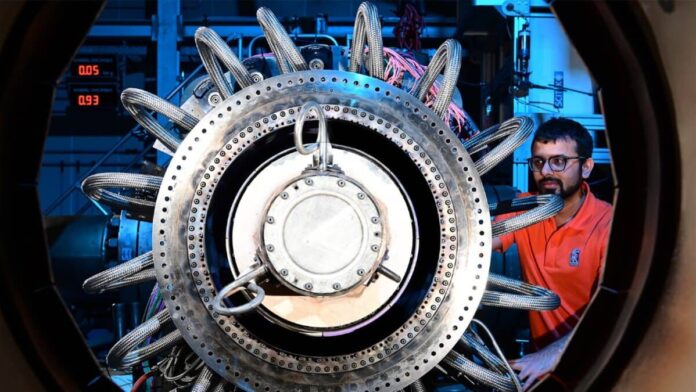

Picture supply: Rolls-Royce Holdings plc

Rolls-Royce (LSE:RR) shares had been actually the standout performer of the Footsie in 2023. Firstly of 2023, the inventory was buying and selling at 98.9p. Now as I write on 17 January, it’s £3 precisely.

That’s over a 200% return.

Nevertheless, that’s the previous. As an investor who lives within the current, I wish to understand how its shares will transfer from now till the top of 2024 and past.

I do know asking for an additional 200% is unrealistic. However can its shares attain £4.50?

This would supply a return of 33.3%.

Whereas it’s not a triple-digit return, it’s nonetheless an quantity that might mark an extremely profitable funding.

Challenges

The most important danger for Rolls-Royce is its dependency on civil aviation engine gross sales. Demand for that is intently linked to the broader financial system and is outdoors of its management.

Whereas there’s optimism that demand for flying is rising and may attain pre-pandemic ranges quickly, this isn’t assured.

The pandemic just a few years in the past is simply an instance of what an financial shock can do to the business.

From March to October 2020, Rolls-Royce shares crashed by over 80%. They solely simply recovered from this within the second half of 2023.

Of its virtually £7bn in income generated final yr, virtually £3.3bn got here from its civil aviation division.

That is additionally its fastest-growing phase, with 38% progress yr on yr, outpacing total income progress of 28%.

Due to this fact, if the financial system does expertise one other disaster, Rolls-Royce’s largest and fastest-growing income stream is in danger.

Strengths

Nevertheless, if we have a look at Rolls-Royce’s half-year outcomes, it’s straightforward to see why buyers are so enthusiastic in regards to the inventory.

As talked about above, income has grown very strongly. Nevertheless it’s additionally about how nicely the corporate has been managed.

It turned a loss earlier than tax of £111m in 2022 right into a revenue of £524m in 2023.

In the identical timeframe, its money outflow of £68m changed into a money influx of £356m. This marks an excellent enchancment.

It’s additionally managing its internet debt nicely. This determine fell from £3.3bn on the finish of 2022 to £2.8bn within the first half of 2023.

Moreover, I wish to observe that despite the fact that its civil aviation division remains to be the dominant drive within the enterprise, Rolls-Royce is well-diversified.

The defence division grew 15% to £1.9bn. In the meantime, its energy techniques phase additionally skilled spectacular progress of 24%, to achieve £1.8bn in gross sales.

Can it attain the £4.50 goal?

Rolls-Royce is a superb firm that I imagine will proceed to impress buyers.

Nevertheless, I’m conflicted on whether or not that is already priced in. A ahead price-to-earnings (P/E) ratio of 27.7 could be very costly.

Finally, due to this frothy valuation, I don’t assume it’ll attain this goal by the top of 2024.

However the well-known Warren Buffett quote, “It’s much better to purchase an exquisite firm at a good value than a good firm at an exquisite value”, additionally rings in my ears.

That’s why, as a long-term investor, if I had the spare money, I’d purchase a few of its shares right now. If administration continues to execute in addition to it has been, and there are not any financial shocks, I can actually see Rolls-Royce shares hitting £4.50 past 2024.