Picture supply: Getty Pictures

I feel investing in UK dividend shares is one of the best ways for me to supply a passive earnings. Listed here are three key rules I’ve personally adopted to benefit from this chance.

1. Get rid of taxes

The primary activity on my investing journey was to open a Shares and Shares ISA. After this, I additionally opened a Self-Invested Private Pension (SIPP) to carry my share investments.

Each of those merchandise defend people from each capital beneficial properties tax and dividend earnings. These merchandise present me with a complete annual allowance of £20,000 (the ISA) and a sum equal to my annual pay, as much as £60,000 (the SIPP).

Given the regular rise in dividend tax, these tax-efficient merchandise provide important benefits. At this time, buyers can obtain simply £500 in dividends exterior considered one of these merchandise earlier than they pay tax. That’s down from £2,000 simply two years in the past.

Please notice that tax therapy is dependent upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is offered for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

2. Diversify for power

With my accounts arrange, I set about constructing a portfolio spanning all kinds of areas, industries, and sub-sectors. It took time, however at this time my ISA and SIPP collectively maintain round 25 totally different shares, trusts, and funds.

A few of my key holdings are Aviva, Coca-Cola HBC, Taylor Wimpey, HSBC, and Major Well being Properties. As you possibly can see, these corporations function in very totally different sectors, serving to my portfolio climate particular shocks and nonetheless ship a strong passive earnings throughout the financial cycle.

3. Don’t simply concentrate on yield

It’s tempting to concentrate on dividend yield when looking for passive earnings shares. This could be a large mistake, as excessive yields at this time might be unsustainable over time.

For that reason, I select corporations with sturdy payout data and ideally a rising dividend over time. I’m looking for companies with respectable payout ratios, sturdy stability sheets, numerous revenues streams, and market-leading positions. In the end, it’s about searching for high quality corporations that may ship dependable dividends by means of thick and skinny.

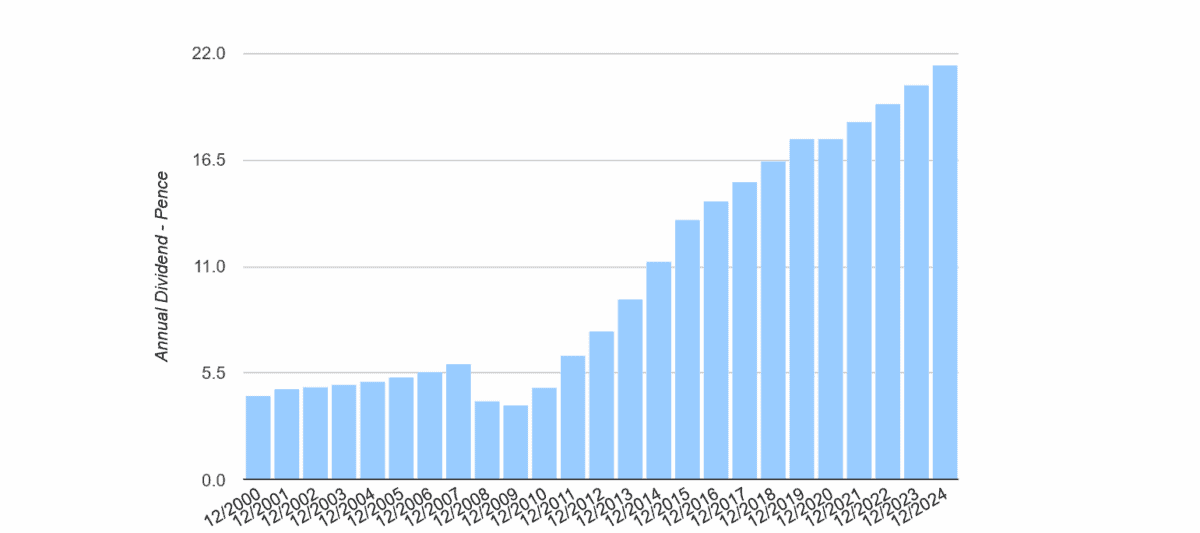

Authorized & Normal (LSE:LGEN) is one such share that ticks every of those bins. I wasn’t simply pulled in by its giant yield, though it’s ahead studying of 8.5% is clearly a serious attraction!

The FTSE 100 firm has raised dividends yearly since 2010. The one exception got here in 2020, when pandemic uncertainty brought about it to freeze the full-year payout.

Authorized & Normal has loads of weapons in its locker that makes it a real dividend hero. One in every of these is its formidable money technology — at this time it’s Solvency II capital ratio is 232%, a sector excessive.

The agency’s superior money flows are supported by its extensive geographic footprint and broad vary of monetary companies — it’s an enormous participant in safety, financial savings, asset administration, and retirement options. This variety leaves it nicely positioned to climate weak point in particular areas or product strains, and to maintain paying a big and rising dividend.

In fact, its operations are cyclical so earnings are uncovered to a world slowdowns. This might have influence on its share worth, although I’m assured it shouldn’t have an effect on the agency’s progressive dividend coverage.

Metropolis analysts share my optimism. And so the dividend yield on Authorized & Normal shares rises to an unbelievable 8.7% for subsequent 12 months, and 9% for 2027.