Picture supply: Getty Photos

The Lloyds Banking Group (LSE:LLOY) share value has gone from 55.04p to 97p in 2025. However the subsequent query for traders is how a lot additional it may run in 2026.

An identical transfer once more subsequent 12 months would see the inventory attain £1.30. Rates of interest could be set to come back down, however there are nonetheless causes for traders to be optimistic.

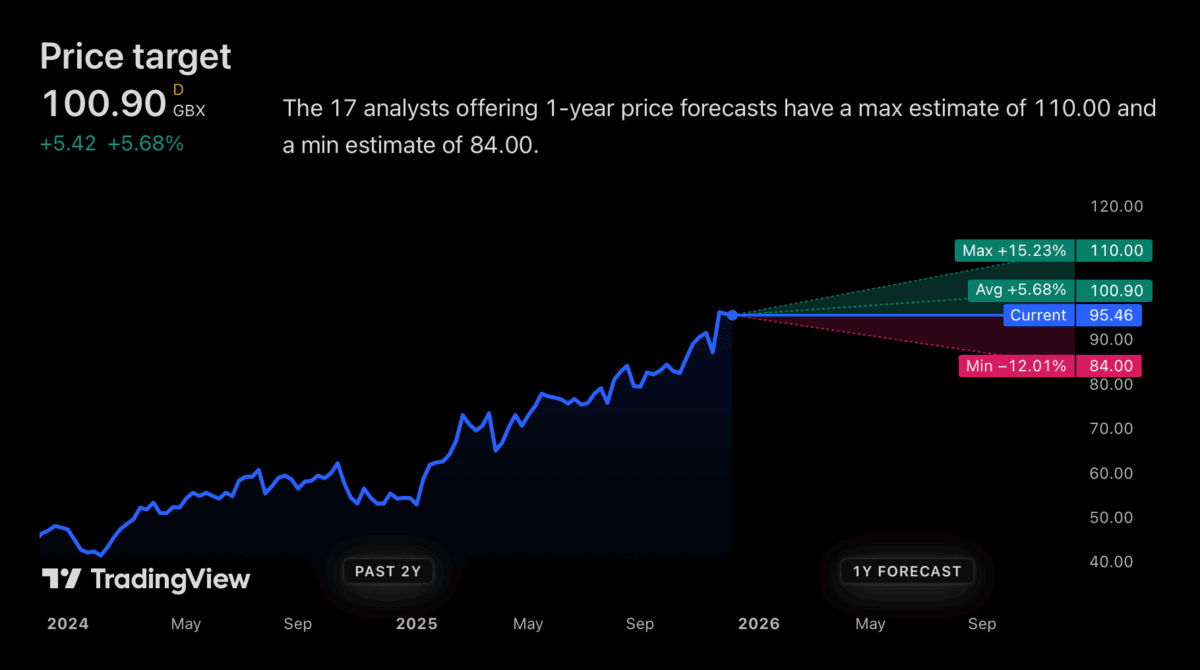

Value targets

From what I can see, the analyst group isn’t anticipating a repeat efficiency from Lloyds in 2026. The very best value goal is round £1.10 – 16% above the present degree.

That wouldn’t be a nasty consequence in any respect – it’s properly above the FTSE 100 common. However the much less optimistic forecasts are projecting a share value decline of as a lot as 12%.

There are good causes for considering that 2026 received’t be such a robust 12 months for the inventory. The obvious is the prospect of decrease rates of interest, which might be more likely to have an effect on lending margins.

Regardless of this, although, there are additionally causes for optimism. With a financial institution the scale of Lloyds, it’s not as easy as the corporate’s income falling if rates of interest get reduce.

Structural hedge

Like plenty of banks, Lloyds makes use of what’s referred to as a structural hedge. That is primarily a mixture of fixed-rate property (resembling bonds) with lengthy durations and rate of interest swaps.

These assist defend the financial institution within the quick time period if rates of interest fall. In different phrases, rate of interest cuts in 2026 shouldn’t imply the agency’s earnings falls away instantly.

In actual fact, decrease charges would possibly imply higher margins in 2026. If the financial institution can scale back the curiosity on its financial savings immediately whereas mortgage charges stay fastened, this might give lending income a lift.

Greater charges are more likely to profit Lloyds over the medium time period. However I don’t assume traders ought to take the view that cuts in 2026 will instantly ship the agency’s earnings into reverse.

Rules

Wanting past 2026, there are additionally extra causes for Lloyds shareholders to be constructive. One is the potential for looser regulation giving the financial institution extra scope to lend.

For the primary time in 10 years, the Financial institution of England has determined to decrease the quantity of Tier 1 capital UK banks are required to carry. That is set to come back in from January 2027.

That ought to depart the likes of Lloyds with extra capital that can be utilized to develop mortgage books. However it’s price noting that this can apply to all banks, so competitors would possibly enhance.

Whereas banks typically keep capital ratios properly above their authorized necessities, a decrease customary means extra scope for lending. And this might assist develop income past 2026.

Don’t be too hasty

Lloyds has been the most effective FTSE 100 shares to personal lately. And whereas cyclical forces have been a part of this, traders shouldn’t be too fast to jot down this one off in 2026.

Falling rates of interest are more likely to current a problem. However that is the sort of factor the financial institution needs to be ready to cope with – and its structural hedge suggests it’s.

Wanting additional forward there are causes to assume the inventory might be a great funding past 2026. However it’s not my high alternative because the New 12 months approaches.