Picture supply: Getty Photographs

I’ve been combing by the FTSE indexes seeking bargains which may assist my portfolio develop. Among the many many choices, two shares have attracted my consideration, regardless of being very totally different from one another. What unites them is their obvious undervalued standing.

FTSE 250 high-yielder

First up is Financial institution of Georgia (LSE: BGEO). Buying and selling on a price-to-earnings (P/E) ratio of three.4, this Tbilisi-based business financial institution is one the most cost effective shares within the FTSE 250. It additionally presents a really tasty forward-looking dividend yield of seven.5%.

This potential fee is roofed 3.1 instances by forecast earnings. Whereas no payout is definite, that sort of excessive dividend cowl is however reassuring.

Above, we will see that the share worth has truly greater than doubled previously 5 years. A giant tailwind since 2021 has been greater internet curiosity margins (the distinction between curiosity earned from loans and paid on deposits).

This has helped the corporate’s earnings per share develop at a compound annual development charge of 18% over the previous 5 years.

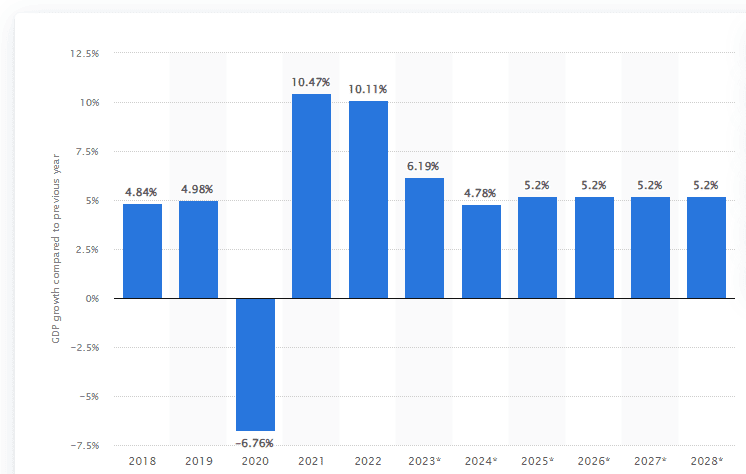

Moreover, the Georgian economic system continues to carry out strongly, which is clearly paramount to the financial institution’s earnings. This wholesome financial development is predicted to proceed till no less than 2028.

So why is the inventory nonetheless so low-cost?

Properly, Georgia shares an approximate 723km border with Russia, in opposition to whom it misplaced a quick warfare in 2008. So there’s perceived geopolitical threat right here.

It has additionally lately gained EU candidate standing. Whereas this accession course of could be prolonged and difficult, and can you should definitely irk Moscow, it ought to additional enhance confidence within the nation’s financial prospects. Its banking system already complies with the EU’s Basel III rules.

To sum up, Georgia is a booming commerce and logistics hub within the Caucasus. Because the nation’s main financial institution with a market share of round 35%, this low-cost high-yield inventory seems like a possible purchase for my portfolio.

A FTSE 100 faller

My subsequent decide, JD Sports activities Vogue (LSE: JD), shall be far much less obscure to UK traders.

On 4 January, the ‘King of Trainers’ issued a revenue warning, saying that vacation season buying and selling had been weaker and extra promotional than beforehand anticipated.

Consequently, it now sees a pre-tax revenue of £915m-£935m for the 12 months ending 3 February 2024. It had beforehand set itself an bold £1bn revenue goal.

The share have tanked 32% since this announcement and now commerce on an extremely low P/E ratio of 9.

Clearly, this drop displays considerations in regards to the tough financial backdrop. And we will’t rule out issues getting worse. But the agency nonetheless expects full-year natural income development of 8%.

If it will possibly obtain this in robust circumstances, it makes me optimistic about higher instances to come back. And absolutely they may for the worldwide athleisure agency, given the world’s rising concentrate on train and relaxed on a regular basis dressing.

It’s additionally necessary to keep in mind that its aggressive place may very well get stronger. I imply, if gross sales are comparatively sluggish at JD, think about how unhealthy issues are for smaller sportswear retailers. Lots of these may go bust, leaving the corporate with a good better future market share.

As such, I’d really feel snug shopping for and holding the inventory if I had spare money to take a position.