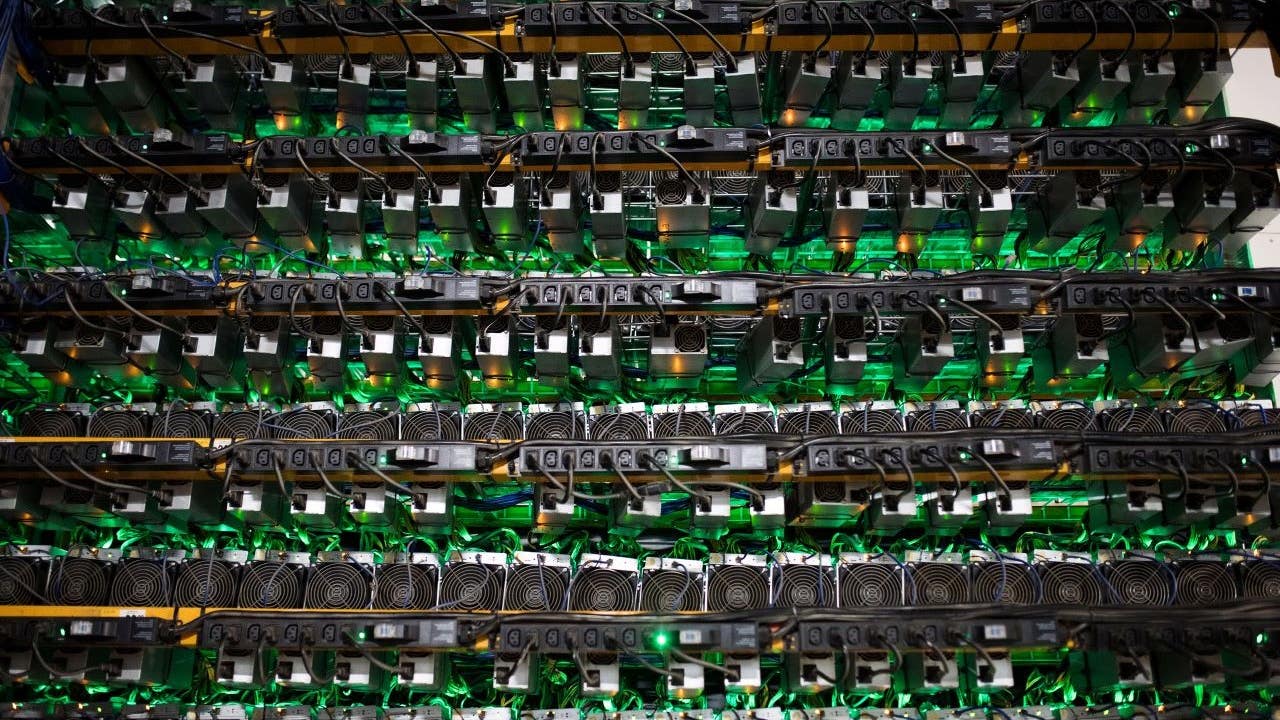

Bloomberg Inventive Pictures/Getty Photos

Bitcoin mining is the method of making new bitcoins by fixing extraordinarily sophisticated math issues that confirm transactions within the forex. When a bitcoin is efficiently mined, the miner receives a predetermined quantity of bitcoin.

Bitcoin is a cryptocurrency that’s gained a large following on account of its wild worth swings and surging worth because it was first created in 2009.

As costs of cryptocurrencies and Bitcoin specifically have skyrocketed lately, it’s comprehensible that curiosity in mining has picked up as properly. However for most individuals, the prospects for Bitcoin mining are usually not good on account of its complicated nature and excessive prices. Listed here are the fundamentals on how Bitcoin mining works and a few key dangers to concentrate on.

Bitcoin mining statistics

- A miner at present earns 6.25 Bitcoin (about $227,500 as of November 2023) for efficiently validating a brand new block on the Bitcoin blockchain.

- Creating Bitcoin consumes 147 terawatt-hours of electrical energy annually, greater than is utilized by the Netherlands or the Philippines, in response to the Cambridge Bitcoin Electrical energy Consumption Index.

- It will take 9 years of household-equivalent electrical energy to mine a single bitcoin as of August 2021.

- The worth of Bitcoin has been extraordinarily risky over time. In 2020, it traded as little as $4,107 and reached an all-time excessive of $68,790 in November 2021. As of November 2023, it traded for about $36,400.

- Whereas it is dependent upon your computing energy and that of different miners, the percentages of a modestly powered solo miner fixing a Bitcoin hash have been about 1 in 26.9 million in January 2023.

- The USA (37.4 p.c), Mainland China (18.1 p.c) and Kazakhstan (14.0 p.c) have been the most important bitcoin miners as of January 2022, in response to the Cambridge Electrical energy Consumption Index.

Understanding Bitcoin

Bitcoin is among the hottest sorts of cryptocurrencies, that are digital mediums of alternate that exist solely on-line. Bitcoin runs on a decentralized pc community or distributed ledger that tracks transactions within the cryptocurrency. When computer systems on the community confirm and course of transactions, new bitcoins are created, or mined. These networked computer systems, or miners, course of the transaction in alternate for a fee in Bitcoin.

Bitcoin is powered by blockchain, which is the know-how that powers many cryptocurrencies. A blockchain is a decentralized ledger of all of the transactions throughout a community. Teams of permitted transactions collectively kind a block and are joined to create a series. Consider it as a protracted public report that features nearly like a protracted operating receipt. Bitcoin mining is the method of including a block to the chain.

How Bitcoin mining works

With the intention to efficiently add a block, Bitcoin miners compete to resolve extraordinarily complicated math issues that require using costly computer systems and massive quantities of electrical energy. To finish the mining course of, miners have to be first to reach on the appropriate or closest reply to the query. The method of guessing the proper quantity (hash) is named proof of labor. Miners guess the goal hash by randomly making as many guesses as shortly as they will, which requires main computing energy. The problem solely will increase as extra miners be part of the community.

The pc {hardware} required is named application-specific built-in circuits, or ASICs, and might value as much as $10,000. ASICs devour large quantities of electrical energy, which has drawn criticism from environmental teams and limits the profitability of miners.

If a miner is ready to efficiently add a block to the blockchain, they’ll obtain 6.25 bitcoins as a reward. The reward quantity is minimize in half roughly each 4 years, or each 210,000 blocks. As of November 2023, Bitcoin traded at round $36,400, making 6.25 bitcoins price $227,500.

Is Bitcoin mining worthwhile?

It relies upon. Even when Bitcoin miners are profitable, it’s not clear that their efforts will find yourself being worthwhile as a result of excessive upfront prices of kit and the continuing electrical energy prices. The electrical energy for one ASIC can use the identical quantity of electrical energy as half one million PlayStation 3 units, in response to a 2019 report from the Congressional Analysis Service.

As the issue and complexity of Bitcoin mining has elevated, the computing energy required has additionally gone up. Bitcoin mining consumes about 147 terawatt-hours of electrical energy annually, greater than most international locations, in response to the Cambridge Bitcoin Electrical energy Consumption Index. You’d want 9 years’ price of the everyday U.S. family’s electrical energy to mine only one bitcoin as of August 2021.

Supply: Cambridge Bitcoin Electrical energy Consumption Index

One option to share a number of the excessive prices of mining is by becoming a member of a mining pool. Swimming pools enable miners to share assets and add extra functionality, however shared assets imply shared rewards, so the potential payout is much less when working by way of a pool. The volatility of Bitcoin’s worth additionally makes it troublesome to know precisely how a lot you’re working for.

How do you begin Bitcoin mining?

Listed here are the fundamentals you’ll want to start out mining Bitcoin:

- Pockets. That is the place any Bitcoin you earn because of your mining efforts shall be saved. A pockets is an encrypted on-line account that lets you retailer, switch and settle for Bitcoin or different cryptocurrencies. Firms akin to Coinbase, Trezor and Exodus all provide pockets choices for cryptocurrency.

- Mining software program. There are a variety of various suppliers of mining software program, lots of that are free to obtain and might run on Home windows and Mac computer systems. As soon as the software program is linked to the mandatory {hardware}, you’ll be capable of mine Bitcoin.

- Laptop tools. Essentially the most cost-prohibitive side of Bitcoin mining includes the {hardware}. You’ll want a robust pc that makes use of an unlimited quantity of electrical energy with the intention to efficiently mine Bitcoin. It’s not unusual for the {hardware} prices to run round $10,000 or extra.

Dangers of Bitcoin mining

- Value volatility. Bitcoin’s worth has diversified extensively because it was launched in 2009. Since simply November 2021, Bitcoin has traded for lower than $20,000 and practically as excessive as $69,000. This sort of volatility makes it troublesome for miners to know if their reward will outweigh the excessive prices of mining.

- Regulation. Only a few governments have embraced cryptocurrencies akin to Bitcoin, and plenty of usually tend to view them skeptically as a result of the currencies function outdoors authorities management. There may be at all times the danger that governments may outlaw the mining of Bitcoin or cryptocurrencies altogether as China did in 2021, citing monetary dangers and elevated speculative buying and selling.

Taxes on Bitcoin mining

It’s necessary to recollect the influence that taxes can have on Bitcoin mining. The IRS has been seeking to crack down on homeowners and merchants of cryptocurrencies because the asset costs have ballooned lately. Listed here are the important thing tax concerns to remember for Bitcoin mining.

- Are you a enterprise? If Bitcoin mining is your enterprise, you could possibly deduct bills you incur for tax functions. Income can be the worth of the bitcoins you earn. But when mining is a interest for you, it’s not going you’ll be capable of deduct bills.

- Mined bitcoin is revenue. When you’re efficiently capable of mine Bitcoin or different cryptocurrencies, the truthful market worth of the currencies on the time of receipt shall be taxed at bizarre revenue charges.

- Capital positive aspects. When you promote bitcoins at a worth above the place you acquired them, that qualifies as a capital achieve, which might be taxed the identical approach it will for conventional belongings akin to shares or bonds.

Try Bankrate’s cryptocurrency tax information to study primary tax guidelines for Bitcoin, Ethereum and extra.

Backside line

Whereas Bitcoin mining sounds interesting, the truth is that it’s troublesome and costly to truly do profitably. The intense volatility of Bitcoin’s worth provides extra uncertainty to the equation.

Take into account that Bitcoin itself is a speculative asset with no intrinsic worth, which implies it gained’t produce something for its proprietor and isn’t pegged to one thing like gold. Your return is predicated on promoting it to another person for the next worth, and that worth is probably not excessive sufficient so that you can flip a revenue.