Picture supply: Getty Photos

For the previous few many years, buy-to-let (BTL) property has been a simple option to construct wealth. With property costs throughout Britain regularly rising, anybody might become profitable.

Just lately nevertheless, the outlook for BTL has grow to be slightly murky. Consequently, I really feel investing within the inventory market via a pension is a greater option to develop wealth.

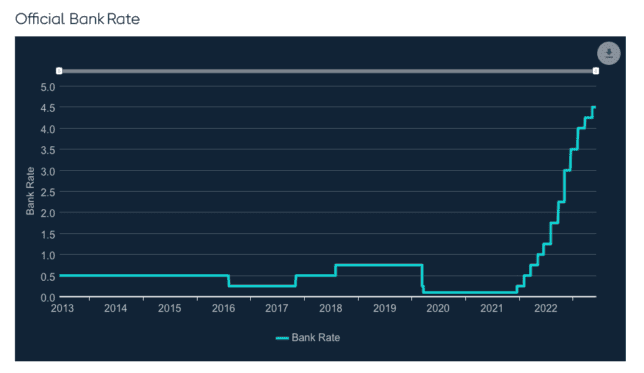

Rate of interest challenges

The latest enhance in rates of interest has been a little bit of a game-changer for BTL investing, and never in a great way. Abruptly, buyers are taking a look at considerably increased borrowing prices. In line with Hamptons Worldwide, a basic-rate taxpayer now must buy a rental property with a yield of seven%+ to make an after-tax revenue.

Excessive taxes

It’s not simply increased rates of interest which can be a difficulty although. One other main issue to contemplate is taxes. Anybody shopping for a rental property at present faces issues like Stamp Responsibility surcharges, tax on rental revenue and on property gross sales.

Pensions have tax advantages

Cash can nonetheless be made out of BTL, after all, nevertheless it’s straightforward to see why lots of specialists suggest investing inside a pension as an alternative.

At present, there are lots of advantages to this strategy to investing. For starters, there’s tax aid on contributions. This implies if a basic-rate taxpayer contributes £1,000 into their account, the federal government provides in one other £250 on high.

Secondly, all features and revenue generated throughout the account are tax-free. So there’s no want to fret about paying Earnings Tax or Capital Features Tax whereas constructing wealth.

Please word that tax therapy relies on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for info functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Entry to unbelievable investments

One of the best factor about investing inside a pension, to my thoughts although, is that they typically present entry to an enormous vary of fantastic investments.

For instance, via a Self-Invested Private Pension (SIPP) we are able to put money into funds like the favored Fundsmith Fairness. This can be a world fairness fund that invests in high-quality companies worldwide. It has returned over 15% a 12 months since its inception in late 2010, though previous efficiency isn’t an indicator of future returns.

They will additionally put money into funding trusts, that are like funds however commerce on the inventory market and sometimes have decrease charges. One instance right here is the Allianz Know-how Belief. It goals to realize long-term development by investing in expertise corporations. During the last 5 years, it’s delivered a share value return of round 80%, though the inventory has been risky at occasions.

In fact, particular person shares can be bought. For instance, this might imply investing in iPhone maker Apple.

Apple shares have been an unbelievable funding currently, turning $10k into about $40k during the last 5 years.

And after the corporate not too long ago launched a ‘combined actuality’ headset – which might simply be the longer term in 5 to 10 years’ time – I’m backing the enterprise to maintain rising (over the long term) although its shares are costly.

Aiming for £1m

Given this successful mixture of tax advantages and high investments, it’s not onerous to construct wealth inside a pension at present.

And with the pension ‘Lifetime Allowance’ not too long ago abolished, there’s nothing to cease an investor aiming for an account value £1m or extra.