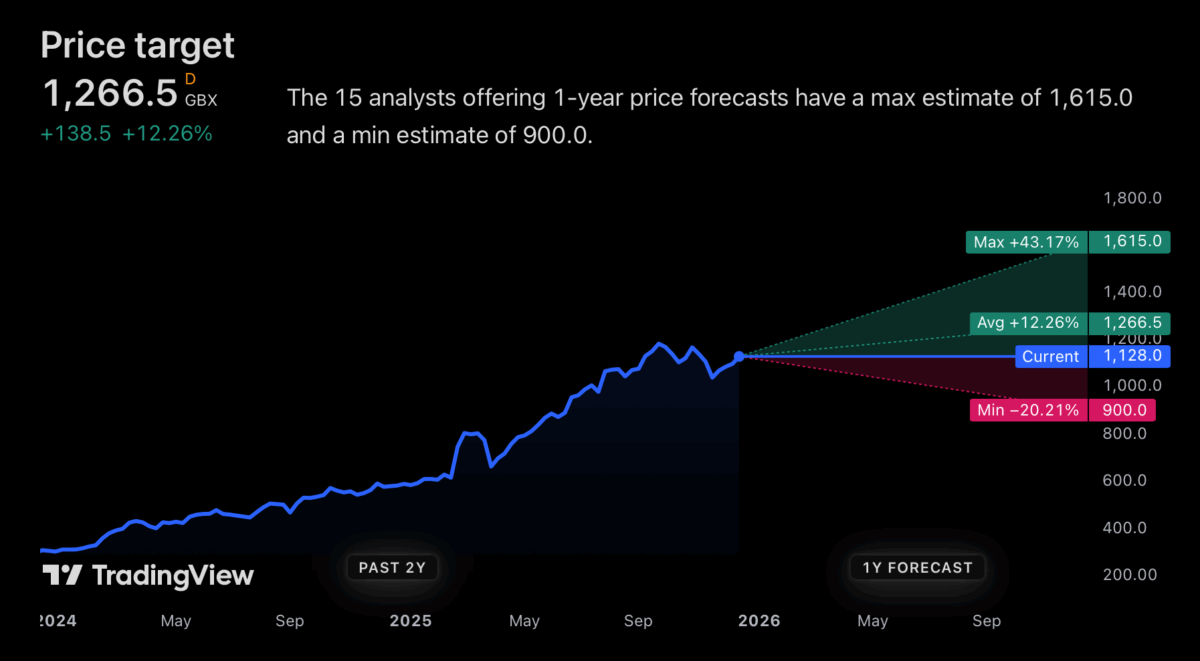

Proper now, the common analyst value goal for the inventory is round 12% increased than the present degree. That’s greater than the FTSE 100 manages in a mean 12 months.

If issues go properly, there’s a case for considering the Rolls-Royce share value might do even higher. The best estimate is simply over £16 – 43% above the place the inventory’s buying and selling proper now.

It’s buying and selling at a price-to-earnings (P/E) ratio of 16, however that features some one-off boosts to income that gained’t be repeated. Adjusting for these, the a number of is extra like 35. Meaning some issues might want to go proper for the agency and these can’t be assured. And which means the excessive a number of is a threat with the inventory going into 2026.

Air journey

Lately, the largest power propelling Rolls-Royce ahead has been its civil aviation enterprise. Air journey demand has been sturdy and this seems to be set to proceed in 2026. There’s, after all, at all times a threat with this trade. Downturns can come all of the sudden and out of nowhere when companies are least anticipating them and so they can have a big effect.

Financial development has been comparatively weak just lately and which means a cyclical downturn is an actual risk. And excessive fastened prices imply margins can contract rapidly.

Importantly although, Rolls-Royce has been on the centre of a few vital long-term developments just lately. So even when air journey demand falters, there may nonetheless be room for positivity.

Defence and energy

Two of the largest themes in 2025 have been defence and synthetic intelligence (AI). These are each areas that Rolls-Royce has publicity to, both instantly or not directly.

NATO commitments to extend defence spending ought to increase demand for plane, submarines and ships. And that’s prefer to carry elevated demand for the agency’s engines.

By way of AI, the information centres that huge tech firms have been constructing want dependable backup energy. And Rolls-Royce supplies each mills and battery options.

Importantly, each of those divisions ought to present rising earnings properly past 2026. So that they’re additionally key causes to be optimistic in regards to the inventory over the long run.

Lengthy-term investing

I’m just a little hesitant in the case of Rolls-Royce shares subsequent 12 months. Something can occur with the agency’s civil aerospace division and the inventory can transfer sharply in both path.

From a long-term perspective issues look a bit extra optimistic, with the corporate uncovered to some key development industries. And which means buyers may need to have a look.

My sense although, is that it’s exhausting to see this as one of the best FTSE 100 inventory to purchase proper now. Whereas it has lots of momentum, I feel there might be higher alternatives to discover.