Picture supply: Getty Photos

I believe the UK inventory market is a good place for dividend buyers in search of shares to think about shopping for. And there are just a few names which have very spectacular monitor information.

A long time of constant dividend development doesn’t assure larger returns in future. Nevertheless it additionally doesn’t come about by chance and it’s one thing buyers may need to take note of.

Croda Worldwide

Croda Worldwide (LSE:CRDA) has elevated its dividend per share every year for over 34 consecutive years. That’s an impressive file and it’s honest to say the corporate has seen all of it.

The final three a long time have included the dot-com bubble, the subprime mortgage disaster, and Covid-19. And thru all of this, the agency has saved its dividend rising.

That is spectacular for any enterprise, however arguably much more extra so for a cyclical operation. However Croda makes specialty chemical substances, the place demand can wax and wane relying on finish markets.

Buyers, although, appear to suppose this spectacular file is beneath risk. The dividend yield has reached nearly 4.5%, which is its highest stage for the final 10 years by some margin.

The priority may properly be that the agency’s free money movement within the final 12 months hasn’t lined its dividend. Croda can bridge the hole within the brief time period, however this isn’t sustainable indefinitely.

A part of this was the results of larger working capital necessities, although, which I count on to stabilise over time. So, because it’s at an uncommon low-cost value, I believe it’s value a glance.

FW Thorpe

FW Thorpe (LSE:TFW) is a a lot smaller firm. It focuses on industrial lighting for issues like airports, tunnels, and hospitals, the place lighting is crucial and sometimes has to fulfill particular necessities.

Meaning working on this sector requires excessive ranges of technical experience, which creates a barrier to entry for potential opponents. And this provides the corporate a level of pricing energy.

FW Thorpe has managed to extend its dividend per share for 22 consecutive years. Whereas the yield is simply 2.2%, the £11m distribution is greater than lined by free money flows of £38m.

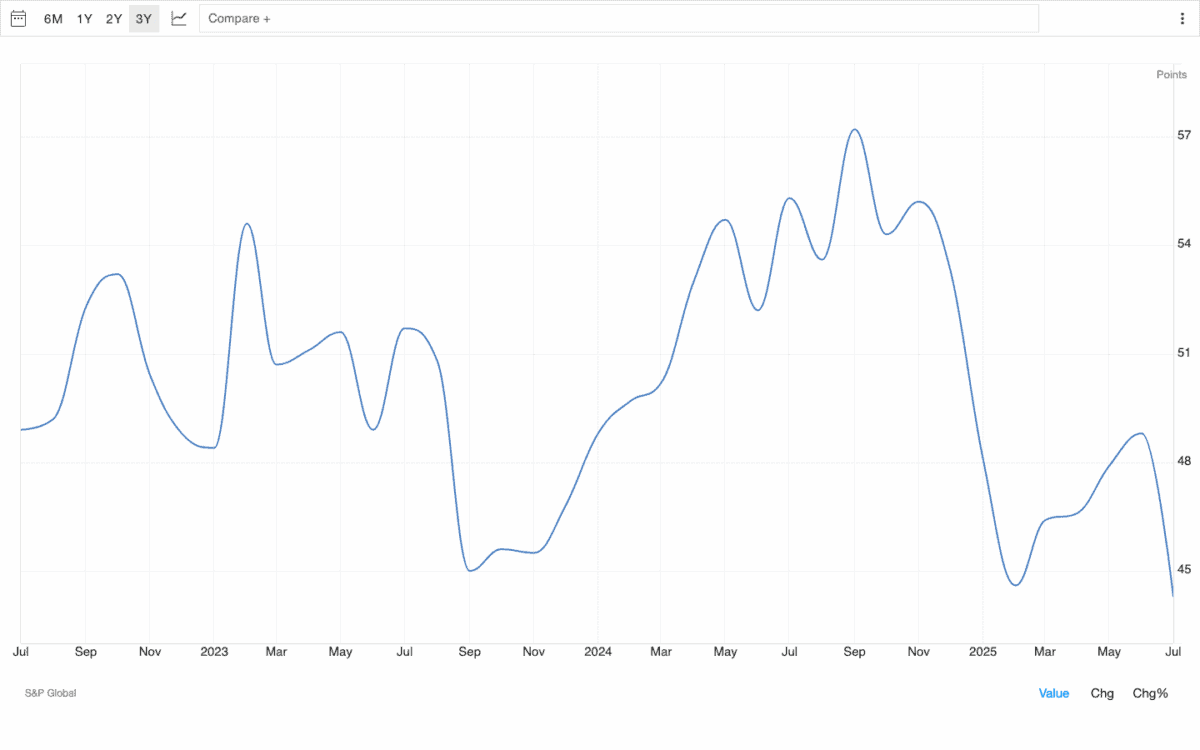

Buyers wanting on the inventory ought to take into consideration the outlook for UK building. And the most effective ahead indicators for that is the UK Building Buying Managers Index (PMI).

UK Building PMI June 2023 – July 2025

Supply: Buying and selling Economics

The most recent studying (from July) got here in at 44.3. That’s a priority as a result of (a) a quantity beneath 50 signifies contraction within the sector and (b) it’s the bottom the index has been within the final three years.

That’s a threat buyers ought to take note of. However for these with a long-term perspective, it’d imply FW Thorpe represents an under-the-radar alternative to be grasping the place others are fearful.

Observe information

Round 66% of companies fail inside their first 10 years. However on the different finish of the size, there are these that may generate larger and better returns for shareholders every year for many years.

Croda Worldwide and FW Thorpe each have excellent information of dividend development. And that is the results of every having a particularly robust aggressive place.

Regardless of the potential of short-term disruptions, I count on each corporations to do properly over the long run. And I believe dividend buyers in search of alternatives ought to take be aware.