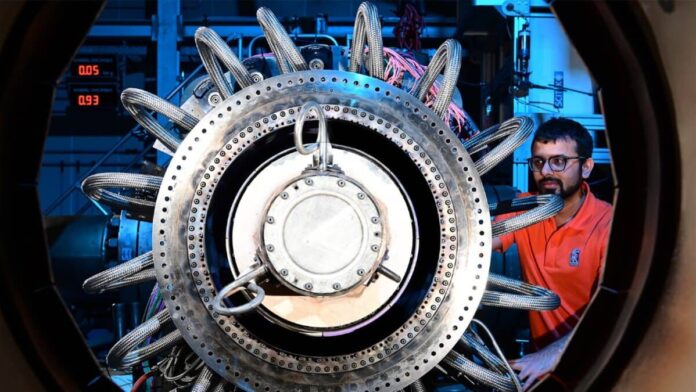

Picture supply: Rolls-Royce Holdings plc

Rolls-Royce (LSE:RR.) shares are exhibiting no indicators of cooling as 2026 will get into full swing. Up 7% since 1 January, the FTSE 100 inventory’s now up a staggering 122% over the past 12 months.

Can the share value proceed its breakneck momentum? I’m not so positive. In reality, I believe the engineer may now be in peril of a correction. Listed here are 4 the explanation why.

1. Provide chains

Due to robust journey demand, Rolls-Royce has seen revenues from the civil aviation business increase lately. With extra planes within the air, and large-engine hours rising sharply, its aircraft servicing operations have thrived. Engine gross sales have risen too, as airways work to replace their fleets.

There’s no assure that this important finish market will stay strong in 2026, as financial and geopolitical uncertainty grows. However let’s say that demand does certainly stay robust. Will Rolls be ready to capitalise on this as provide chain points linger?

The corporate warned in November of “continued provide chain challenges.” Underlining the continued business risk, Airbus final week predicted points with one other main engine provider Pratt & Whitney would final “for the foreseeable future.”

Indicators of rising pressure — and any consequent influence on Rolls’ operations and value base — might have important ramifications for its share value.

2. Competitors

Rolls-Royce is a heavyweight throughout a wide range of engineering markets. The issue is that it competes with different business bruisers, leaving it uncovered to aggressive threats that would derail earnings development.

Take the widebody market, the place the FTSE agency locks horns with GE Aerospace. Its US rival is a fierce competitor when it comes to product reliability and lifecycle prices, and the strain is rising as GE steadily develops new know-how (like its Open Fan engine).

Don’t get me flawed: Rolls is greater than holding its personal within the business. However issues can change shortly. If rivals begin successful main contracts on the agency’s expense, it might undermine investor confidence in its development prospects.

3. Greenback weak point

A weakening US greenback is on paper unhealthy information for Rolls-Royce. When corporations with Stateside operations like this convert income there into kilos, they appear smaller on the revenue and loss account when the dollar drops.

In apply, this isn’t an issue for the engineer proper now. With an infinite foreign money hedge e book, the enterprise has ‘locked in’ a assured change fee for years into the long run.

However this doesn’t cowl danger past the short-to-medium time period. And the issue for Rolls is that the greenback’s declining sharply (down 9% over the previous 12 months) as worries over political situations within the US develop, the Federal Reserve cuts rates of interest, and buyers diversify away from the foreign money.

If the dollar retains dropping, fears over international change pressures afterward will naturally mount, probably impacting the share value.

4. Valuation

But regardless of these risks, Rolls-Royce shares proceed to command an infinite premium. At £12.85 per share, they commerce on a ahead price-to-earnings (P/E) ratio of 38.9 occasions.

That’s miles above the 10-year common of 15. Neglect for a second how this might restrict future share value development. At these ranges, the inventory might fall off a cliff on even the slightest signal of buying and selling weak point.

Rolls shares could be a beautiful selection for extra danger tolerant buyers. Nevertheless, I gained’t be shopping for them for my very own portfolio.