Picture supply: Getty Photographs

The FTSE 100 index reached its highest closing worth of 8,012.53 factors on February 16, 2023. This marked a big milestone for the index that had been treading water for a while. The index is barely up 12% over 5 years.

The index’s surge to eight,000 factors was pushed by a mixture of things. This included robust company earnings, a recovering international economic system, and the outperformance of the assets sector, which is well-represented on it.

That bull run got here to an finish with the Silicon Valley Financial institution fiasco, and we’ve seen additional downward stress through the 12 months.

A resurgence

The FTSE 100, together with different international indexes, surged final week as central banks hinted at an finish to an aggressive fiscal tightening programmes aimed toward countering inflation. This diminished the uncertainty surrounding rate of interest hikes, which had weighed on market sentiment.

Extra usually, issues a few potential financial downturn have subsided, with constructive financial knowledge and enhancing company earnings boosting investor confidence.

The Buying Managers’ Index (PMI) for the UK and different main economies confirmed robust development within the manufacturing and providers sectors, whereas company earnings stories usually exceeded expectations.

Rates of interest and shares

The connection between rates of interest and shares, significantly their attractiveness to traders, is rooted within the alternative value of capital.

When rates of interest are low, returns from fixed-income investments like bonds are much less engaging. Consequently, traders might flip to shares looking for increased potential returns.

Conversely, when rates of interest rise, the attraction of fixed-income investments will increase, doubtlessly making shares much less engaging.

Nevertheless, the connection is nuanced, contemplating numerous financial elements.

Extra broadly, in a low-interest-rate surroundings, shares could also be favoured for his or her development potential, whereas in a high-interest-rate surroundings, income-generating property like bonds may acquire choice.

So, with rates of interest anticipated to fall, capital ought to transfer away from debt and money, in the direction of shares.

And the quicker rates of interest fall, the extra rapidly we will count on to see this transition from debt to shares.

A wholesome forecast

Forecasts change on a regular basis. Nevertheless, one I usually keep watch over is from the Financial system Forecast Company. Its prediction isn’t all the time appropriate, however sometimes, it’s been very correct.

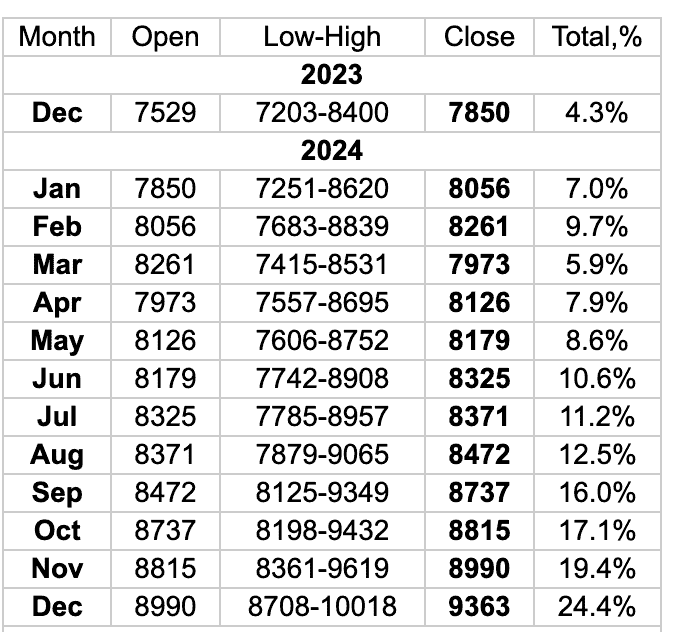

Following the latest dovish narratives from the US Federal Reserve and altering sentiment throughout the Financial institution of England, the forecast has lately been upgraded. And it seems to be fairly good.

As we will see, the company expects to see the index shut above 8,000, at 8,261 in January, representing a wholesome 7% premium on the present place. That’s nice.

It additionally means that UK shares will go from power to power through the 12 months. The index might shut at 9,363 in December 2024. That’s 24.4% above the place we at the moment are.

Possibly we will assume that this enhancing forecast is expounded to falling rates of interest. If that’s the case, a January rise to eight,000 won’t occur, however a 2024 rise to that stage simply may.