Picture supply: Getty Photos

Incomes an ample second revenue for little (or no) effort in retirement is the dream of all buyers. It’s my plan to realize this by constructing a diversified portfolio of FTSE 100 and FTSE 250 dividend shares.

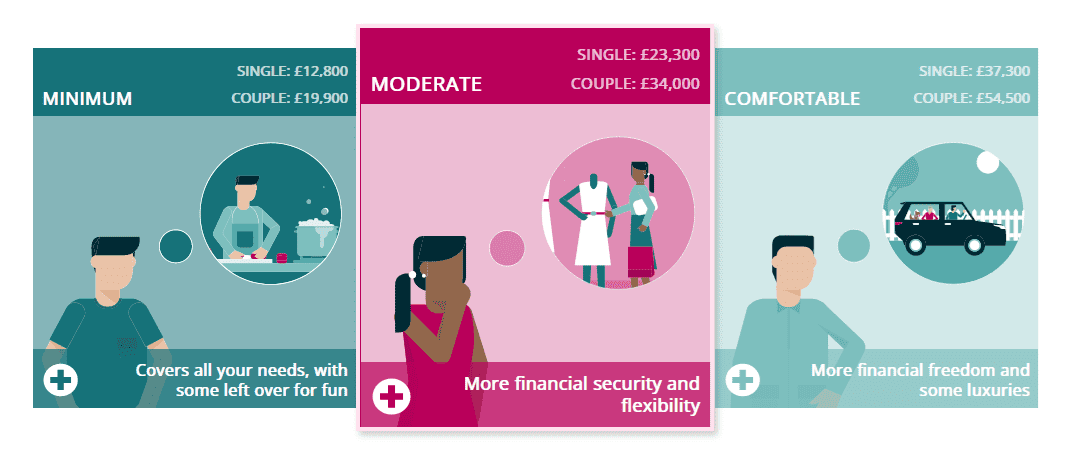

How a lot one might be have to have accrued by retirement age differs from individual to individual. However an excellent technique might be to observe what the Pensions and Lifetime Financial savings Affiliation thinks the typical Brit will want as soon as they hit retirement age.

They imagine retirees will want an annual revenue of £23,300 to get pleasure from a ‘reasonable’ way of life. A much-higher determine of £37,300 is required for people to reside comfortably.

Right here’s my plan

This leaves an enormous downside for people who find themselves counting on the State Pension to fund their retirement. As of April, the pension is scheduled to come back in at simply £11,502 a yr.

This leaves a shortfall of round £25,800 for individuals who need to get pleasure from a ‘snug’ way of life. And I imagine this disparity will develop even bigger by the point I personally grasp up my work apron for good as the price of dwelling and social care soars.

However I’m not panicking. Whereas future income usually are not assured, the gorgeous returns UK share buyers have made in current a long time counsel I may reside comfortably no matter what the long run holds for the State Pension.

Compound positive factors

My optimism relies on the distinctive returns that FTSE 100 and FTSE 250 shares have delivered over the long run.

Footsie buyers who reinvested all of their dividends between 2010 and 2019 loved a mean annual return of 8.3% between. In the meantime, those that purchased FTSE 250 shares loved an excellent higher yearly return of 13%.*

Reinvesting dividends is the important thing to supercharging one’s long-term wealth. Doing this with dividends permits me to build up extra shares, resulting in elevated dividend payouts and thus the prospect to purchase further shares.

Over time, this mathematical miracle (generally known as compounding) will help me make market-beating returns.

* Figures courtesy of IG Group.

A £3,337 second revenue

Now I’ll present you ways compounding will help me make a passive revenue in retirement. Let’s say that I’ve a lump sum of £20,000 to construct a balanced portfolio of UK blue-chip shares.

Over the house of 30 years, and with an additional £200 invested every month, I’d have constructed a formidable nest egg of £1,001,225 to retire on. That’s based mostly on the typical 10.65% return for FTSE 100 and FTSE 250 shares through the 2010s.

If I then drew down 4% of this quantity a yr, I’d have a wonderful month-to-month revenue of £3,337. On an annual foundation this works at £40,049.

That might be sufficient to provide me that snug retirement that the PLSA describes. And that’s not even considering the additional increase that the State Pension will present to my funds.

There might be bumps alongside the way in which. However I’m assured that, with the correct funding technique (and assist from consultants like The Motley Idiot) I may make a big passive revenue for my later years.