Picture supply: Getty Photos

I feel these UK shares are wonderful selections for traders to contemplate in the event that they’re searching for a robust second earnings. Right here’s why.

Platinum play

Gold shares aren’t the one recreation on the town for traders seeking to seize upon hovering earlier steel costs. Buying shares in platinum group steel (PGM) producers is one other potential play to have a look at as costs right here additionally take off.

Gold costs have risen 45% in worth over the past yr. Platinum, in the meantime, has risen 47% over the interval. And it may very well be due for additional important beneficial properties as steel provide falls.

In keeping with the World Platinum Funding Council, whole platinum provide will slip to five-year lows in 2025. With jewelry demand rising and funding curiosity additionally rising, the organisation expects the market to report an 850,000-ounce deficit this yr.

Buying platinum shares like Sylvania Platinum (LSE:SLP) is usually a extra worthwhile method of capitalising on appreciating steel costs than bodily steel or a metal-tracking fund. This South African miner’s 75% share worth rise over the past yr illustrates this principle.

Miners get pleasure from a ‘leverage’ impact, the place revenues rise alongside commodity costs whereas their prices stay largely secure. This could result in supersized earnings, as indicated by the 118% year-on-year EBITDA improve Sylvania loved within the final monetary yr (to June 2025).

Remember that the ‘leverage’ issue may also imply earnings can nosedive if steel costs reverse. However proper now I feel this phenomena ought to proceed working within the firm’s favour.

Metropolis analysts share my optimism, and count on earnings to nearly double within the monetary 2026. Forecasts are additionally boosted by firm plans to spice up full-year platinum, palladium, rhodium and gold — the so-called 4E grouping — to between 83,000 and 86,000 ounces from the report 81,002 final yr.

This additionally means brokers count on the annual dividend to soar to round 4p per share this yr from 2.75p final yr. That leaves Sylvania Platinum carrying a wholesome 5.2% dividend yield.

A FTSE 100 favorite

BAE Programs (LSE:BA.) doesn’t provide this kind of excessive dividend yield over the close to time period. For 2025 and 2026, they sit at 1.8% and a pair of%, respectively.

But the prospect of extra market-beating dividend development nonetheless makes this FTSE 100 share worthy of significant consideration.

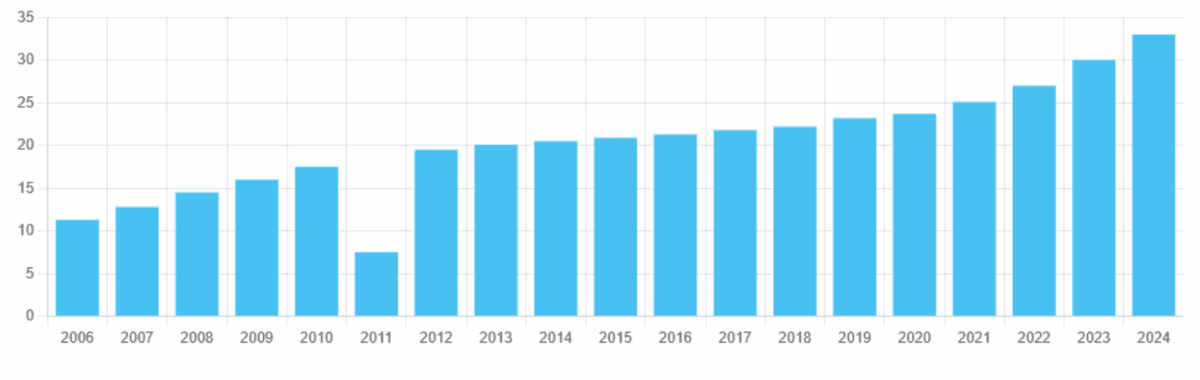

Shareholder payouts have risen yearly since 2012, leading to final yr’s 33p per share dividend. And Metropolis brokers expect them to rise one other:

- 8% in 2025, to 35.7p.

- 10% in 2026, to 39.4p.

To place all that in perspective, dividend development throughout the broader UK share index has averaged 3%-4% this century.

This doesn’t make BAE Programs a no brainer inventory to purchase although. As a serious provider to the Division of Protection, its profitability is uncovered to any pulling again in US army exercise on the worldwide stage.

But this isn’t a formality because the geopolitical panorama continues to evolve. In addition to, the corporate can count on gross sales to different key clients just like the UK, Australian and Saudi Arabian governments to maintain rising. Sturdy spending from NATO nations and associate nations drove group gross sales 11% larger within the first half.

This in flip inspired BAE to raise the interim dividend 9% yr on yr. With Western rearmament tipped to proceed, I’m anticipating dividends to maintain marching larger as properly.