Picture supply: Getty Photographs

The London inventory market is full of high alternatives for SIPP traders to discover across the begin of this new tax 12 months.

Right here’s an inexpensive FTSE 100 heavyweight, an underpriced funding belief, and a surging exchange-traded fund (ETF) to contemplate.

Please observe that tax therapy depends upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Customary Chartered

It’s my perception that Customary Chartered (LSE: STAN) is among the FTSE’s finest cut price shares to have a look at at the moment.

For 2025, it trades on a ahead price-to-earnings (P/E) ratio of 8.6 occasions. That is primarily based on dealer forecasts that annual earnings will rise 14% 12 months on 12 months.

On high of this, the corporate’s corresponding price-to-earnings development (PEG) ratio is simply 0.5. Any studying under 1 implies {that a} share is undervalued.

StanChart shares additionally look low cost primarily based on the worth of its belongings. As with its PEG ratio, the financial institution’s price-to-book (P/B) a number of sits under the worth watermark of 1, at 0.7.

Its low valuation displays, partially, fears over how commerce tariffs may influence income. The risk is particularly excessive in its key Chinese language market.

But Customary Chartered’s resilience to date means I’m optimistic about its capacity to experience out any volatility. Working revenue and pre-tax revenue rose 5% and 10%, respectively, in Q1.

Henderson European Belief

The Henderson European Belief (LSE:HET) — because the title implies — holds a portfolio of shares which can be primarily based on the continent (however excluding the UK). Extra particularly, it targets “world leaders that occur to be primarily based in Europe,” like semiconductor producer ASML, defence big Safran and financial institution BNP Paribas.

At this time the belief trades at a 7.2% low cost to its web asset worth (NAV) per share of 203.3p. I feel this represents a lovely dip-buying alternative to contemplate.

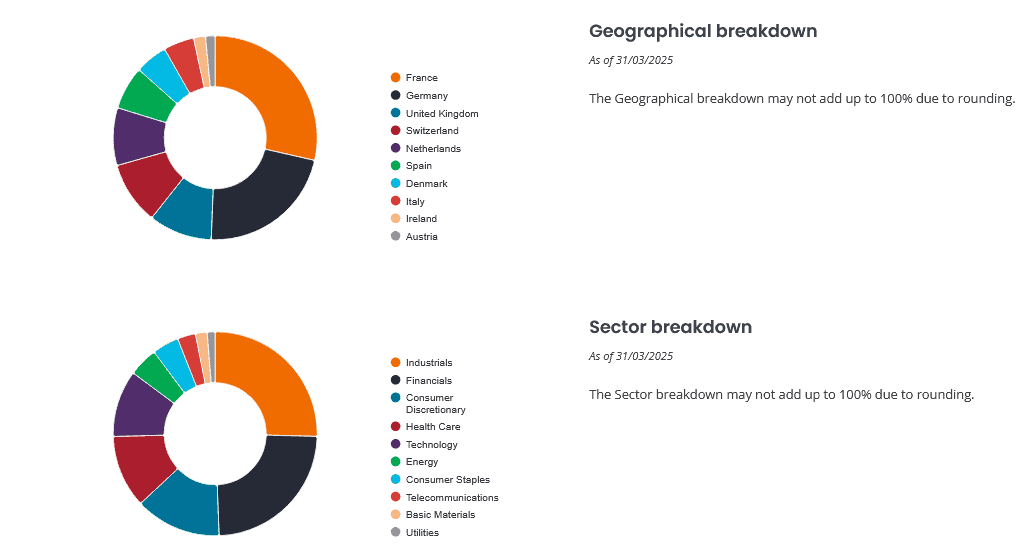

I like this Henderson fund due to its huge diversification by each geography and sector. This doesn’t remove the very actual risk posed by a eurozone-wide slowdown. But it surely helps to restrict the danger to traders’ funds.

This distinctive diversification hasn’t impacted its capacity to ship a wholesome return to date. Its common annual return since 2015 stands at a tasty 7.8%.

WisdomTree Bodily Gold

International gold-backed ETFs are having fun with spectacular demand as macroeconomic fears linger and the US greenback weakens. Each of those are basic drivers of the safe-haven asset, and encouragingly for gold traders, each phenomena look set to proceed.

Based on newest World Gold Council (WGC) knowledge, bullion-backed ETFs loved their strongest inflows since March 2022 final month. Complete belongings below administration (AUMs) now stand at report highs of $379bn.

Weak jewelry gross sales and cooling central financial institution purchases pose a risk to gold costs. However on steadiness, I’m anticipating bullion to surpass final month’s report peaks of $3,500 an oz. attributable to sturdy retail investor demand within the quick time period.

Towards this backdrop, I feel the WisdomTree Bodily Gold (LSE:PHAU) fund is value severe consideration. A fund like this protects traders the effort of getting to purchase and retailer bodily gold.

And in contrast to gold miner shares, it doesn’t expose traders to the risky enterprise of metals mining.