Picture supply: Getty Photos

Down 22% over the previous 12 months, the Lloyds Banking Group (LSE:LLOY) share worth has underperformed the broader FTSE 100. The total-year outcomes are due out on 22 February. Forward of this, I believe it’s essential for traders to take a step again and contemplate if Lloyds shares are undervalued as we presently stand.

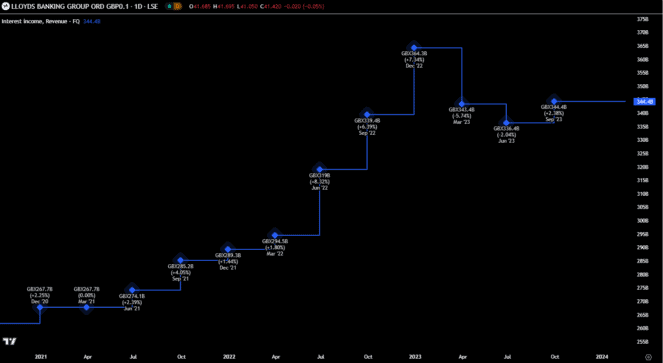

Noting adjustments in curiosity revenue

A key metric to test on the well being of Lloyds is the income derived from curiosity revenue. This cash is made due to the distinction within the price it prices on loans versus what it pays on deposits. Because of the rise within the base price from the Financial institution of England, this margin has risen considerably over the previous couple of years. That is proven within the chart under.

Nonetheless, curiosity revenue has been stalling for the previous couple of quarters, as rates of interest stay on maintain. Trying ahead, I anticipate rate of interest cuts later this summer season. This might act to cut back the curiosity revenue for the financial institution, reducing general income.

For the share worth, I don’t see it undervalued once I contemplate that the impression of decrease rates of interest is unlikely to have been absolutely factored in to the present worth.

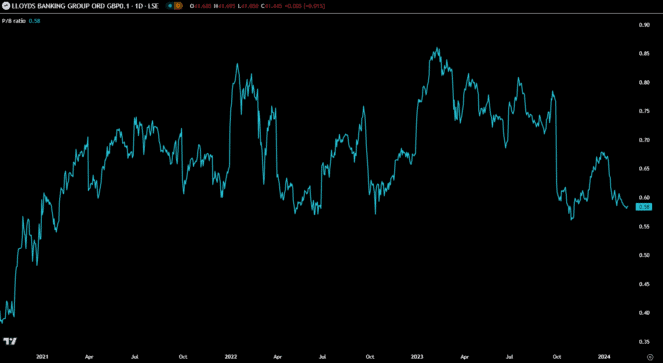

Relative worth metric seems fascinating

Many have a look at the price-to-earnings ratio to see the worth of a inventory. In its place, I prefer to additionally use the price-to-book (P/B) ratio. This seems on the share worth relative to the agency’s e book worth, primarily its uncooked worth if all of the belongings and liabilities have been settled in the present day. A determine of 1 would equate to a good worth. The P/B ratio for Lloyds is presently 0.58 and is at a low degree when scanning the previous few years.

From this chart, I’d say that the inventory does look undervalued. Granted, the ratio won’t bounce again to parity anytime quickly. However a transfer again to 0.80 is real looking. Assuming the e book worth stays the identical, the share worth would want to leap by 38% to get again to this fairer worth.

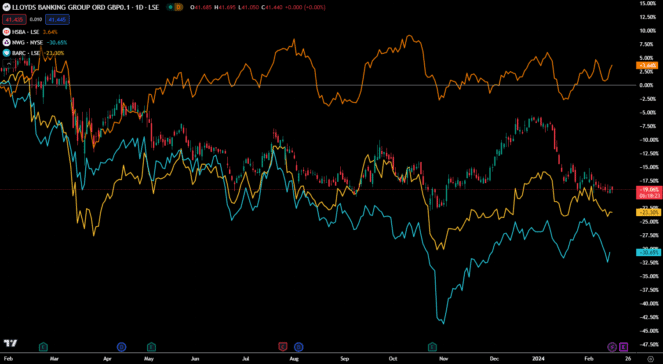

friends

Lastly, I need to have a look at how the inventory has carried out relative to friends. As a substitute of simply evaluating it to the FTSE 100 index, I get a greater really feel once I evaluate it to rivals. Beneath exhibits the 12-month share worth share beneficial properties/losses for Lloyds. But I’ve additionally included HSBC (orange), Barclays (yellow) and NatWest Group (blue).

As may be famous, Lloyds isn’t the worst performer, with each NatWest and Barclays experiencing steeper slumps over this time interval. As a shrewd investor, it makes me need to have a look at the 2 different banking shares as an alternative. I believe there might be a chance that both agency presents higher worth proper now.

Though the price-to-book ratio seems engaging, it’s outweighed by the considerations about curiosity revenue. Which means I don’t assume that the Lloyds share worth is really undervalued. After I evaluate it to friends, I really feel there are higher worth choices on the market from the identical sector. Due to this fact, I’d look elsewhere if I used to be wanting so as to add a price inventory to my portfolio proper now.