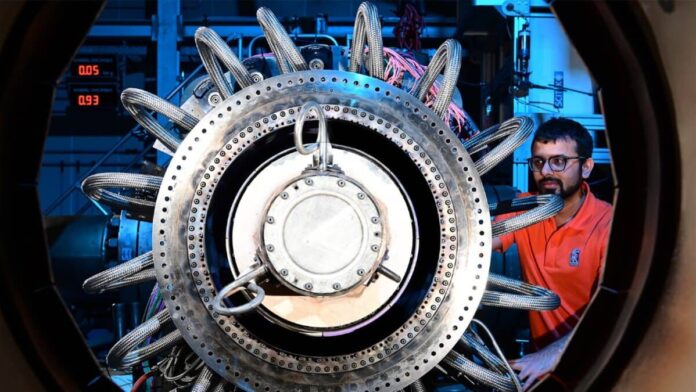

Picture supply: Rolls-Royce Holdings plc

Rolls-Royce (LSE:RR.) shares are at the moment altering palms for greater than 3 times what they have been initially of 2023. However regardless of this spectacular efficiency, the share worth is on the identical stage it was 5 years in the past.

Have I left it too late to get a chunk of the motion?

Snog

Whatever the firm concerned, investing for the brief time period is — for my part — by no means a good suggestion. In reality, holding shares for a couple of days (or hours) is buying and selling, somewhat than investing.

Share costs might be extremely risky over brief durations.

Maybe probably the most profitable investor of all time, Warren Buffett, as soon as stated: “Our favorite holding interval is perpetually.”

Marry

The arguments for tucking away Rolls-Royce shares in my Shares and Shares ISA — and forgetting about them till I retire — are compelling.

Nonetheless, right now, I’m not persuaded that is the fitting plan of action.

The corporate has undoubtedly bounced again effectively from the pandemic. It upgraded its earnings forecast twice in 2023, which helped it change into the FTSE 100‘s greatest performer.

Flying hours — the one largest contributor to the group’s income — are roughly 85% of the place they have been earlier than Covid arrived.

Encouragingly, the corporate reported in August 2023 that its massive engine order e-book had elevated for the primary time since 2018. Its Civil Aerospace enterprise has now acquired ahead buyer commitments equal to roughly eight years’ income.

The corporate’s Defence division can be performing effectively. The UK and US governments are massive clients, and have pledged to spend extra on safety.

Throughout the enterprise, it’s launched into a cost-cutting programme supposed to save lots of £200m a 12 months. And the administrators are planning to eliminate non-core property.

All this implies the corporate’s worthwhile as soon as extra.

Plus internet debt is falling.

Keep away from

However regardless of these good causes to speculate, I really feel the shares are costly.

The consensus forecast of analysts is for earnings per share (EPS) to be 12.9p, for the 12 months ending 31 December 2024.

If right, it means the shares are at the moment valued at 24 occasions’ earnings.

Wanting additional forward, the expectation is for EPS of 16.5p, in 2025. This can be a a number of of 18, which continues to be not low-cost.

After all, analysts could also be flawed. However their forecasts must be wildly inaccurate for the corporate to have a price-to-earnings ratio near that of the FTSE 100, of roughly 11.

High quality firms rightly command a premium — Rolls-Royce has a fantastic model and robust status.

However I think a lot of the expectations of improved profitability have already been factored into the share worth.

Additionally, the corporate doesn’t pay a dividend.

Though it’s anticipated to be reinstated quickly, even probably the most optimistic are forecasting a payout effectively under the FTSE 100 common.

That doesn’t attraction to an revenue investor like me.

For higher for worse, for richer for poorer

For these causes, I’m going to maintain the inventory on my watch checklist.

And revisit the funding case ought to there be a correction within the share worth.

Earlier than committing to marriage, I wish to be sure I’ve made the fitting resolution. In any other case, a painful (and costly) divorce could possibly be on the playing cards.