Picture supply: Getty Photographs

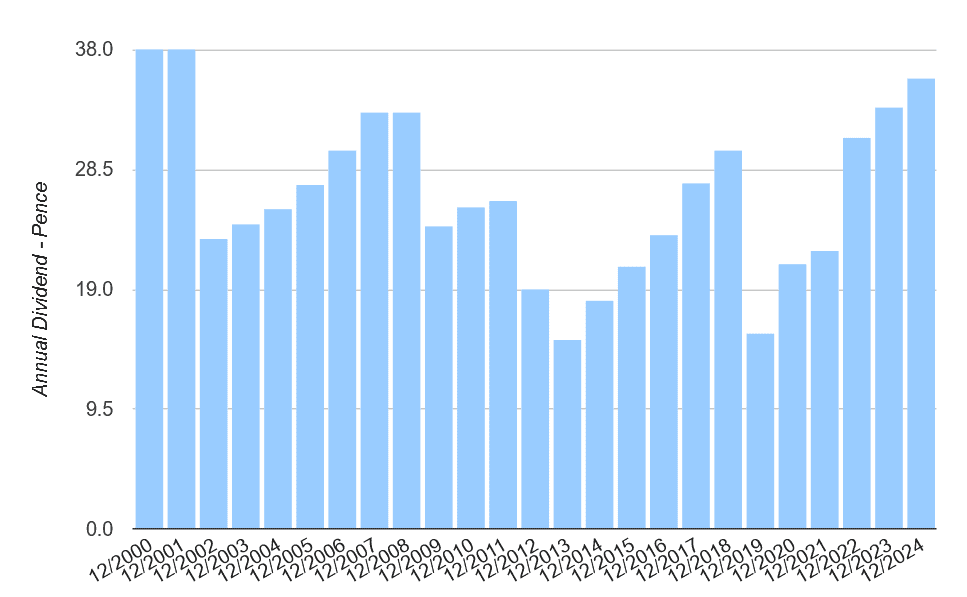

Aviva (LSE:AV.) has proved to be considered one of Britain’s most profitable passive revenue shares in recent times. Since rebasing the dividend in 2013, the FTSE 100 firm has raised shareholder funds yearly, apart from 2019, when the pandemic struck.

With asset gross sales aiding its steadiness sheet restoration, dividends have usually risen strongly because the mid-2010s, together with a 7% hike in 2024 to 35.7p. What’s extra, the agency’s dividend yields have usually overwhelmed the Footsie’s long-term common of three%-4% over the interval.

However with international financial uncertainty rising, can the monetary companies large hold its dividend momentum going? And may traders contemplate shopping for Aviva shares right this moment?

Strong forecasts

Regardless of the specter of weaker shopper spending in Aviva’s markets, Metropolis analysts expect its earnings to rise by triple-digit percentages in 2025, and by double-digits within the following two years.

This, in flip, results in forecasts of additional sturdy dividend development over the interval:

| Yr | Dividend per share | Dividend development | Dividend yield |

|---|---|---|---|

| 2025 | 37.87p | 6.1% | 6.4% |

| 2026 | 40.65p | 7.3% | 6.9% |

| 2027 | 43.78p | 7.7% | 7.4% |

For this 12 months, shareholder payouts are tipped to rise at a larger fee than the 1.5%-2% that’s predicted for the broader FTSE 100 index. What’s extra, the tempo of development is predicted to speed up in 2026 and once more in 2027.

You’ll additionally discover that yields enhance by round a proportion level over the interval. For 2027, too, the dividend yield is round double the more moderen FTSE ahead common.

But, it’s essential to do not forget that dividends are by no means assured, and that dealer forecasts are by no means set in stone. And based mostly on dividend protection, there’s a hazard that the passive revenue from Aviva shares could disappoint.

For the following three years, predicted payouts are lined between 1.3 instances and 1.4 instances by anticipated earnings. These figures fall means in need of the determine of two and above that usually present good safety.

Robust dividend cowl is very necessary for cyclical shares like Aviva throughout unsure instances. Nevertheless, I’m nonetheless optimistic the enterprise can have the power to pay these projected dividends, even when earnings undershoot forecasts.

As of March, the corporate’s Solvency II ratio was 201%, greater than double the regulatory requirement. And its technique of specializing in capital-light companies will assist it to keep up sturdy monetary foundations.

Greater than half (56%) of working revenue got here from such operations within the first quarter. This can transfer to 70% if its deliberate acquisition of Direct Line goes forward.

Is it a purchase?

Investing in Aviva isn’t with out danger, because the robust financial atmosphere may have penalties for the dividend and/or the share worth. However on steadiness, I believe the potential advantages of proudly owning the inventory outweigh the potential risks.

I actually imagine it may show a profitable inventory to personal over the long run. Demographic modifications throughout its UK, Irish, and Canadian markets could supercharge demand for its retirement, safety, and wealth merchandise.

Given these large dividend yields and undemanding price-to-earnings (P/E) ratio of 11.3 instances, I believe it’s an important FTSE discount to contemplate.