The FTSE 100 is on a roll correct now. At spherical 7,900 elements, the UK’s premier share index is inside a whisker of hitting new highs. And as market confidence steadily builds, a barge by the use of this stage seems to be like inevitable.

However no matter this power, the Footsie continues to be jam-packed with wise bargains. Financial firms giant Phoenix Group Holdings (LSE:PHNX) is one blue-chip share that I consider nonetheless presents engaging value no matter present optimistic features. Let me current you why.

Earnings

The first port of title is to ponder Phoenix’s share value relative to forecast earnings. At 539p per share, it trades on a forward price-to-earnings (P/E) ratio of 11.5 events, which is solely above the FTSE 100 widespread of 10.5 events.

It’s moreover worth considering the company’s value in distinction with completely different companies throughout the monetary financial savings, wealth, and pensions space. As a result of the chart below displays, its P/E ratio is below these of (in descending order) Zurich Insurance coverage protection Group, Aviva, and Licensed & Fundamental Group.

It’s marginally dearer on this basis than M&G, nonetheless. So, on steadiness the enterprise presents sturdy (if not wonderful) value, in my opinion.

Dividends

The forward dividend yield is one different vital measure of how low price a share is. This represents dividend income as a proportion of the current share value.

On this metric, Phoenix Group’s shares is likely to be considered pretty wonderful. At 10%, the yield proper right here soars above the three.7% widespread for FTSE shares.

Furthermore, as a result of the desk below signifies, Phoenix moreover comfortably beats all of its rivals (bar M&G) on this metric.

| Stock | Forward dividend yield |

|---|---|

| Aviva | 7% |

| Licensed & Fundamental | 8.4% |

| M&G | 10.5% |

| Zurich | 5.9% |

Property

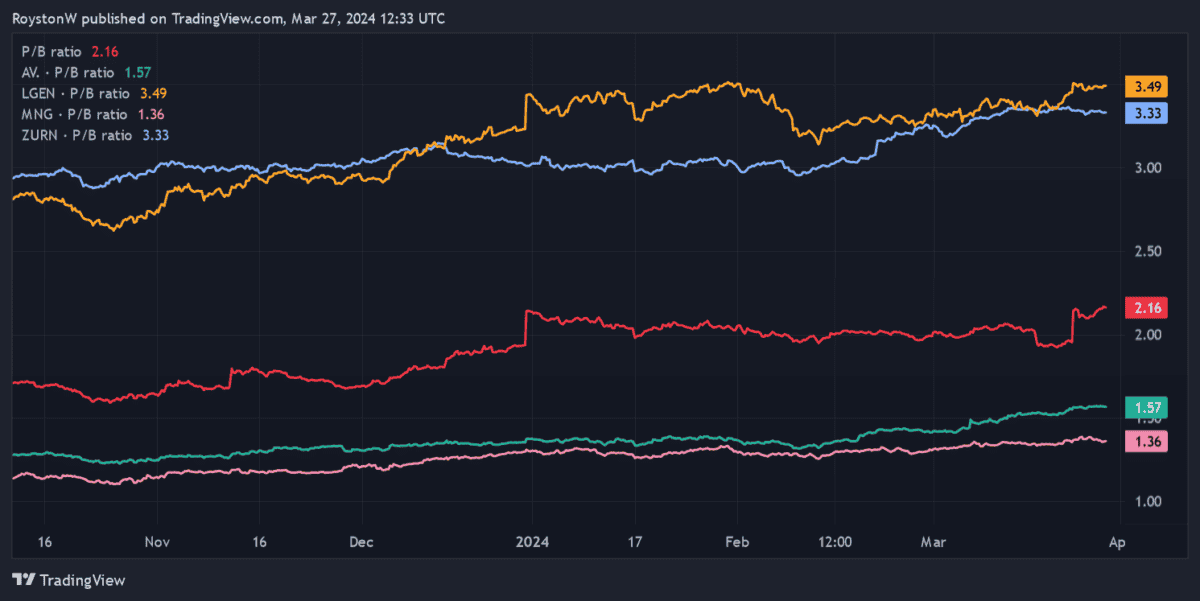

The very last item to ponder is how Phoenix’s share value stacks up relative to the price of the company’s property. A most well-liked means to do this is to calculate its price-to-book (P/B) ratio, which divides the company’s full information value (property minus liabilities) by all the number of wonderful shares.

With a finding out of spherical 2.2, the enterprise trades at a very good premium to the price of its property. As an investor I’d be looking out for a finding out spherical or below one.

Whereas disappointing, Phoenix isn’t the financial firms enterprise’s costliest operator primarily based totally on the P/B ratio. As a result of the chart displays, Licensed & Fundamental and Zurich carry readings above three. Nonetheless Phoenix’s quite a lot of is larger than these of Aviva and M&G.

Should I buy Phoenix shares?

Based mostly totally on these charts, M&G is fingers down the right value stock all through this grouping, along with in distinction with the broader FTSE 100.

Nonetheless what about Phoenix? Successfully the charts level out to me that Phoenix shares nonetheless provide sturdy for value. Definitely, they could very effectively be significantly engaging for consumers in quest of passive income on account of that enormous dividend yield that’s supported by a robust steadiness sheet (its Solvency II surplus received right here in at £3.9bn in 2023).

The financial firms enterprise would possibly endure extra turbulence if the charges of curiosity keep elevated. Nonetheless the longer-term outlook proper right here stays sturdy, with rapidly ageing populations tipped to supercharge demand for wealth and pension merchandise.

I consider Phoenix — which is the UK’s largest monetary financial savings and retirement enterprise — could very effectively be a great way to generate dividend income throughout the coming a very long time. And at current prices I’m considering opening a spot.